Abbott Laboratories (ABT.US) stock fell over 2.0% in pre-market despite the fact that medical devices and health care companies posted quarterly figures which topped market estimates.

- Company earned $1.73 on revenue of $11.9B boosted mainly by high demand for its COVID-19 test kits and other medical devices. Meanwhile analysts expected earnings of $1.47 on revenue of $11.04B.

- Abbott expects a full-year 2022 diluted EPS on a GAAP basis around $3.35 and projected adjusted diluted EPS of at least $4.70 remains unchanged.

- Guidance for the current fiscal year includes projected COVID-19 testing-related sales of approximately $4.5 billion, which Abbott expects to largely occur in the first half of the year and will update on a quarterly basis.

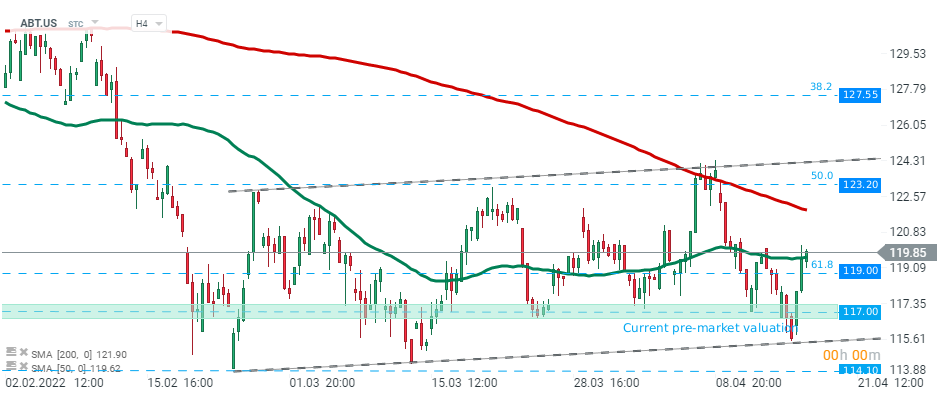

Abbott Laboratories (ABT.US) stock has been moving within an ascending channel since the end of February 2022. However price moved lower following the releases of quarterly figures and is currently approaching the lower limit of the formation. Should break lower occur, downward move may accelerate towards local support at $114.10. Source: xStation5

Abbott Laboratories (ABT.US) stock has been moving within an ascending channel since the end of February 2022. However price moved lower following the releases of quarterly figures and is currently approaching the lower limit of the formation. Should break lower occur, downward move may accelerate towards local support at $114.10. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.