Nvidia is one of the technology leaders fundamentally changing the future of digital innovation. Starting as a graphics card manufacturer for gaming and research centres, it has risen to the forefront of high-performance computing, with almost 90% market share across global GPU markets driving global artificial intelligence (AI) capabilities. Nvidia graphic cards are no longer dedicated to gamers. The largest companies in the world in 2023 and 2024 were in a rush to buy Nvidia GPUs. But will it last forever?

Even today, Nvidia technologies can be found in every major industry - from AI in data centres to gaming to autonomous driving and robotics. It’s true that digital transformation, driven by automation due to LLMs and other AI products, is here and works. The article provides an overview of NVIDIA's key innovations and shows how they can impact the lives of consumers and businesses. So let’s consider Nvidia investing and explain its role in the global economy, as well as technology supply chain. Investing in Nvidia stock became more and more popular since ChatGPT inception in 2022. But does the stock growth have any boundaries? Read the article to know.

Nvidia is one of the technology leaders fundamentally changing the future of digital innovation. Starting as a graphics card manufacturer for gaming and research centres, it has risen to the forefront of high-performance computing, with almost 90% market share across global GPU markets driving global artificial intelligence (AI) capabilities. Nvidia graphic cards are no longer dedicated to gamers. The largest companies in the world in 2023 and 2024 were in a rush to buy Nvidia GPUs. But will it last forever?

Even today, Nvidia technologies can be found in every major industry - from AI in data centres to gaming to autonomous driving and robotics. It’s true that digital transformation, driven by automation due to LLMs and other AI products, is here and works. The article provides an overview of NVIDIA's key innovations and shows how they can impact the lives of consumers and businesses. So let’s consider Nvidia investing and explain its role in the global economy, as well as technology supply chain. Investing in Nvidia stock became more and more popular since ChatGPT inception in 2022. But does the stock growth have any boundaries? Read the article to know.

Latest Updates

29 January 2025: NVIDIA Market Update

2025 has started with a bang for Nvidia. It had been one of the top performers on the S&P 500 in 2024, however, since then its stock price has struggled due to the emergence of Chinese large language model, DeepSeek, which threatens the US’s position as the dominant AI superpower and challenges the utility of Nvidia’s latest high-tech chips.

DeepSeek’s AI model was unveiled in January and immediately caught the market’s attention. The focus has been on the cost of its R1 model, which reportedly only cost $6mn to build, a fraction of the cost of Open AI’s ChatGPT. US tech firms are building out their AI capability using Nvidia’s latest GPUs, which cost thousands of dollars per unit and need complicated processors for them to run correctly. DeekSeek’s AI model challenges the need for these expensive GPUs, since it is reportedly run on limited first-generation GPUs.

Initially, Nvidia’s stock sold off sharply. It dropped by 17% and had the biggest decline in market capitalisation for any stock in history on Monday 27th January. However, since then it has staged a decent recovery, although at the time of writing it had not fully clawed back all of its losses. The impact of DeepSeek on the economics of AI is not yet known. Analysts are still trying to work out exactly how it was created on such a tight budget, and it is unclear how this could impact demand for Nvidia’s most advanced GPUs in the future.

However, this development in the AI trade has had a significant impact on the Magnificent 7, the group of mega cap tech stocks on the US index, and there has been a shake up of leadership. Nvidia was the top performer out of the Magnificent 7 for most of 2024, however, since the start of 2025, it has struggled, while Meta, the owner of Facebook, is now the top performer. This suggests that the Magnificent 7 are not in total alignment. Nvidia produces the hardware, the GPUs, which are necessary to build out AI capability. The rest of the Magnificent 7 are Nvidia’s customers, so they could benefit if they spend less money on chips and GPUs in future, which will reduce their capex budgets and may boost their share prices.

The arrival of DeepSeek has not burst the AI bubble, but it could put Nvidia at a permanent disadvantage. It also suggests that this group of mega cap tech stocks will not necessarily move as a single unit going forward.

