Today, after the close of the trading session on Wall Street, financial results for the first quarter of the year will be presented by Apple (AAPL.US), which recently lost its status as the largest company on Wall Street, after being dethroned by Microsoft. Investors took this as evidence that the Cupertino-based company is starting to become a 'marauder' in AI services and will not see a significant driver of product demand and margins from this. Investors expect the company's profits and revenues (for the 5th consecutive quarter) to show declining year-on-year growth. In today's report, investors will be looking at how much AI and resilient, high-margin services will offset the company's almost certainly much lower iPhone sales, which in Q1 lost about 20% of its market share in China, once a key expansion driver for Apple. The options market is pricing in about 4% volatility in Apple's stock price following the report.

- Expected revenues: $89.99 billion (5.1% YoY decline)

- Expected earnings per share: $1.51 (0.7% YoY decline)

What to expect?

- Evercore ISI expects that Apple's AI-based services will only be a complementary offering, and that investors have a legitimate problem understanding the artificial intelligence expansion strategy.

- Wall Street will be awaiting Apple's comments on the Justice Department's antitrust investigation, which could affect App Store sales.

- Wedbush analysts recently suggested that ultimately the company will likely face a financial penalty, but the size of the fine is unknown.

- Apple's VisionPro VR/AR headset debuted in February, but Wall Street does not currently see the product as a strong growth catalyst to justify higher valuations

- Along with Alphabet, with whom Apple is working on Gemini AI, the company may also be affected by new EU digital legislation. Here, too, the market can expect a comment from the company

- According to recent reports, Apple is developing its own AI server processor using 3nm technology from TSMC. The company's goal is to have it in mass production by the second half of 2025. Developing its own AI processors, would mean optimizing the supply chain, perhaps favoring margins

- AI in Apple products (Mac family and others) will not appear until Q4 2024, and probably early next year. The market is beginning to worry that a possibly weakening consumer may avoid spending on hardware and undermine the company's pro-cyclical business

Apple is likely to have lost about 19% of its smartphone market share year-on-year, in China, in Q1 2024. In turn, IDC research indicated that the iPhone lost share not only in China, but worldwide. Apple had previously expected iPhone sales revenue to remain flat y/y in Q1 2024, with a sequential decline of 27% k/k (it's worth noting that a good portion of it is due to the seasonality of comparisons to the holiday quarter). Meanwhile, service revenues are expected to grow 11% year-on-year. Any disappointment in this area could lead to a downward reaction in the company's shares. Source: Counterpoint Research

Apple is likely to have lost about 19% of its smartphone market share year-on-year, in China, in Q1 2024. In turn, IDC research indicated that the iPhone lost share not only in China, but worldwide. Apple had previously expected iPhone sales revenue to remain flat y/y in Q1 2024, with a sequential decline of 27% k/k (it's worth noting that a good portion of it is due to the seasonality of comparisons to the holiday quarter). Meanwhile, service revenues are expected to grow 11% year-on-year. Any disappointment in this area could lead to a downward reaction in the company's shares. Source: Counterpoint Research

AI and services vs hardware sales weakness

iPhone sales account for about 60% of Apple's total revenue, and China accounts for about 20% of the flagship smartphone's sales. In addition, higher interest rates for a longer period of time may also weaken demand in its main market, the US. In the last quarter of 2023, iPhone sales in China fell 13%. In the first quarter of 2024, overall global smartphone sales fell to 50.1 million, down 9.6% from the same quarter in 2023. It is almost certain that with flat or slightly higher y/y iPhone sales in other markets, China's weakness will not be offset by other markets.

Apple's services account for about 20% of revenue and allow the company to earn very high margins. Apple Store, Pay, TV+, Music, iCloud and Arcade accounted for $85.2 billion in Q4 2023, with gross margins of 73% versus 40% averaging gross margins on hardware sales. It appears that the company can maintain strong services margins or even improve them if we add the projected contribution of artificial intelligence and related services. In the medium term, however, in the absence of an immediate catalyst, profitability from services is likely to be hampered by falling hardware sales.

Sales of the iPad, Macs, and wearables, home and accessories accounted for about 20% of total revenue in Q4 2023 and saw a y/y decline in 2023, with a 27% decline in iPad sales and a 3% decline in Mac sales (versus a 3% y/y increase in iPhone sales and a 9% increase in services). The question is how much will the prospect of AI implementation improve hardware and services sales? Still, there is no confirmation of AI implementation for iOS18 and iPhone16, although the company is in talks with Alphabet and OpenAI. Next week, the company's CEO Cook is expected to host a conference where he will reveal more information about AI at Apple.

