Alibaba (BABA.US) stock dropped over 2.5% after Bloomberg reported that Chinese e-commerce giant is considering the sale of its 30% stake in social media advertising company Weibo (WB.US), to state-owned Shanghai Media Group. Company’s shares dropped over 50% over the last year due to a myriad of concerns such as Chinese regulatory crackdowns hurting its business and how its shares could get delisted from US bourses.

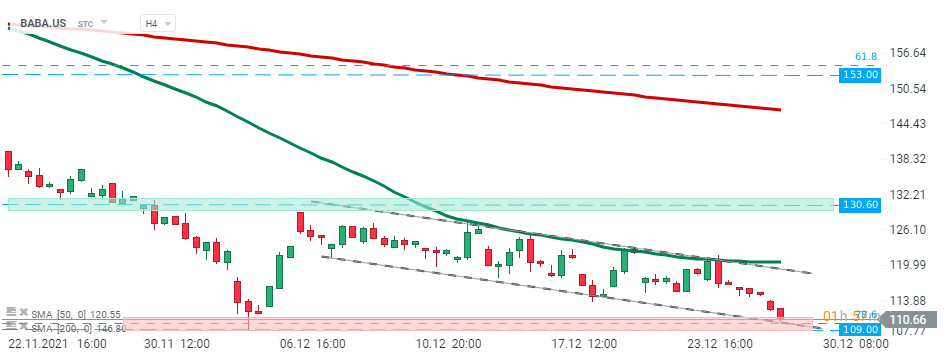

Alibaba's (BABA.US) stock launched today’s session lower and is currently testing major support zone around $109.00 which is marked with December lows, lower limit of the descending channel and 78.6% Fibonacci retracement of the large upward wave launched back in September 2015. Should break lower occur, downward move may accelerate towards psychological $100.00 level. On the other hand, if buyers manage to halt declines here, then another upward impulse towards the upper limit of the aforementioned channel may be launched. Source: xStation5

Alibaba's (BABA.US) stock launched today’s session lower and is currently testing major support zone around $109.00 which is marked with December lows, lower limit of the descending channel and 78.6% Fibonacci retracement of the large upward wave launched back in September 2015. Should break lower occur, downward move may accelerate towards psychological $100.00 level. On the other hand, if buyers manage to halt declines here, then another upward impulse towards the upper limit of the aforementioned channel may be launched. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.