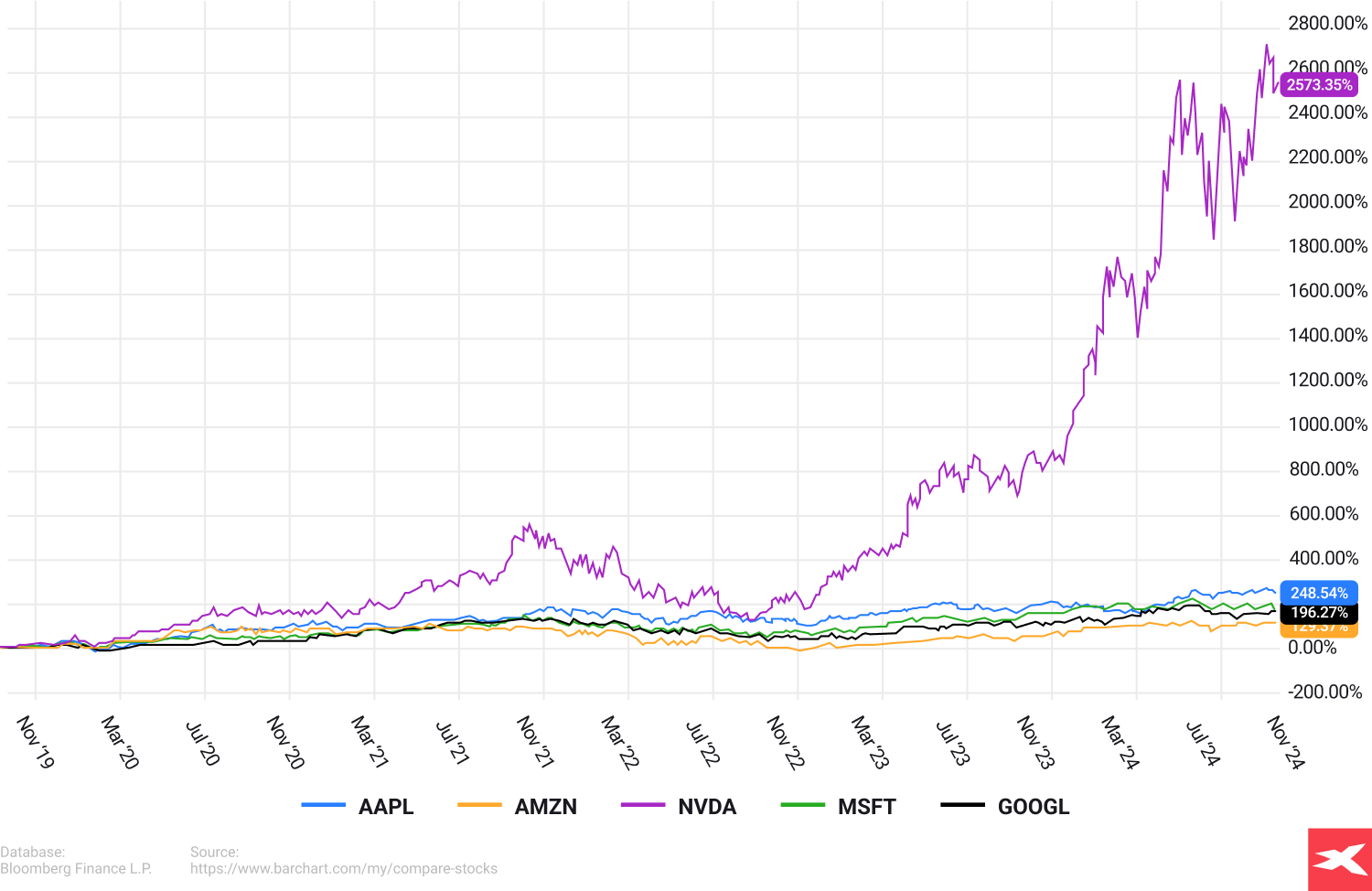

Chart 1: The Magnificent 7, normalised to show how they have moved together in the last 12 months.

Source: XTB and Bloomberg, Past performance is not a reliable indicator of future results.

