Alaska Air Group (ALK.US) is losing more than 6% today following the release of its 2Q24 results and the presentation of its forecasts for the next quarter. The company, despite its solid results, disappointed investors most strongly precisely with its projections for the next quarter, which differed sharply from analysts' predictions.

The company generated $2.9 billion in revenue in 2Q24, an improvement of 2.1% over the previous year, marking a record quarter for the company. Sales of premium seats accounted for 33% of the company's total revenue, and it was this segment that led to such a strong result.

The company recorded similar growth in RPM, or the value equivalent to one mile traveled by one paying passenger (revenue passenger miles). The company recorded RPM 15.3 billion (+2.5% y/y). Stronger growth was recorded in cpacity, as measured by the ASM value (a measure of 1 seat allowing to travel 1 mile). In this value, Alaska Air achieved 6% y/y growth to a value of 18.2 billion. The value of RASM, which stands for revenue per ASM unit, declined y/y by 3.7% because of higher capacity growth.

Adjusted EPS came in at $2.55, compared to $3 a year earlier, a stronger result than the $2.38 the market had predicted.

The company expects capacity growth to diminish in the following months, while for the full year of 2024 it expects growth to decline to 2.5% y/y, due to lower deliveries from Boeing than it had previously anticipated.

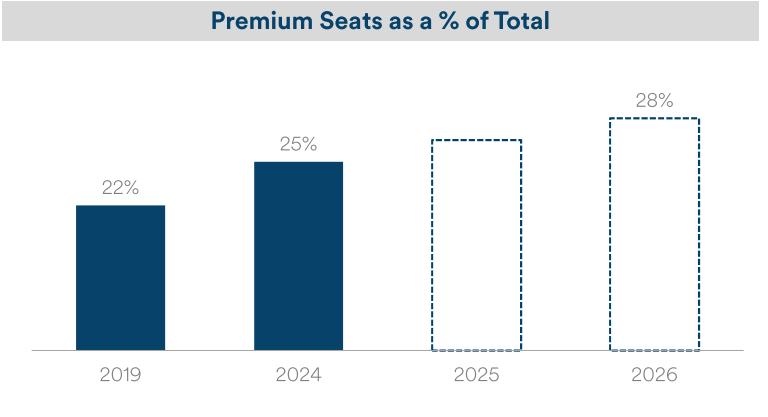

Alaska Air also announced an increase in the share of premium seats on its aircraft, which should boost both the company's revenue and its margins. Fleet modifications this September include adding premium seats to 64% of the group's aircraft. Ultimately, by 2026, the share of premium seats in the number of total seats offered is expected to rise to 28% from 25% today.

Source: Alaska Air Group

Source: Alaska Air Group

The company, despite solid results, disappointed investors most strongly with its predictions for the coming periods. In 3Q24, it expects to deliver $1.4-1.6 in adjusted earnings per share versus Wall Street's average expectation of $2.06. The drop in projected profit is due to following in the footsteps of its competitors including United AIrlines Holdings and Delta Air Lines, which have decided to cut prices for the summer season, which translates into increased competition for the record number of passengers expected to travel this summer, some 270 million. The price cut will also affect profitability for all of 2024, with the company lowering its forecast to $3.5-4.5 (previously: $3.25-5.25). The market consensus was for $4.52 for the full year.

The company is losing more than 6% today after the release of results and forecasts, approaching the support level at around $37 set by the consolidation zone from February this year. The company has remained in a downtrend since the April peaks. Source: xStation

2Q24 RESULTS:

- Revenues: $2.9 billion (+2.1% y/y), expected: $2.93 billion

- Revenue from passengers: $2.65 billion (+2.1% y/y), expected: $2.68 billion

- RPM: $15.3 billion (+2.5% y/y), expected: $15.74 billion

- ASM: 18.2 billion (+6% y/y), expected 18.17 billion

- RASM: 15.92c (-3.7% y/y)

- Adjusted EPS: $2.55 (vs. $3 a year earlier), expected $2.38

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.