The stock market is known for its price volatility and is widely regarded as a high-risk investment. Volatility in itself can be for some investors an opportunity to increase income, while for others it can be a source of loss.

The VIX index, commonly known as the 'fear index', allows investors to generate profits from the expected volatility levels of the S&P 500 index. The name 'fear index' has its origins in investor psychology, as fear in the market always causes very rapid price reactions, which occur during panics. The greater the extent of the panic, the more sharply the VIX rises, as investors anticipate massive price declines out of dangerous assets. Trading on the VIX also allows you to make profits when the trend reverses and positive sentiment returns to the market.

This is why VIX trading has become particularly popular with traders trying to find the lows and peaks of euphoria and panic and with traders playing strategies based on forecasts of events that could affect the economy. In this article you will learn what VIX is, what are the basic strategies played on this index and how to start trading on VIX in our xStation platform.

What is the VIX index?

The VIX is known as the Volatility Index and was created by the Chicago Board Options Exchange (CBOE). The index reflects market expectations of volatility. The VIX is constructed in such a way that it represents the pronounced volatility of the S&P 500 index. The VIX is widely known as a proxy for the entire US equity market despite the fact that its benchmark is the S&P 500 index only (available for trading at xStation as US500).

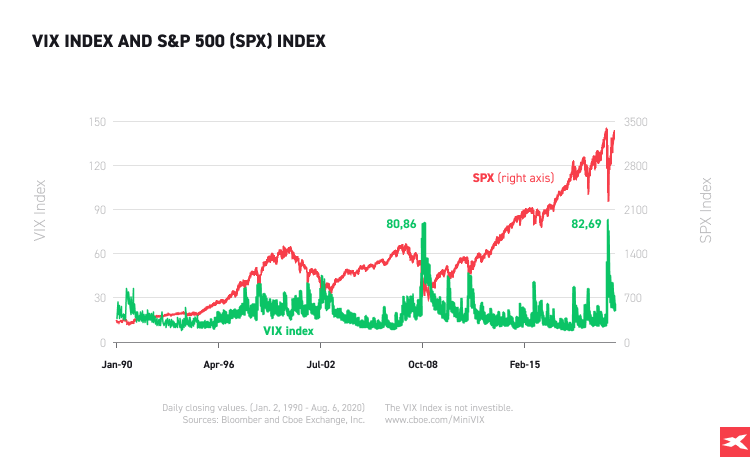

The VIX is calculated from the prices of options on the S&P 500 index and is expressed as a percentage. If the value of the volatility index is rising, it is very likely that the S&P 500 index is just falling. If the VIX is falling, the S&P 500 is probably consolidating or rising and there is positive investor sentiment in the market.

The VIX is also known as the 'fear index' because it measures the level of fear among investors in the market.

Understanding the VIX

There is a known strong negative correlation between the VIX valuation and stock market returns. In this model, if the VIX is rising, it is likely that the S&P 500 is falling due to rising investor fears and investment in equities becomes temporarily less profitable as large capital then flees from risky assets.

Conversely, when the volatility index falls, then the S&P 500 is likely to experience gains or consolidation so there is little investor stress and the stock market delivers satisfactory returns. Trading volatility is not always synonymous with market declines, however, as it is possible for the stock market to fall but for volatility to remain relatively low. Only economically or geopolitically significant events can significantly increase market volatility. Usually, it is events that are negatively perceived by investors that generate the greatest price volatility.

Volatility is therefore a measure of the movement of an asset price, not a measure of the asset price itself. In practice, this means that when you trade volatility in the market by opening positions on the VIX, you should not only focus on the direction of change, but also on how much the market has moved and what the prospects are for further large movements. This is the reason why the VIX is priced in percentage points.

Index values below 20 percentage points are seen as a sign of stability and when the level rises above 30 points the market indicates high price volatility.

For investors who try to anticipate the peaks and troughs of the S&P 500 when the VIX reaches extreme highs, this is seen as a sign of a trend reversal and a return to growth for the S&P 500. Conversely, when the index reaches extreme lows, this can be seen as a return to decline for the S&P 500. This creates investment opportunities for contrarian investors who try to outperform the market in order to outperform their positions.

Type of positions on VIX

When you want to start trading the VIX index, there are two positions you can take: a short position or a long position. It is important to remember that when trading volatility you are not necessarily interested in whether the price of the S&P 500 index rises or falls continuing the trend, as both situations present opportunities. However, it is worth remembering that it is negative news that tends to sharply increase volatility in the market.

The position you decide to take will depend on your expectations of the level of volatility and not the direction of ups or downs in the price of indices or the stock market.

Long position on VIX

A long position ‘BUY’ is particularly popular when there is fear and uncertainty in the market or when there are external circumstances that could cause the negative instrument to return. In such a situation, if you assume that the S&P 500 will experience a rapid price decline after an economic or political announcement, you can take a long position on volatility. In this way, you can play trading strategies for specific events occurring in the world that are likely to raise or significantly reduce asset price volatility.

If high volatility were to occur, your forecast would be correct and you could realize a profit. Conversely, if you took a long position and there was no volatility in the market, your position would suffer a loss.