Key Takeaways

- Nvidia: A Leader in AI and Digital Transformation - Nvidia stands at the forefront of artificial intelligence (AI), revolutionising industries from gaming to healthcare. Nvidia GPUs power the world's most advanced AI systems, making it a first step in AI transformation of global data centres.

- Nvidia boundary is here - The natural boundary for Nvidia growth is demand imbalance, and oversupply risk as global companies increasingly buy Nvidia GPUs, driving global GPUs inventories.

- Strong Fundamentals Backed by Innovation - Nvidia's robust financial performance is driven by its dominating market position, cutting-edge technology and relentless innovation in AI, gaming, data centres, and autonomous vehicles, ensuring long-term growth potential. Digital business in the modern world just more and more needs AI support, as generative AI becomes popular.

- AI Boom and Data Center Demand - The rising demand for AI solutions and data centre AI infrastructure positions Nvidia as a key beneficiary of these transformative trends, making it an attractive investment opportunity. However, as history shows, investors should know the risk of ‘overvaluation’.

- Diversified Revenue Streams - Beyond AI, Nvidia thrives in gaming, professional visualisation, and automotive sectors, providing a diversified foundation for stability and growth. The company focuses not only on AI innovation but also on robotics and quantum computing.

- Investment Considerations - Investors should assess Nvidia’s valuation, market conditions, and long-term growth prospects while keeping an eye on competition and broader semiconductor market trends, which are usually cyclical, related to global economic conditions.

- Long-Term Growth Potential - As AI and digital transformation reshape the global economy, Nvidia's leadership in technology positions it as a possible choice for long-term investors. But nothing in the stock market is guaranteed, so investors should increase their own knowledge to make informed decisions. It’s still hard to predict Nvidia future of Nvidia.

Understanding AI and Investing in Nvidia

Image source: Adobe Stock Photos

Nvidia is the largest semiconductor company in the world, and a pioneer in the technology revolution, particularly in artificial intelligence (AI). Founded in 1993, the company initially made its mark by producing graphics processing units (GPUs) for the gaming industry. Today, these GPUs have evolved into the backbone of AI innovation, powering everything from deep learning models to autonomous systems.

Due to its wide business moat, high-quality management by CEO Jensen Huang and his team as well as perfect relationships with its contractor producer Taiwan Semiconductor, Nvidia’s “being early”, allowed the company to dominate a key for data centres and AI capabilities - the global GPU market, with more than 90% market share in AI chips as of 2024. Nvidia chips are for the AI trend, something similar to oil, needed by the transportation sector. The more strong AI chips are, the stronger computing power can be, driving advanced Large Language Models (LLMs).

Nvidia investment story

The Nvidia investment thesis is simple: without rising AI infrastructure spending and CAPEXes, global technology companies will almost not have AI strong enough to drive their business segments. AI may be a key for future digital transformation of each business segment.

- As of 2024 Nvidia artificial intelligence GPUs have almost no major peers. So it’s easy to conclude that companies which want to invest in AI at scale, just have to sit at the table with Nvidia and order GPUs such as H100, H200 or Blackwell. The stronger AI will be, the more it can do.

- Investors believe that Nvidia's future is AS, quantum computing and robotics with each of those segments to be huge future business catalysts. However, according to critics this thinking may be risky, leading to excessive optimism and overvaluation, similar to the Nifty 50 bubble from the US 1960s and 1970s (Kodak, Polaroid, Xerox, IBM and so forth).

Nvidia Key Business Segments

Nvidia operates across several high-impact business segments, each contributing to its growth and industry leadership. The most important is the Nvidia artificial intelligence business division, the data centres.

- Data Centres: Powering the AI revolution, Nvidia’s data centre GPUs, such as the A100 and H100, are essential for machine learning, AI training, and cloud computing. This segment is crucial as industries increasingly adopt AI technologies.

- Gaming: Nvidia's GeForce GPUs remain the gold standard for gamers worldwide, delivering unmatched graphics performance and real-time ray tracing. Gaming is one of Nvidia’s largest revenue drivers, supported by innovations like DLSS (Deep Learning Super Sampling).

