Shares in Europe's largest aerospace-industrial conglomerate Airbus (AIR.FR) are trading down 12% today, as the company lowered its financial forecast for the full year 2024. It now expects lower pre-tax profits and fewer aircraft to add to its fleet this year. The company also indicated that the decision to lower expectations was influenced by higher costs in the space operations segment and problems in supply chains (particularly in the engine and cabin equipment sectors).

- The company expects EBIT to be around €5.5 billion this year, compared to the €6.5 to €7 billion estimated on April 25. Aircraft deliveries are expected to reach 770 models this year, against 800 expected; at the same time, Airbus has postponed the return of A320 production.

- Airbus relayed that costs for its space systems unit rose to €900 million in the first half of the year, as a result of higher service and labor costs. Airbus has already surprised the market once this year with a weaker-than-forecast report, and investors expect the problems with satisfactory profitability to continue. Half-year results will be released on July 30, 2024.

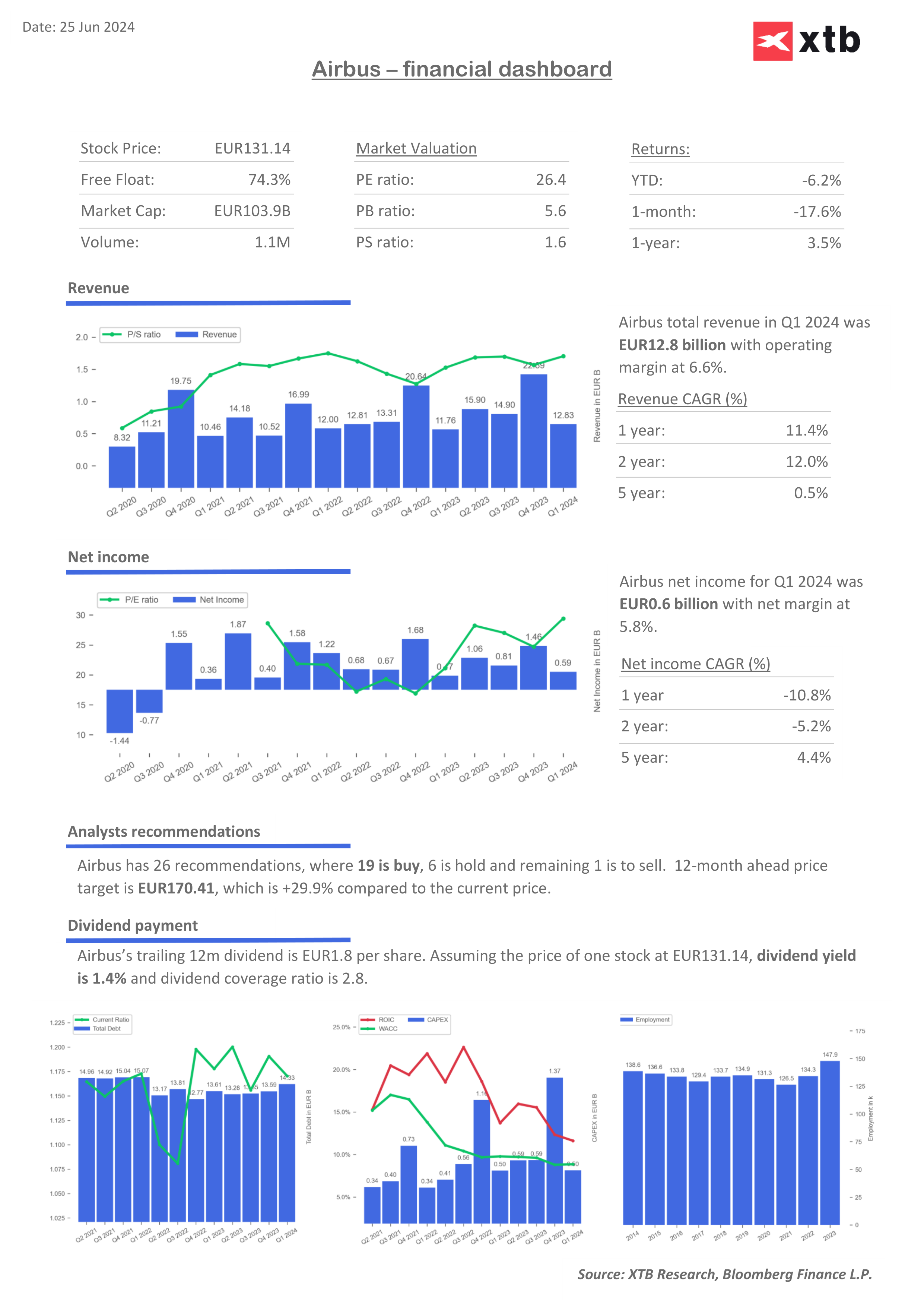

Airbus shares (AIR.FR)

Airbus shares are experiencing one of the biggest sell-offs in their history and are trading 10% below the 200-day simple moving average (SMA200, red line). The relative strength index (RSI) is trading at 20 points, signalling a deep oversold condition. Significant support can be found around EUR120 per share.

