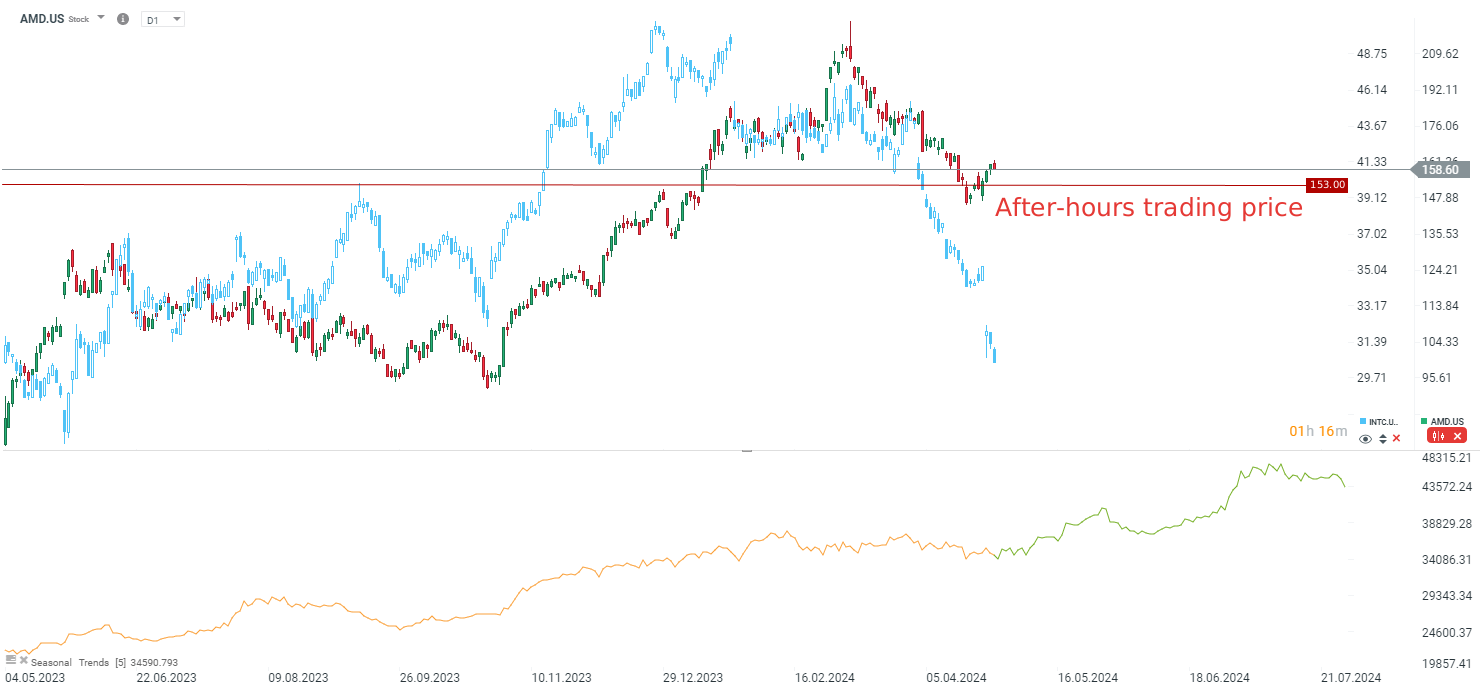

AMD announced results for the first quarter of 2024, which were mostly in line with analyst expectations. The company's revenue was $5.47 billion, up 36% from last year. Earnings per share (EPS) were $0.62, beating expectations of $0.61. On the other hand, the company presents rather mixed guidance. Results in line with expectations and rather weak guidance show that the company is not able to grow like Nvidia at the moment, which may suggest that despite a strong correction, the company's stock declines may not be over yet. AMD loses approximately 3.6% in after-market quotations. Moreover, SMC shows weaker results (mainly in terms of revenues and guidelines), which also worsens the mood in the chip sector.

Key Points:

- AMD reported Q1 2024 revenue of $5.47 billion, up 36% YoY, meeting analyst expectations.

- EPS of $0.62 beat expectations of $0.61.

- Data Center segment revenue grew 80% YoY to $2.3 billion, driven by strong demand for MI300 AI accelerators and Ryzen and EPYC processors.

- Client segment revenue grew 85% YoY to $1.4 billion but declined 6% sequentially.

- Gaming and Embedded segment revenues declined 48% and 46% YoY, respectively.

- Q2 revenue guidance of $5.4-$6.0 billion below analyst expectations.

- AMD continues to invest heavily in R&D, spending $1.53 billion in Q1.

- The company expects data center demand to remain strong as AI adoption grows.

- AMD faces stiff competition from Intel and Nvidia in data centers, PCs, gaming, and embedded systems.

- The stock is down about 3.6% in after-hours trading, following Intel's downward trend.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.