- Amazon will release its financial results for the second quarter today after the market closes.

- The company is expected to announce a significant increase in both revenue and earnings per share.

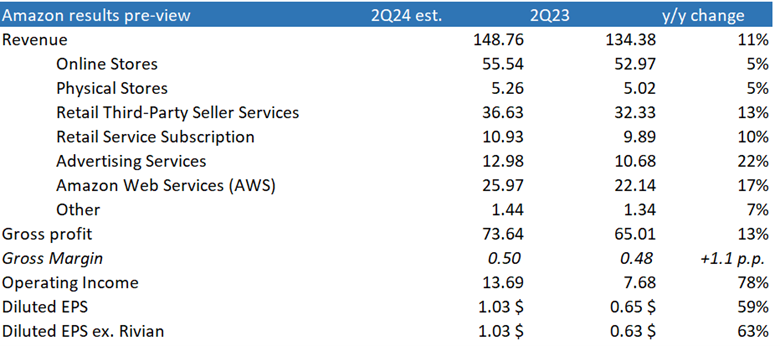

- Revenue is projected to climb 11% year-over-year to $148.76 billion, while earnings per share (EPS) are expected to soar nearly 60% to $1.03.

- Investors will be closely watching the performance of Amazon's advertising business, a relatively new but rapidly growing segment, as well as its cloud computing division, Amazon Web Services (AWS).

Market Expectations

Amazon has consistently exceeded earnings expectations for the past six quarters. In fact, on average, the company has surpassed analyst estimates by a remarkable 70% over the last decade. More recently, the average earnings surprise has been around 40%. To maintain this trend, Amazon would need to report EPS of approximately $1.40.

Similarly, the company has outperformed revenue expectations for six consecutive quarters. While the most recent beat was a more modest 0.51%, Amazon's average revenue surprise historically has been 1.3%. Based on this, revenue is anticipated to surpass $150 billion.

Market expectations for Q2 2024. Source: Amazon, Bloomberg, XTB

Key Areas of Focus

Several factors will be in the spotlight. Amazon's advertising business is gaining traction and contributing increasingly to overall results. AWS, the company's cloud computing arm, achieved 17% growth in the first quarter, reaching $25 billion in revenue. Expectations for Q2 AWS growth are also around 17%. Amazon's CEO has emphasized the company's commitment to technology and its belief that AWS will be a cornerstone of global artificial intelligence development. The acquisition of AI startup Anthropic earlier this year underscores this focus.

Investors will also be keen to hear about the progress of Alexa, Amazon's AI-powered virtual assistant. Recent reports suggest the product is still under development, and any lack of updates or a delayed launch could dampen investor sentiment.

Core Business and Challenges

Online retail remains Amazon's core business, although the company has expanded into food delivery, which has the potential to increase revenue from Prime members (now totaling 200 million). However, Amazon faces growing competition from Chinese e-commerce giants like Temu, Shein, and AliExpress.

Other Key Indicators

Beyond the top line and bottom line, investors should monitor the following:

- AWS Growth: Any slowdown in AWS growth below the expected 17% could disappoint investors, especially given the strong performance of competitors like Alphabet's cloud business.

- Impact of Food Delivery: The contribution of food delivery subscriptions to overall sales and profitability will be closely watched.

- Competitive Response: Amazon's recent introduction of discounts for Chinese customers could positively impact future results, but the company's ability to compete effectively against Chinese rivals remains a key challenge.

Stock Performance

Amazon's stock price has experienced a recent correction after reaching highs above $200 per share. Analysts have set a 12-month price target of $223, implying potential upside of around 7% from the current level of $185. Key support and resistance levels are identified at $175, $185-$190, and $198.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.