- Automotive: Nvidia’s DRIVE platform provides AI-powered solutions for autonomous vehicles and driver assistance systems. By working with global carmakers, Nvidia is shaping the future of mobility.

- Professional Visualisation: From architecture to filmmaking, Nvidia’s Quadro GPUs and Omniverse platform enable professionals to create highly detailed simulations, visual effects, and 3D models with ease.

- Quantum Computing: Nvidia is paving the way in quantum computing with its cuQuantum tools, designed to accelerate quantum research using classical GPUs, helping scientists and researchers solve complex problems.

- Omniverse and Metaverse: Nvidia is a pioneer in the metaverse, providing tools for virtual collaboration and simulation through its Omniverse platform, which caters to creators, designers, and developers across industries.

What Makes Nvidia Unique?

At its core, Nvidia’s strength lies in its ability to develop hardware, but also software (CUDA) solutions that fuel high-performance computing. The company's GPUs, specifically the GeForce and data centre-grade A100 and H100 series, are highly optimised for AI tasks. Nvidia CUDA software made its business even more resilient, increasing a moat. These include natural language processing, image recognition, and autonomous decision-making, which are essential in sectors like healthcare, automotive, and finance. The biggest Nvidia clients are companies like Meta, Alphabet (Google), Amazon, Super Microcomputer and companies such as Tesla and X - both owned by Elon Musk.

Nvidia’s Role in AI Innovation

Nvidia’s breakthrough was recognising the potential of GPUs beyond gaming. GPUs excel at parallel processing, enabling them to handle massive amounts of data simultaneously. This makes them perfect for training and running AI models. Nvidia's CUDA software platform further strengthens its ecosystem, allowing developers to build AI applications more efficiently.

AI Applications Powered by Nvidia

- Data Centres: Nvidia GPUs are the preferred choice for powering cloud-based AI services offered by giants like AWS, Microsoft Azure, and Google Cloud.

- Autonomous Vehicles: Nvidia’s DRIVE platform is enabling self-driving cars to perceive their surroundings and make real-time decisions.

- Healthcare: From drug discovery to medical imaging, Nvidia’s AI solutions are revolutionising the way healthcare professionals work.

- Gaming and Virtual Reality: Nvidia continues to innovate in gaming, where real-time AI applications enhance graphics and user experiences.

The AI revolution has created unprecedented demand for Nvidia’s products. As more industries integrate AI into their operations, Nvidia’s technology will remain indispensable. Its ability to anticipate and capitalise on these trends positions the company as a key player in shaping the future. Investing in Nvidia means backing a company that is not just part of the AI revolution but is driving it.

Understanding Nvidia’s contributions to AI provides insight into its future growth potential and the industries it could disrupt. Whether you are a seasoned investor or a newcomer, Nvidia’s AI story is at least one worth following. But the history of financial markets shows that even stocks of the biggest companies, with major market share, can crash. The flagship example here is Cisco Systems, which after dominating the internet-related products market, collapsed after the dot-com bubble, as the global economy entered a recession, with the Fed increasing interest rates. Investors should understand risk.

Source: Barchart.com. Past performance is not a reliable indicator of future results.

AI Computing Leadership

NVIDIA is positioning itself as a key player in AI computing with its graphics processing units (GPUs) that enable complex computations to be performed faster than traditional processors. This capability has become the foundation for a range of AI applications - from machine learning to complex simulations.

xAI Supercomputer and its contribution

One of NVIDIA's most advanced projects is the xAI Supercomputer. This supercomputer, which uses NVIDIA Ethernet Networking, enables academia, industry, and startups to develop new applications faster. xAI Supercomputer finds applications such as medical research, predictive analytics for business, and intelligent assistant applications.

The xAI Supercomputer has the potential to accelerate research and innovation in a number of fields. In medicine, for example, it can reduce the time needed to develop new treatments or predict the evolution of diseases. In business, it can help companies analyse big data and predict customer behaviour, leading to better personalisation of services and products.

