AMC Entertainment (AMC.US) shares fell sharply during today's session even despite the fact that theater chain posted better than expected quarterly results.

-

Meme-stock phenomen reported a 12th quarterly loss, this time of 22 cents per share, smaller than the 26 cents loss anticipated by analysts. AMC did not have a profitable quarter on a GAAP basis since first half of 2019.

-

Revenue of $968.4 million also topped market projections of $961 million. In the same period last year the company recorded revenue of $763.2 million.

-

CEO Adam Aron said AMC’s results were impacted by soft box office results in the latter part of the quarter, however pointed out that per-patron metrics for admissions revenue and food and beverage spending remained above pra-pandemic levels and jumped 12% and 30%, respectively.

-

“We expect to make more business development announcements in the coming weeks and months, which along with an improving movie theater sector positions AMC Entertainment to create value for all our stakeholders,” Aron said in the earnings release.

-

Earlier this week the company announced a new partnership with digital video conferencing firm Zoom Communications (ZM.US). This joint venture will launch next year and will enable decentralized workforces and customer bases to meet in large groups to host cohesive virtual and in-person events.

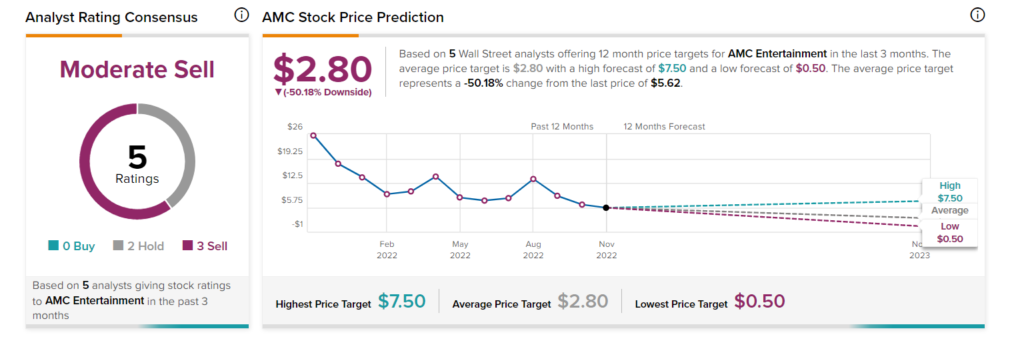

Company has a moderate sell consensus based on 5 analysts ratings - 0 buys, 2 holds, 3 sells, with an average price target at $2.80, which implies approximately 50.00% downward potential from current levels. Source: Tipranks.com

AMC Entertainment (AMC.US) stock has been on a wild roller-coaster ride since the pandemic outbreak. It seems that if the company does not come up with a way to increase profits, stock price may be moving towards March 2020 lows around $2.00 per share. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.