Bank of America (BAC.US) is up nearly 2% in pre-open market trading following the release of 2Q24 data. Despite the decline in profits, the bank showed stronger revenues, supported in particular by its investment banking results.

Source: xStation

Source: xStation

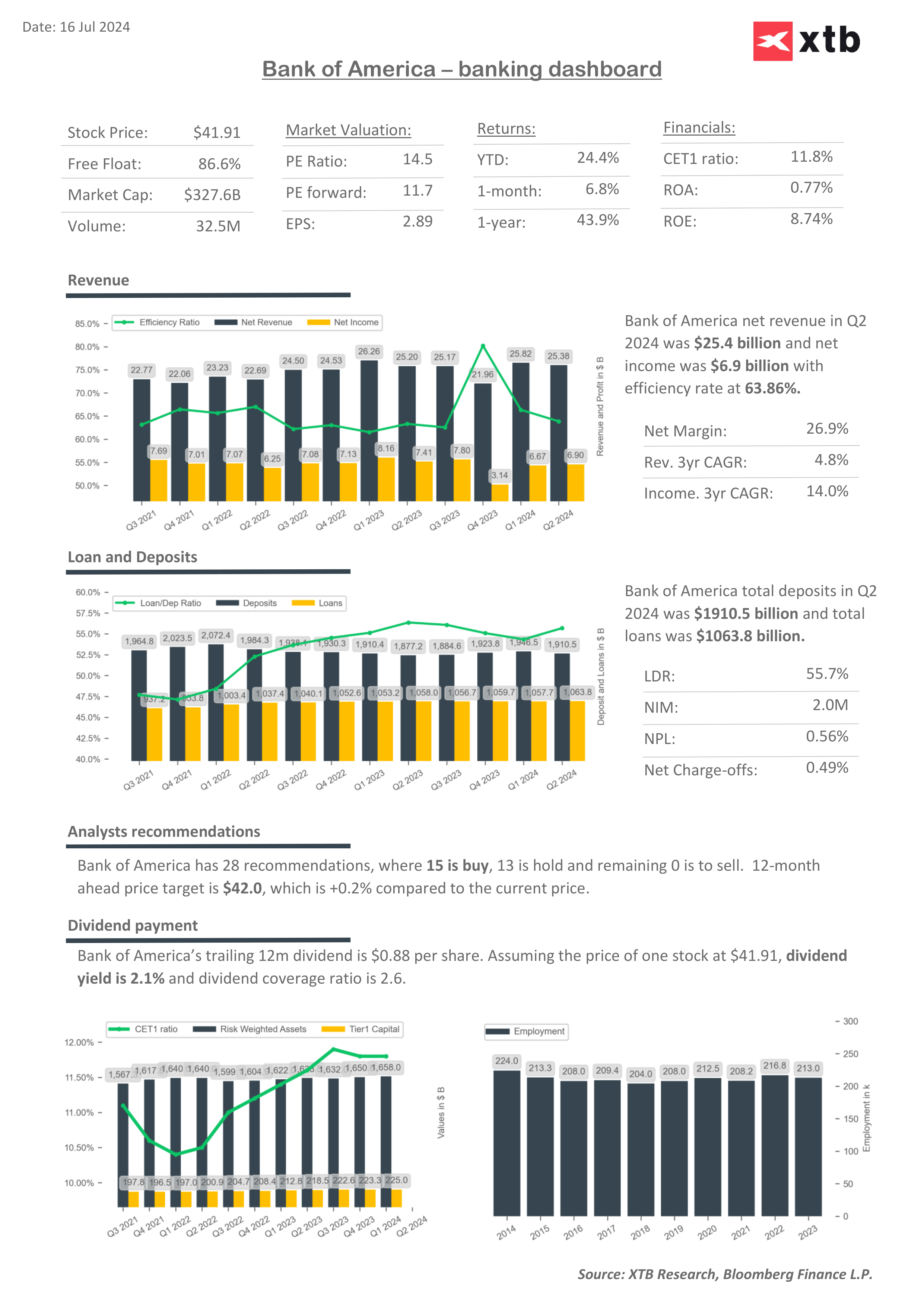

The company's revenues totaled $25.38 billion in 2Q24 (+1% y/y), almost in line with expectations of $25.22 billion. The increase was due to higher management fees, as well as an increase in trading revenues. The company reported 6% higher revenues in this segment at $5.6 billion, and after excluding DVA (deposit valuation adjustments), they amounted to $4.68 billion (+7% y/y and $0.15 billion more than the consensus forecast).

However, overall revenues were weighed down by weaker interest income, which amounted to $13.7 billion (-3% y/y). The decline in earnings was driven by higher conversion of deposits to higher interest-bearing accounts and weaker growth in loans and advances.

The company also reported higher non-interest expenses of $16.3 billion (+2% y/y). This figure is in line with expectations.

Diluted earnings per share amounted to $0.83, down 5% y/y from the previous 2Q23, while it was still higher than the $0.80 forecast.

The company's results are in line with the trends we are seeing for large banks during the 2Q24 earnings season. Interest income is declining with a lower pace of lending due to the high interest rate environment and a concomitant increase in deposit servicing costs, which must offer higher interest rates to customers in order to remain competitive with the money market, where high yields still boast government bonds, among others. At the same time, non-interest costs are rising. The key thing for BofA is that the company on these most closely watched figures came in lower (on cost and revenue declines) than forecast. Hence, the bank's results remain well received so far.

This is also helped by the forecast for 4Q24 interest income, which is expected to be $14.5 billion, $0.22 billion higher than expected. For this forecast, the bank factored in 3 interest rate cuts of 25 bps each. This would translate into an approximate 225 million reduction in interest income. A possible failure by the Fed to follow this path could bolster the bank's revenues.

4Q24 Net interest income outlook. Source: BofA

2Q24 Financial results:

- Trading revenue excluding DVA: $4.68 billion, +6.7% y/y, estimate $4.53 billion

- FICC trading revenue excluding DVA $2.74 billion, estimate $2.8 billion

- Equities trading revenue excluding DVA $1.94 billion, estimate $1.73 billion

- Net interest income: FTE $13.86 billion, estimate $13.81 billion

- Wealth & investment management total revenue: $5.57 billion, estimate $5.58 billion

- Revenue net of interest expense: $25.38 billion, estimate $25.27 billion

- Provision for credit losses: $1.51 billion, estimate $1.5 billion

- Compensation expenses $9.83 billion, estimate $9.77 billion

- Investment banking revenue $1.56 billion, estimate $1.45 billion

- Net charge-offs $1.53 billion, estimate $1.45 billion

- Loans $1.06 trillion, estimate $1.05 trillion

- Total deposits $1.91 trillion, estimate $1.93 trillion

- Non-interest expenses $16.31 billion, estimate $16.3 billion

Financial ratios:

- ROE 9,98%, est. 9,57%

- ROA 0,85% vs. 0,94% y/y, est. 0,82%

- ROTC 13,6%, est. 13,1%

- Net interest margin 1,93% vs. 2,06% y/y, est. 1,95%

- CET1 ratio: 11,9%, est. 11,9%

- Efficiency ratio 63,9% vs. 63,3% y/y, est. 64,2%

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.