The Bank of England turned a page on Thursday. The period of high inflation is behind us, external shocks are no longer dominating monetary policy and the time for rate cuts has come. The Bank cut interest rates for the first time since 2020 on Thursday, in a move that was widely expected by economists, however, up until last week, the market only had a low conviction that the BOE would go ahead and cut rates. The vote was close, 5 MPC members voted to cut versus 4 who voted to hold rates. The usual suspects voted to hold rates: Catherine Mann, Jonathan Haskell, Huw Pill and Megan Greene, while the other members, including the Governor Andrew Bailey, all voted to cut rates. The decision was almost too close to call; however, we believe that some of those who voted to hold rates at today’s meeting could be persuaded to join the calls to cut rates in the coming months.

Overall, although this was a close decision, the accompanying Monetary Policy report forecasts for growth and inflation are dovish and support further rate cuts from the BOE. The Bank’s reason for cutting rates was down to progress made in inflation. The decline in headline inflation and other inflation indicators could feed through to weaker pay and price setting dynamics and a ‘margin of slack’ could appear if the economy stalls and the labour market slows. The BOE statement said that it was appropriate to reduce ‘slightly the degree of policy restrictiveness’, does this mean that there is more to come?

Growth and inflation forecasts crucial for future of monetary policy

Interestingly, the BOE cut interest rates although they revised up their growth and inflation forecasts for this year. Growth was revised much higher for 2024. The BOE now expects the UK economy to grow by 1.5% this year, vs. expectations of 0.5% in May. The 2025 forecast for GDP was revised down slightly to 0.8% vs. 0.9% previously. Growth was also revised down for 2026 to 1.4% from 1.3%. Inflation was revised higher. Modal CPI was revised up to 2.3% from 2.2% for 2024, inflation forecasts for 2025 and 2026 were both revised down a notch. In our view, these forecasts support more rate cuts from the BOE in the future.

Interest rates are set to be lower than the BOE’s May forecast

Although the short-term forecasts for growth and inflation were revised higher, the BOE revised down longer-term forecasts for both. This comes even though the BOE has also lowered its forecasts for the Bank Rate in the coming years. Bank Rate is now expected to fall to 4.2% next year, the previous estimate was 4.4%. In 2026 the BOE also revised down its Bank Rate estimate to 3.8% from 3.9%. Thus, although the BOE said in its statement that this was a cautious first step, these forecasts suggest that they are expecting to engage in a protracted rate cutting cycle. The BOE may not end up being as slow to cut rates as some expected, which could weigh on the pound in the medium term.

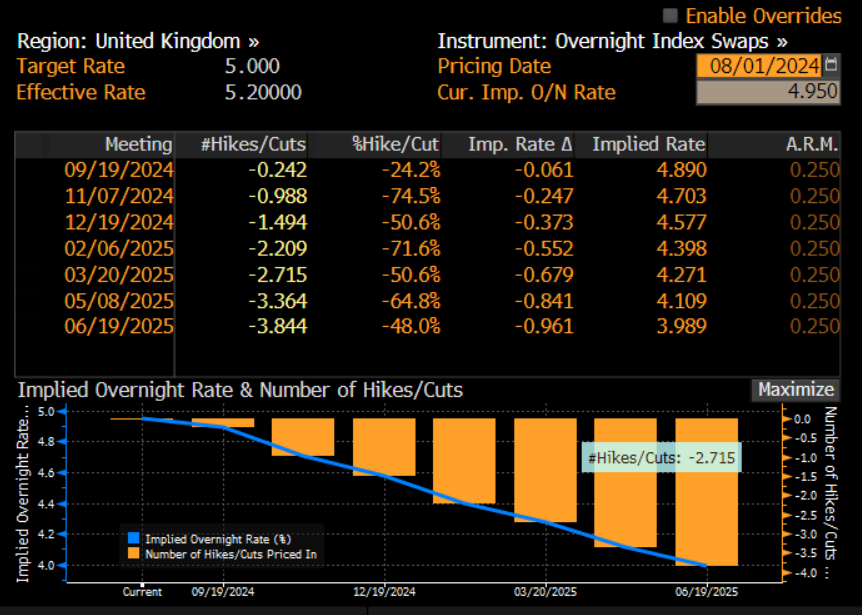

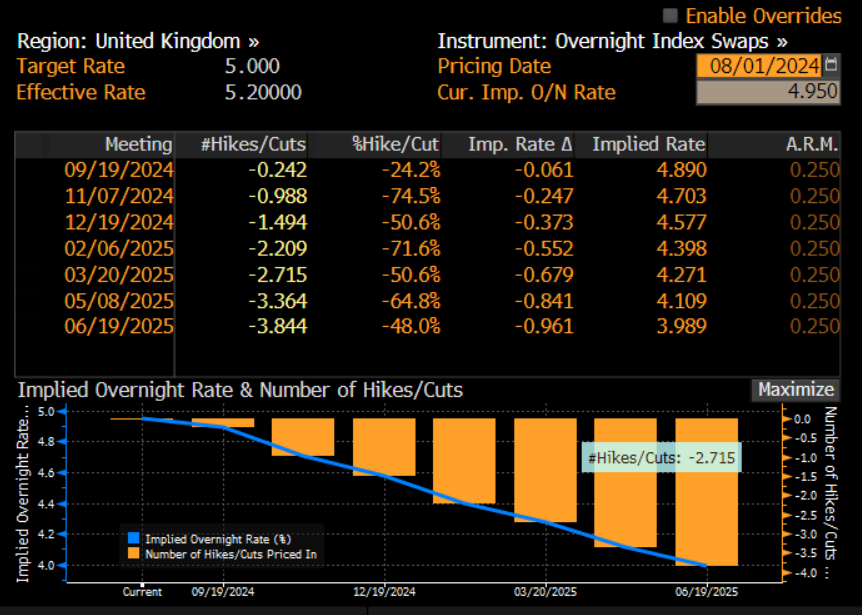

This does not mean that interest rates will fall as sharply as the market had wanted, the interest rate futures market was expecting UK interest rates to fall to 4.0% by mid-2025. Thus, you can decide if the market is getting ahead of itself or if the BOE is behind the curve. The BOE is still concerned about the second-round effects of inflation lasting longer than anticipated, which is why the BOE is not as bullish on rate cuts as the market.

The BOE’s latest forecasts are not as bad as they seem, although growth is expected to fall sharply in 2025, the unemployment rate has been revised lower for 2025 from 4.7% to 4.6%. Thus, the BOE sees a soft landing when it comes to the economy.

The meeting that had something for everyone

Overall, this meeting had something for everyone, the vote was close, the wording of the statement was not too exuberant, yet the Bank’s long-term inflation and growth figures were dovish. Added to this, the BOE does not expect any slowdown in the economy to increase the unemployment rate by much. No wonder this rate cut was such a close call.

BOE: the market impact

The market impact has been muted so far. GBP/USD is still trading below $1.28, although it has bounced off earlier lows. UK Gilt yields are lower across the curve, and the FTSE 100 is up 0.2%, and is bucking the trend for weaker European equities on Thursday. The move in Gilt yields is likely a reaction to the shift to the longer term BOE forecasts for growth, inflation, and Bank Rate, which justify lower UK yields. Thus, the pound may struggle to break above $1.30 in the medium term.

Chart 1: UK interest rate expectations

Source: Bloomberg and XTB

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.