The G20 summit could be the most important remaining event of 2018. It’s expected to end with a Trump-Xi meeting which has the potential to cast a shadow on the whole of 2019. We point at three markets that could react strongly to the outcome of the meeting.

Summary:

- Presidents Trump and Xi will discuss trade on Saturday

- Full blown Trade War could cause recession in China, and in turn a global slowdown

- US500, AUDUSD, Soybean could react strongly to the outcome

What is the event about?

Trade Wars have intimidated investors for much of this year and they were the most visible on the US-China line. The White House has slapped 25% tariffs on imports worth $50 billion and 10% ones on another $200 billion. Donald Trump plans to raise the lower rate to 25% starting from January 2019 and could even apply tariffs on all the remaining imports from China (over $200 billion) unless he makes a trade deal. China has introduced retaliatory actions but because it buys much less from the US there’s not much retaliation the country could use. While markets were bracing for the troubles, Trump called Xi to offer more talks and they will meet at the G20 meeting that starts on Friday. The meeting is expected to take place on Saturday.

Why is it important?

China is the second largest global economy and there are increasing signs it is slowing down. High tariffs on its exports will have a major negative impact on growth and may cause a hard landing. For the US, it means higher input prices and probably some kind of retaliation while markets expect economic moderation in 2019 anyway as the effects of recent tax cuts wane. Trade barriers are the last thing the global economy needs at this stage, so a deal would be a great relief for concerned investors. It is possible that a deal ends with a promise of expert-levels talks in order to strike an agreement towards the end of the year.

Watch these 3 markets:

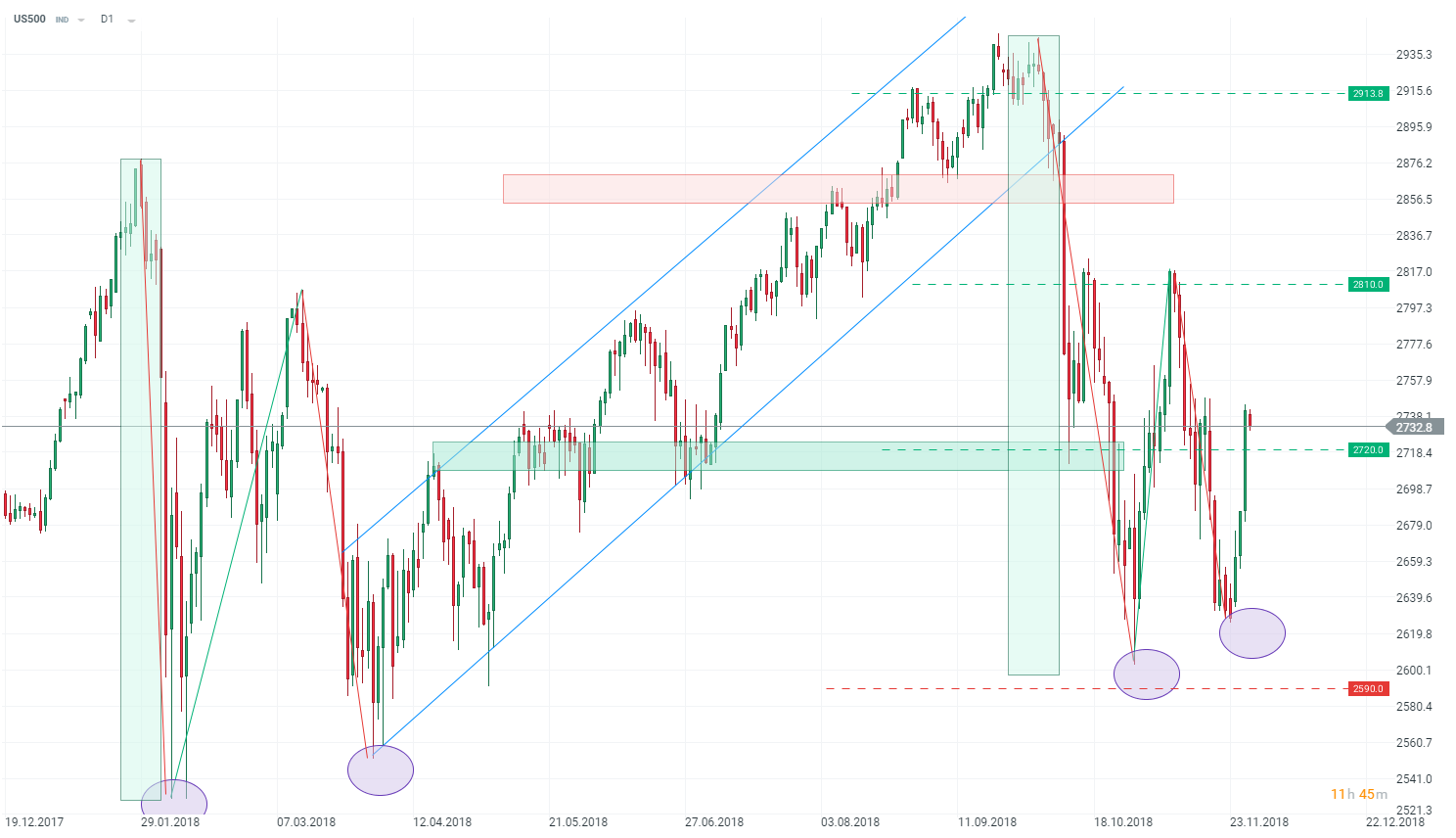

US500

The US stock market has had a turbulent period but it has been recovering lately using a double bottom formation. Market sentiment has been buoyed by the suggestion from the FOMC chairman Jerome Powell that the central bank could slow interest rate increases next year. Obviously some kind of a deal is a precondition for a bigger rally and return of trade concerns could quickly sour sentiment.

AUDUSD

AUDUSD

AUDUSD was in a strong downtrend for much of this year, but the pair has managed to break to the upside recently and is now testing the key 0.7340 resistance zone. Australia is heavily dependent on China in terms of exports so Trump-Xi talks will surely impact the Aussie. Bear in mind that the latest data from Australia has been mixed so a disappointment could weigh on the currency.

Soybean

Soybean

China used the sensitive soybean market in the first round of retaliation for the US tariffs and Trump is likely to seek a removal of those tariffs to have a success story for voters in some key states. We can see a reverse head and shoulders formation on this market and a deal could help drive prices above the key $900 zone but bear in mind that a difference between the US and Brazilian beans has been reduced (as the Brazilian real gained) limiting upside for the US market.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.