XTB does not determine the amount of the minimum initial deposit. In practice, this means that you can open a real account and start trading from any deposit.

XTB does not determine the amount of the minimum initial deposit. In practice, this means that you can open a real account and start trading from any deposit.

What is a minimum deposit?

A minimum deposit is the smallest amount of funds required to open an account with a financial institution, such as a bank or brokerage firm. It is sometimes called an initial deposit or funding. The minimum deposit means that you will first need to transfer this amount to your brokerage account from your bank account in order to start trading. XTB does not charge a deposit fee, which means we won't deduct anything from your hard earned money and need to take into consideration only the costs charged by the bank or another financial institution you are using to transfer funds.

Source: XTB

Source: XTB

Do you need a lot of money to become a trader?

Many people stay away from investments due to insufficient funds. Some brokers still require a specific amount of money to open an account in order to generate revenue, which are used to cover the administration and other costs associated with servicing that account.

However, at present the majority of brokerage firms including XTB try to make life easy for small first time investors who do not have significant funds. A large number of firms decided to limit or completely remove account minimums, which means that even if you have only a few dollars in your pocket, you can easily open a brokerage account and start investing. Of course, you might be wondering if this actually makes sense as you wouldn't have had too much money to buy the assets. To address this issue, many brokers have made a number of changes over the past few years that have made investing practical even for small investors, for example, introducing micro lots or fractal shares.

However, investors with a small amount of funds in their account should always act wisely and avoid risky instruments, such as CFDs, which can very quickly lead to losses. It is always worth having the appropriate amount of free cash in relation to open trades that will protect you from margin calls, should the situation on the markets not go your way.

Is there a minimum deposit?

XTB does not determine the amount of the minimum initial deposit. In practice, this means that you can open a real account and start trading after you make an initial deposit.

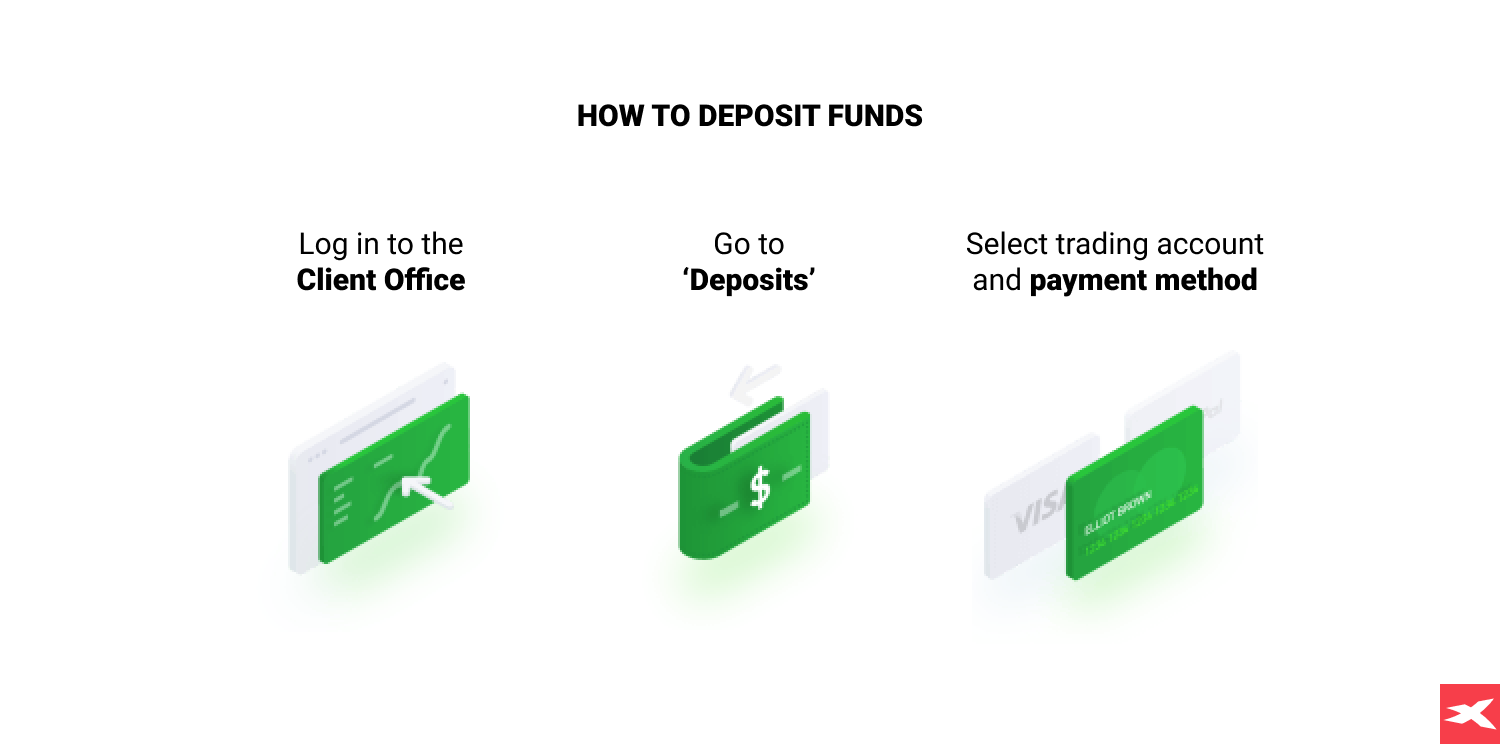

The only limitation will be the minimum transaction volume and the resulting minimum margin deposit. One should bear in mind the issue of the deposit required to open a position for a given instrument, which is legally regulated and its size depends on the specification of the asset. In summary, XTB does not require a minimum deposit just to open an account, but an appropriate amount of money is required to open a specific position. You can add funds through xStation or your Client Office via a number of methods, including credit card, debit card, PayPal, Paysafe (formerly Skrill), or bank transfer.

Source: XTB

Source: XTB

It is also worth remembering that using the demo account does not require a deposit of any kind.

The Best Trading Platform for Beginners

International Women’s Day: In celebration of female CEOs

The FCA Consumer Duty: What is it?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.