Short position on VIX

When you take a short position ‘SELL’ on the VIX index, you are essentially assuming that the valuation of the S&P 500 will rise. A short position on volatility is particularly popular when there is reasonable and predictable economic growth and interest rates are relatively low, resulting in reduced volatility in financial markets. This situation generally lasts longer than periods of elevated volatility.

In such a model, the combination of low volatility and economic growth leads to a steady and stable rise in the share prices of the companies that make up the S&P 500 index. An investor may then choose to take a short position on volatility, expecting the stock market to continue to rise while leaving volatility at low levels. Contrarian investors may also seek their advantage by forecasting a return of positive sentiment to the market when extreme fear prevails. The VIX index is then at very high levels and if the political and economic situation improves, which generally causes positive sentiment in the stock market, a short position can yield significant profits.

Then when the S&P 500 index rises, the VIX is likely to fall and you can realise a profit. A short position on the VIX is, of course, risky because circumstances could occur at any time that would cause negative sentiment among investors to resume.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Best time to start VIX (VOLX) trading

The best time to get interested in VIX futures trading is during the period of increased volatility and fear, which causes the price of the index to rise.

When traders anticipate increased volatility the VIX is likely to rise. Forecasted volatility is correlated with fear in the market. Thus, if investors expect declines and there is panic in the market in the early or developed phase the VIX tends to rise spectacularly.

This is the period when many traders wait for opportunities to actively trade the instrument. When the market is calm and there are upward movements, the VIX price changes very little and its volatility is limited.

The historical price chart of the VIX index shows that during each crisis situation, when there was fear in the market the VIX tended to rise, which of course ended with a fall in its valuation as positive sentiment returned to the market.

Price declines on stock exchanges tend to be rapid and violent, thus price increases of the VIX instrument also have this feature. Price increases on the stock exchange are usually of a calmer nature and during their duration the market does not assume exceptionally high volatility of asset prices. As a result, dynamic increases of VIX index prices may be interspersed with periods of consolidation, during which the instrument price will move in a sideways trend with minor deviations. Consolidation of the VIX price will reflect positive and calm investor sentiment.

It follows that traders interested in starting to trade the VIX index should follow political and macroeconomic news coming from the world, especially from major countries and economies. Any negative information can increase fear among investors which results in the market forecasting higher volatility. Usually it’s a good time to start active VIX trading.

How to start trading VIX (VOLX)?

VIX trading is available in our xStation trading platform and You can start Your volatility index trading by entering into CFD (contract for differences) transactions on the VOLX instrument and use the full leverage potential.

By trading VIX you can take advantage of market volatility and open positions during very fast price movements. Leverage is very risky, but it can multiply a day trader's profits. Trading VIX is dedicated to active traders who like risk and price volatility.

Thanks to the 1:5 leverage, You will need only a 20 % margin to open a position. By using 2000 USD You will open a position which is worth 10 000 USD. Because of leveraged CFD instruments high risk level potential revenue of the position also can be high, but also potential loss is possibly higher as a result. VIX CFD Trading gives traders the opportunity to open short and long positions. Short positions give traders the opportunity to make profits when emission prices are falling.

If You want to read more about CFD and financial leverage You can read informations there: https://www.xtb.com/en/education

The only fees you incur for such trading are spread (difference between buying price ASK and selling price BID) and swap points. The spread is very small and costs cents depending on the size of your position. Swap points are the costs the broker incurs to fund leveraged positions; swaps are charged daily to the open position on the VOLX instrument.

By trading VOLX contracts you can take advantage of market volatility and open positions during very fast price movements. Leverage is a high risk instrument and may occur losses, but can multiply a day trader's profits.

VIX trading is speculative and for active traders only the price fluctuations matters on this instrument. This type of contract is a financial agreement which pays out the difference in settlement price between open and closed transaction without any physical delivery of the traded instrument.

Online trading allows you to trade VOLX without leaving home, with zero commissions and low spreads. Also due to the liquidity of the VOLX market you can close your position with one mouse click at any time when the market is open. This is why online VOLX contracts trading has so many advantages and is now increasingly popular.

VIX index price

The VIX is known as a volatile instrument and the price can do big moves at any moment. That's why keeping track of the VIX quotation is very important for traders. At xStation, we provide real-time quotes for future contracts on VIX by offering VOLX instrument.

VIX (VOLX) Trading hours

What about available VIX (VOLX) hours? This information is especially important for day traders. VOLX trading is available 5 days per week from 00:00 CET to 22:15 CET from Monday to Thursday and from 00:00 CET to 22:00 CET on Friday. Trading VOLX is not available during weekends on our platform. VOLX price is static when the market is closed. At all other times the prices are constantly fluctuating.

Of course the best time for VOLX trading is during periods of very high volatility when investors feel extreme emotions. When fear is in the market VOLX index volume increases. This situation is a big opportunity for risk likeable traders, who are using leverage to take large profits on long but also on short positions.

Increasing fear could be influenced by publishing negative political or macroeconomic news. VOLX is one of the most volatile instruments when fear increases and it’s pierce is directly related to macroeconomic and political issues f.e. information about FED monetary’s policy or information about global conflict or political crisis. These factors can make investors feel fear and this is always a sign of big VOLX moves.

Indices Trading

NASDAQ Trading - How to invest in NASDAQ (US100) index?

How to Start Trading S&P 500?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.