Source: xStation5

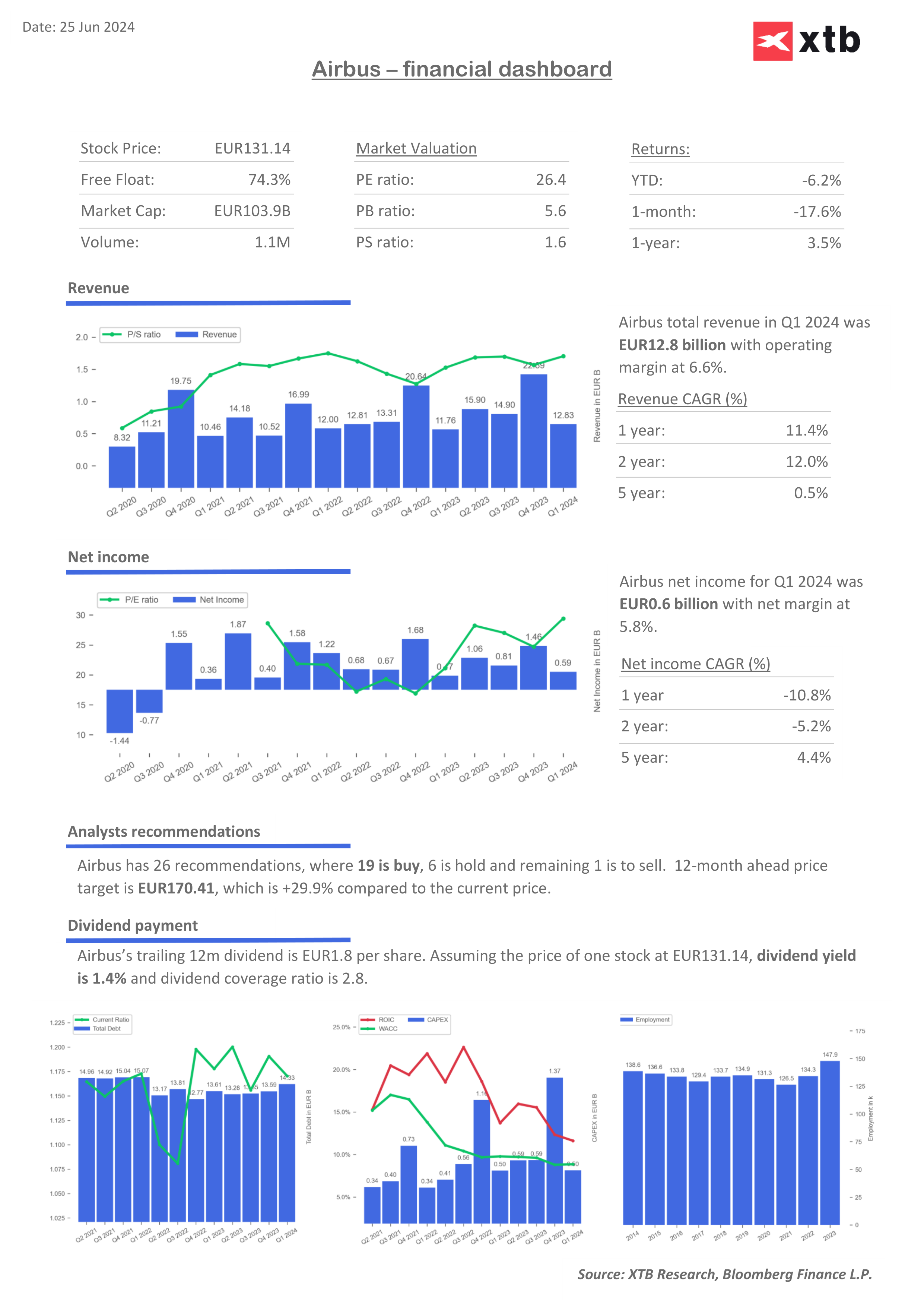

Airbus valuation forecasts and multipliers

As a result of lower earnings, the price-to-earnings ratio for Airbus shares is rising, while ROIC or ROE ratios are falling, suggesting challenges in the business. Higher costs could eventually cause the WACC ratio to rise above ROIC, reducing economic value added (EVA).

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.