Generative AI: Faster content creation with NVIDIA NIM

Generative AI and Nvidia NIM

Generative AI is revolutionising content creation. It enables businesses to produce large amounts of visual and textual material quickly and efficiently. NVIDIA, with NVIDIA NIM, delivers a platform that makes this creation dramatically easier. With NVIDIA NIM, businesses can generate high-quality visual and textual content - from photos and videos to text.

This is especially helpful for digital marketing and media companies that need to create personalised content at scale and respond quickly to change. Marketing teams can use NVIDIA NIM to create dynamic content for social media or online campaigns, while e-commerce companies can use AI to optimise product descriptions and visuals on their platforms.

Nvidia in finance and robotics

Image source: Adobe Stock Photos

Adaptation to Key Segments

- Automotive: Nvidia’s DRIVE platform provides AI-powered solutions for autonomous vehicles, enabling real-time perception, mapping, and decision-making. It collaborates with leading carmakers to integrate advanced driver assistance systems (ADAS) and full autonomy.

- Professional Visualisation: Through its Quadro GPUs and Omniverse platform, Nvidia supports industries like architecture, film, and engineering. It enables photorealistic rendering, real-time collaboration, and immersive simulations for professionals.

- Quantum Computing: Nvidia is advancing quantum research with its cuQuantum software development kit, designed to accelerate quantum simulations on classical GPUs. This bridges the gap between classical and quantum computing, helping researchers tackle complex problems.

Finance: Real-time data and modelling

The financial sector places high demands on real-time analysis of large volumes of data. NVIDIA technologies help create advanced market prediction models that enable analysts to react to market changes in real time. NVIDIA's powerful GPUs enable financial services companies to quickly and accurately model complex scenarios, which is key to optimising risk.

Banks, investment firms and fintech startups are using NVIDIA technology to improve their financial models. The computing power of NVIDIA GPUs enables them to analyse the market with high accuracy and design strategies that increase competitiveness and efficiency.

Robotics

In robotics, NVIDIA offers technologies that enable the development of advanced robotic systems. These systems are used in industry to optimise production, as well as in home automation, where they help make everyday activities more convenient and efficient.

For example, in the automotive industry, robotic systems with NVIDIA chips enable improved production quality and faster manufacturing processes. The technology is also being used in sectors such as healthcare, where robotic systems help care for the elderly or perform assistive functions in the home.

Importance for emerging markets

Emerging markets can accelerate their digital transformation with NVIDIA technologies, increasing their competitiveness and creating new jobs. With the implementation of AI and robotics, these markets can focus on improving healthcare services, optimising agricultural processes or modernising public transport.

NVIDIA is actively supporting digital transformation in developing countries, especially in India. There, its technologies are helping in the areas of healthcare, education, finance and AI infrastructure. This collaboration enables innovative solutions that improve quality of life and create new opportunities for local AI talent.

FAQ

Nvidia’s popularity comes from its leadership in artificial intelligence (AI), gaming, and data centres. Its cutting-edge GPUs power revolutionary technologies, and the AI boom has made it one of the hottest stocks on Wall Street.

You can buy Nvidia stock (ticker: NVDA) on major stock exchanges like Nasdaq through any brokerage account. Many platforms also offer fractional shares, allowing beginners to invest with smaller amounts.

Yes! Nvidia combines strong growth potential with a leading position in transformative industries like AI and autonomous vehicles. It’s often considered a solid choice for tech-savvy investors, but remember to evaluate your risk tolerance before investing.

Nvidia’s GPUs are the brains behind AI. They process massive amounts of data quickly, making them essential for training AI models. Companies like OpenAI and Tesla rely on Nvidia’s hardware for breakthroughs in AI and automation.

Nvidia started with gaming GPUs and remains a leader in this space. Its GeForce graphics cards are favourites among gamers worldwide. But today, Nvidia also dominates AI, data centres, and even automotive technology.

Nvidia’s stock often surges when AI adoption grows because it is a primary supplier of AI hardware. Recent advancements in generative AI (like ChatGPT) have made Nvidia a star performer in the tech sector.

What is Next for the AI Trade?

Investing during a crisis: Strategies and Tips

US Presidential Election 2024: Kamala Harris vs Donald Trump. Which candidate is better for stock markets?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.