Apple shares (AAPL.US) (D1)

Apple shares are trading below the 200-session moving average (SMA200, red line). The stock is currently hovering around the 38.2 Fibonacci retracement of the January 2023 upward wave. A drop below this zone could indicate a test of the 61.8 Fibo, near $150. On the other hand, maintenance of this support could herald a rise toward $180, where we also observe the aforementioned SMA200 average. Since the beginning of the year, Apple is losing about 12% and is the second-weakest company of the 'Magnificent 7' after Tesla.

Source: xStation5

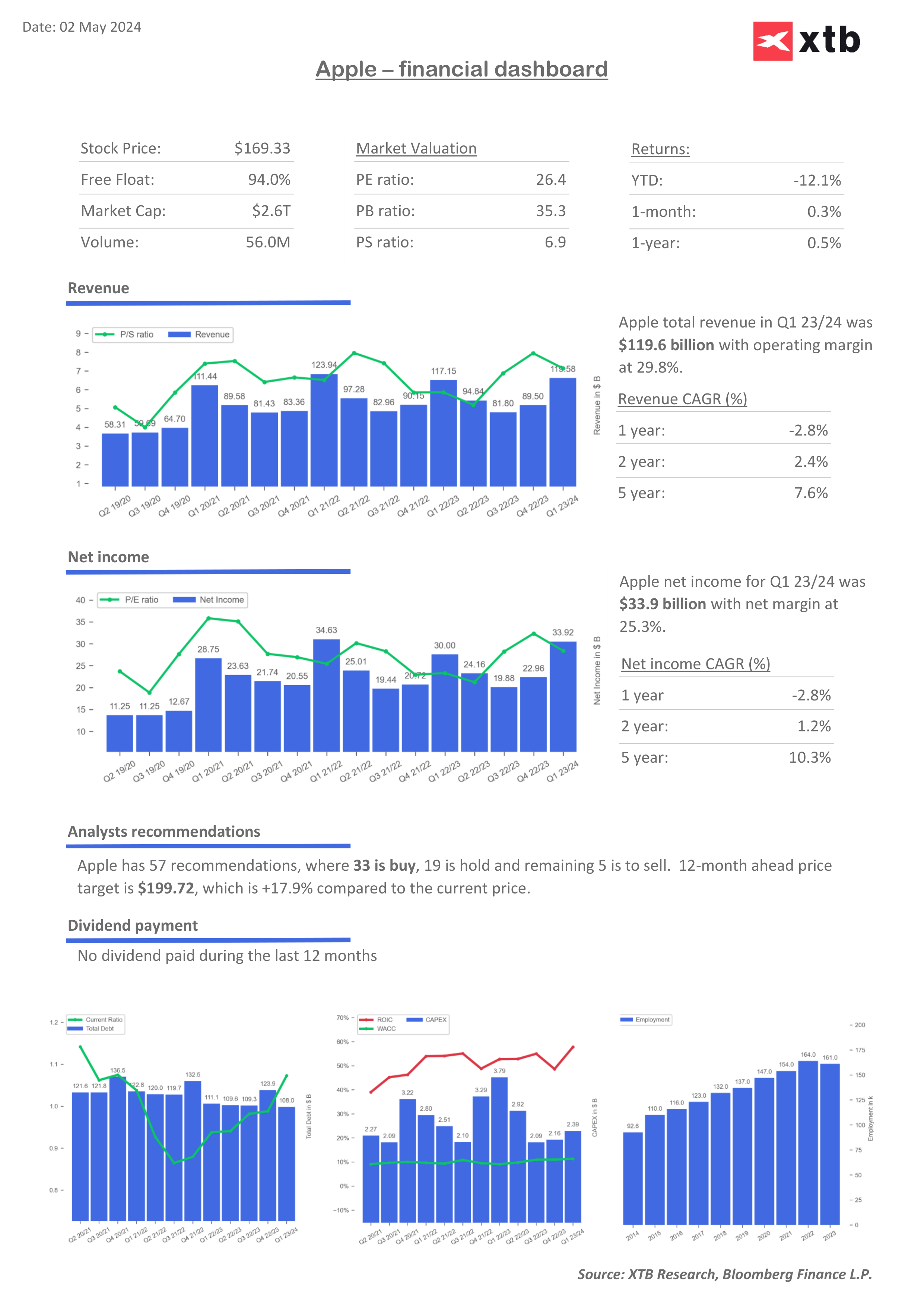

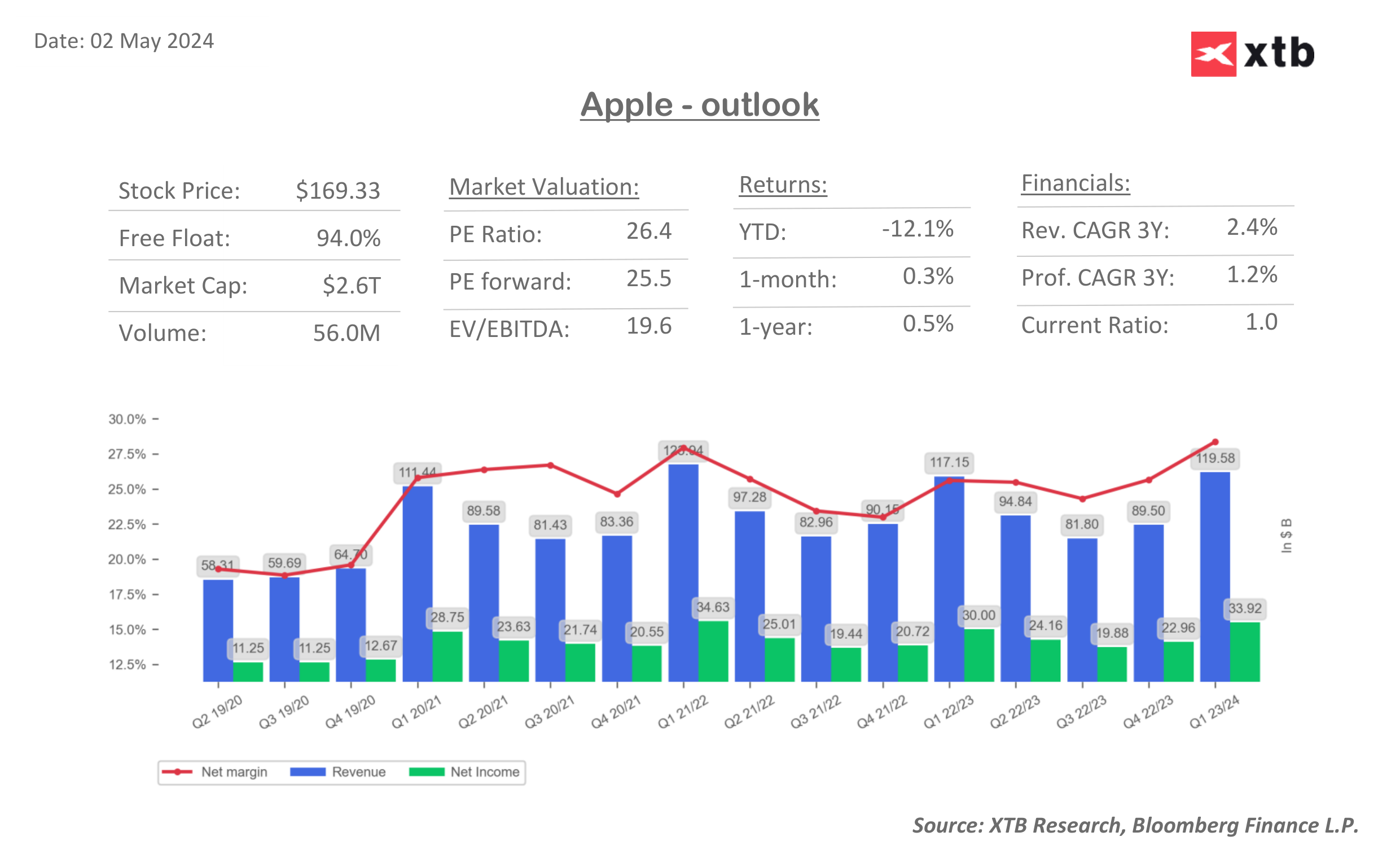

Apple's multipliers, indicators and expectations

Despite some slowdown in business momentum, Apple's recent results have been very solid, and net margins are continuing to improve. The question is at what cost to revenues, will margins grow, and will the company continue to have the strength to improve them; with a potentially extended cycle of higher interest rates.

Source: XTB Research, Bloomberg Finance LP

Source: XTB Research, Bloomberg Finance LP

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.