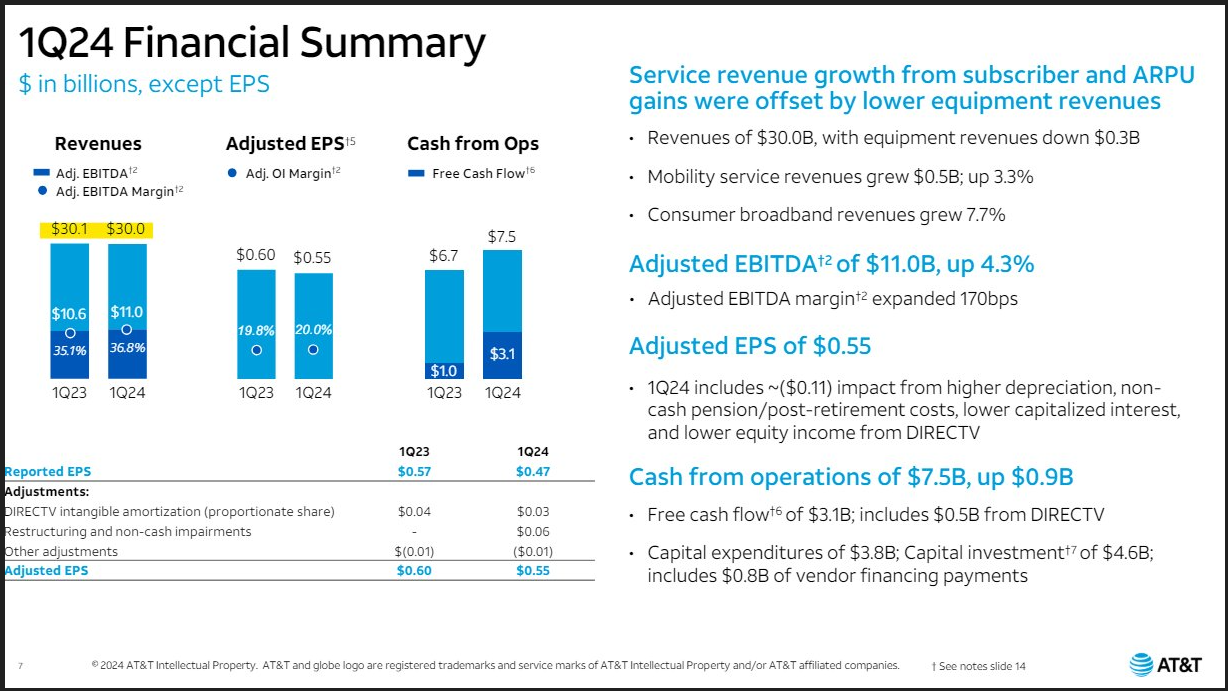

Profits at one of the largest U.S. telecom corporations AT&T (T.US) beat expectations, although sales came in lower than forecast, in a highly competitive environment. As a result, the company's shares are trading up 3.5% today before the open. AT&T reported $30 billion in revenue (down about $100 million YoY), below forecasts of $30.53 billion. However, earnings per share of $0.55 (down 12% YoY, from $0.6 in Q1 2023) for the first quarter of 2024 came in higher than forecast. The market expected $0.53.

- Earnings per share came in $0.11 lower on one-time factors, among which the company cited weakness in DIRECTV's services, pension-related severance costs and lower interest capitalization. At the same time, free cash flow increased significantly to $3.1 billion, compared to $1 billion, in Q1 2023.

- According to the company, results were solid, primarily due to business initiatives in 5G and fiber optics development. Revenues from mobile services rose 3.3% YoY to $20.6 billion ($21.13 billion was expected), but consumer business was 7.7% higher YoY. Adjusted EBITDA rose 4.3% YoY and 170 basis points (1.7%), respectively. Paid wireless subscriptions increased by 389,000 in Q1, compared to nearly 416,000 forecast.

- The company maintained its earnings per share forecast for 2024 in the vicinity of $2.15 to $2.25.

AT&T earnings summary

Source: AT&T

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appSource: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.