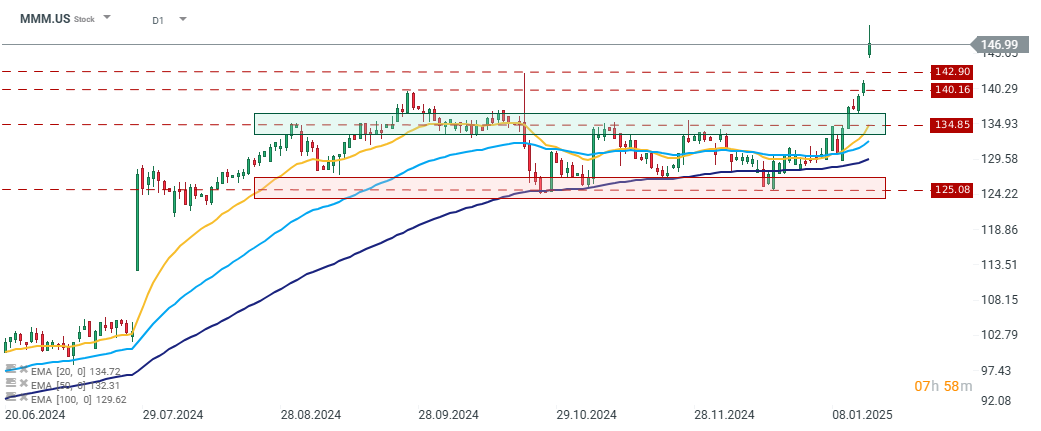

3M (MMM.US) released its Q4 2024 results today. Most of the figures exceeded expectations, and first trading reactions indicate a positive reception by the market. The company's stock is up by approximately over 4% at the start of the session.

The company posted $6 billion in revenue for Q4, showing flat year-over-year growth. On a comparable basis, revenue grew by 2.1% year-over-year, marking the strongest growth in recent quarters and exceeding consensus estimates by 1.2 percentage points. The security and industrial segment recorded the highest growth, a positive signal given its dominant contribution to total revenues, accounting for 45% of the company's Q4 2024 revenue.

Operationally, this segment also delivered the highest operating margin at 21%, surpassing the company's overall core margin by 3 percentage points. Year-over-year, this margin improved by 1 percentage point. For the full year 2024, the security and industrial segment's margin reached 23%, up 2 percentage points compared to 2023.

In 2024, the company returned $3.8 billion to shareholders, with nearly 30% distributed in Q4 alone. 3M also provided its 2025 outlook, which aligns closely with prior estimates. The company forecasts adjusted EPS in the range of $7.60 to $7.90, with the midpoint of $7.75 nearly matching the consensus estimate of $7.78. On a comparable sales basis, 3M expects growth of 2.5%, signaling continued acceleration in growth rates compared to previous quarters, though currency fluctuations may pose headwinds.

FINANCIAL RESULTS:

- Revenue: $6.0 billion; estimates: $5.78 billion (flat year-over-year)

- Adjusted EPS: $1.68; estimates: $1.66 (-2% year-over-year)

- Full-year sales: $24.6 billion; adjusted sales: (+1.3%), GAAP sales: (-0.1% year-over-year)

- Full-year GAAP EPS: $7.26; previous year: -$15.17

- Full-year adjusted EPS: $7.30; previous year: $6.04 (+21% year-over-year)

- Free cash flow: $1.3 billion (Q4); full year: $4.9 billion

- Shareholder returns: $1.1 billion (Q4); full year: $3.8 billion (through dividends and share buybacks)

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.