Summary:

-

Asian equity markets bounce back despite losses seen in the US the day before

-

British pound among the best performing G10 currencies ahead of a Brexit vote

-

Oil prices move up, OPEC and its allies to meet in March

China provides green

Several days ago we wrote about another stimulus planned by Beijing aimed at reviving economic growth and boosting the local stock market. Today we were offered a bit more details regarding this idea. According to PBoC’s deputy governor Zhu Hexin, deputy finance minister and deputy chairman of the National Development and Reform Commission (NDRC) the government will continue to cut taxes, especially for small businesses and the manufacturing sector. In the document distributed to reporters we may find that China confirmed “more supportive measures” for this year to stabilize the economy. The world’s second largest economy will also increase bond issuance to support key projects while the government will slash its general expenditures by more than 5%. Small and private companies will be offered looser funding conditions, the NDRC added. However, the vice chairman of the China’s state planner also said that China would not resort to ‘flood-like’ stimulus and instead it would speed up investment projects. In turn, deputy governor of the People’s Bank of China ensured that monetary policy would remain prudent but it did not mean there would be no changes. Both money supply and total social financing growth are expected to rise in line with nominal GDP growth. As far as the exchange rate is concerned, the PBoC added that it was confident the currency could be kept stable despite cuts in the banks’ reserve requirement ratio. What does it mean? Although Beijing tries to revive economic growth and restore confidence among equity investors, it could prove to be a tough task as economic activity keeps slowing there as evidenced by the trade data released on Monday. Therefore, while these stimulatory measures may soothe negative effects to some extent, it seems to be inevitable that GDP growth will be losing momentum with all consequences to the global economy. Indices in Asia are moving higher this morning with the Hang Seng (CHNComp) rising 1.9% and the Shanghai Composite climbing 1.2% at the time of writing. The Japanese NIKKEI (JAP225) closed almost 1% higher. Note that these gains came despite moderate losses seen on Wall Street the day before where the NASDAQ (US100) slid the most losing 0.9%.

The 50DMA on the SP500 chart appears to be the nearest resistance for buyers. Our base scenario signals that this line could be remarkably hard to be broken unless some encouraging developments concerning trade talks come out. Source: xStation5

Crucial day for the GBP

The British currency is gaining 0.3% against the US dollar this morning being placed among the best G10 currencies. Tuesday is a crucial day for Theresa May and her Brexit plan which will be voted in the UK parliament this evening with tiny odds to be approved. The latest revelations suggest that as much as 70 of her Conservative Party, as well as the DUP members, are expected to vote against her plan. If true, it would mean a defat by a margin of 150 or more, the largest one in 95 years. What will happen next if her deal is voted down? According to the Sun’s article British Prime Minister Theresa May was offered last-minute help from German Chancellor Angela Merkel providing May with extra concessions if MPs reject her deal. From the FX market point of view the most important could be the amount of MPs voting against the May’s deal. The number above 60 could signal that the deal is virtually dead which could be GBP negative. The vote is expected to take place between 7:00 and 9:00 pm GMT.

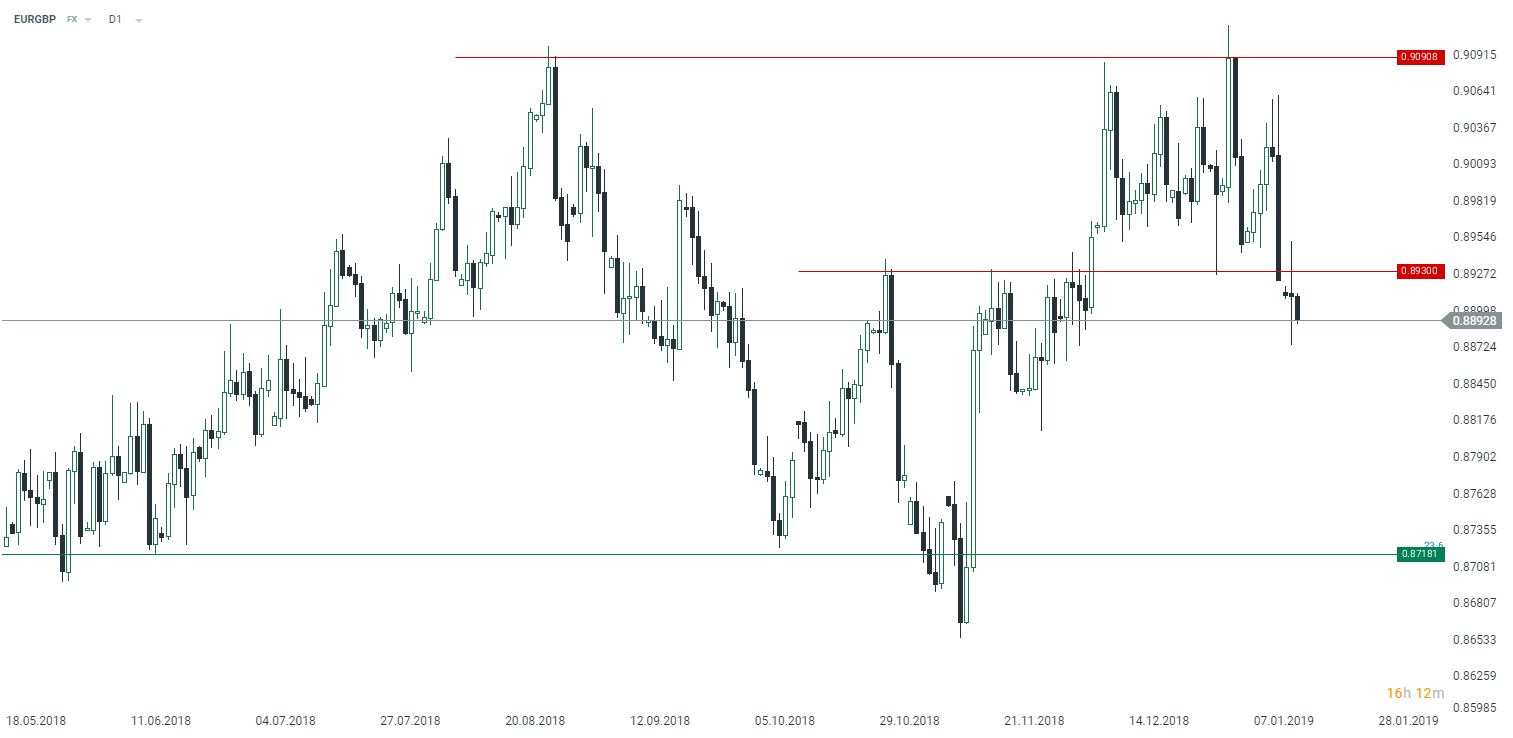

The EURGBP is moving lower after it failed to stay above 0.9090. Moreover, the cross also rejected to come back above 0.8930, hence it seems that the price may continue heading south. Technically the first support could be found in the vicinity of 0.8720 but with a lot of uncertainty surrounding the vote it may be a hectic day for the pound. Source: xStation5

In the other news:

-

OPEC and its allies plan to hold a meeting in March so as to assess their oil-production accord in Azerbaijan, then ministers will meet in April; oil prices trade 1.4% higher this morning

-

Swedish Social Democrat leader Stefan Lofven has been given one day to form consensus for a new government; the SEK trades 0.1% higher against the dollar this morning

-

US 10Y yield has climbed notably in recent hours from 2.66% to almost 2.72% as risk appetite has improved

-

Japanese machine tool orders fell 18.3% YoY in December after falling 17% YoY in November

-

New Zealand's food prices declined 0.2% MoM in December after a 0.6% MoM drop in November

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.