Summary:

-

A strong labour market release from Australia supports AUD in the morning

-

The US government asks China for a new round of trade talks

-

Fed’s beige book signals the central bank stays on course to continue lifting rates

Another robust jobs report coming from the Australian economy is supporting the local currency in the morning even as odds for any rate hike in the foreseeable future are really low. In August Australian employers increased their staff by 44k, the number turned out to be well above the median estimate of 18k new jobs. What’s more, the pick-up was predominantly driven by full-time employment as it rose as much as 33.7k, part-time jobs added 10.2k.

The level of employment in Australia keeps booming suggesting there is still some slack in the labour market holding back wage growth. Source: Macrobond, XTB Research

This is another month in a row with really solid employment numbers suggesting that there is still some slack left in the Australian labour market and therefore any pressures on higher wages might remain subdued. The unemployment rate held at 5.3% in line with expectations and this increase must be analyzed in the light of the rising labor force participation rate which jumped to 65.7% from 65.6% (revised up from 65.5%). These numbers imply that the attractiveness of the labour market has risen (the increase of the participation rate reflects a pick-up in employment but the unchanged jobless rate suggests that new entrants occurred). Although the report could be encouraging, it does not change the RBA’s reaction function hence nobody should be surprised that the market-implied rate hike probability gives under 50% odds until August 2019. Anyway, the Aussie has not performed well recently so today’s release could be a chance to regains some of its charm. The AUD is 0.18% higher this morning as of 6:50 am BST.

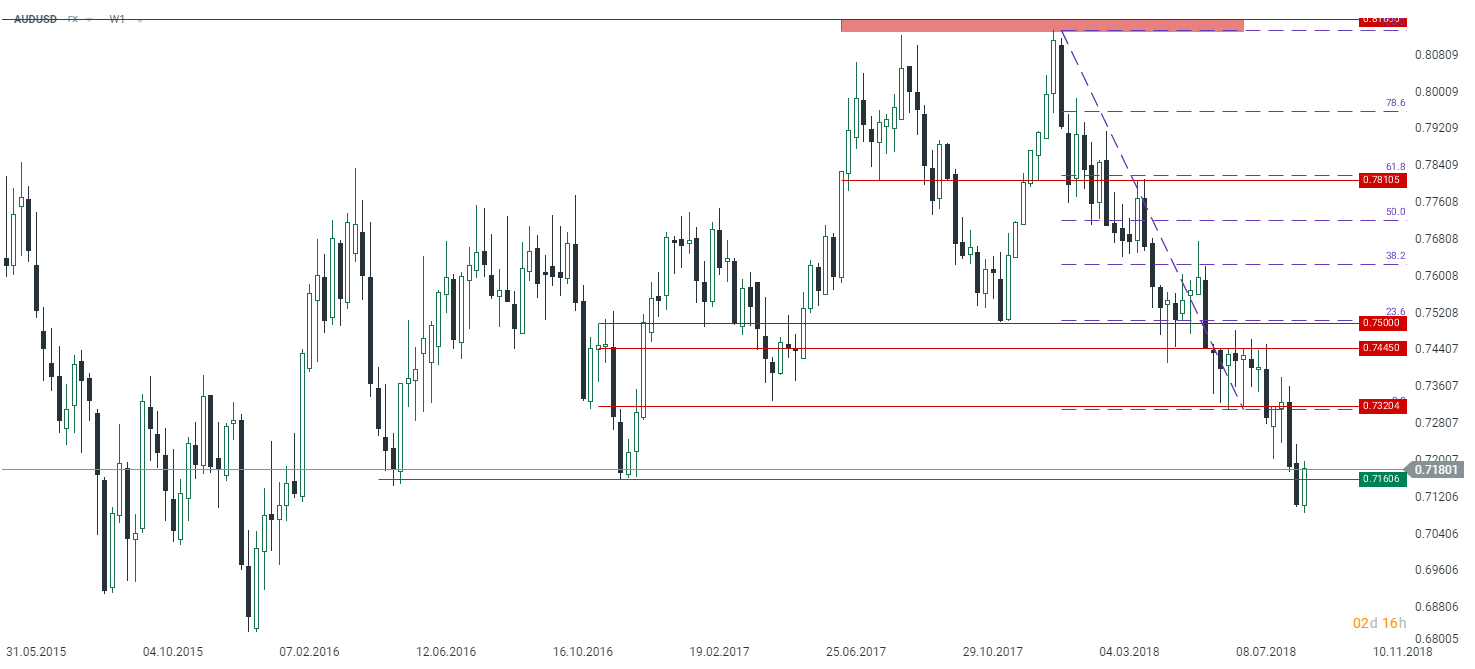

Technically the pair is dancing around its crucial support which needs to be broken (once again) to provide buyers with some hopes to continue such a move in the next week. Thus all eyes on 0.7160 as the week is slowly coming to an end. Source: xStation5

Technically the pair is dancing around its crucial support which needs to be broken (once again) to provide buyers with some hopes to continue such a move in the next week. Thus all eyes on 0.7160 as the week is slowly coming to an end. Source: xStation5

According to the US president’s top economic adviser the US government has proposed another round of trade talks with Beijing to avoid further escalation of the trade war. However, this time the possible round would be led by Treasury Secretary Steven Mnuchin. Larry Kudlow, director of Trump’s National Economic Council, confirmed the report saying “it’s positive thing”. The news supported US indices helping them erase earlier losses. The China’s stock market is also clearly higher today with the Hang Seng (CHNComp) jumping as much as 1.6% as of 6:47 am BST. The US 10Y yield has marginally risen and is trading at 2.964% at the time of writing.

The Hang Seng is benefiting from upbeat remarks regarding the trade war but the key obstacle remains in place. Note that this week’s close could be outstandingly important from a technical standpoint. Source: xStation5

The Hang Seng is benefiting from upbeat remarks regarding the trade war but the key obstacle remains in place. Note that this week’s close could be outstandingly important from a technical standpoint. Source: xStation5

The Federal Reserve published its monthly “Beige Book” on Wednesday and the document assured market participants that the US central bank is highly likely to pursue its monetary tightening. We got some hints regarding tariffs as they are seen to be contributing to higher input costs in all districts. According to the release some businesses decided to curb investment on trade concern. The labour market was described as “tight” what is not a surprise given the steady increase in JOLTS, robust jobs reports and a remarkably low number of weekly jobless claims. At the end of the day, businesses generally remained optimistic about the near-term outlook. The next rate hike is broadly expected to come later this month followed by a move in December, if delivered, it would be the fourth increase this year.

In the other news:

-

Fonterra set its milk price forecast at 6.75 NZD per kilogram for the fiscal year of 2018/2019 plus a expected dividend of 0.3 NZD

-

Japan’s core machinery orders jumped 13.9% YoY in July smashing the consensus of 4.3%, the data suggests that solid CAPEX could continue contributing to growth in the third quarter as well

-

Japan’s PPI grew 3% YoY in August slightly missing the median estimate of 3.1% YoY

-

Italy’s finance minister Giovanni Tria has threatened to step down following pressure from the Five Star Movement regarding a promise to fund a basic income for the poor

-

Canada’s Freeland suggested that NAFTA talks will continue today in Washington

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.