Risk and volatility may discourage lots of people from investing. But history tells, that the financial market may be a huge vehicle of long term wealth. So the question is how to deal with market risk and uncertainty, which are always actual in both investing and business. A deep understanding of the market's nature isn’t just helpful. It's essential. Let’s dive in.

Risk and volatility may discourage lots of people from investing. But history tells, that the financial market may be a huge vehicle of long term wealth. So the question is how to deal with market risk and uncertainty, which are always actual in both investing and business. A deep understanding of the market's nature isn’t just helpful. It's essential. Let’s dive in.

Key Takeaways

Market volatility is influenced by economic news, global events, and investors psychology. It can be measured using indicators like the VIX index. Building a stable investment portfolio requires diversification across asset classes, investment in fixed income and alternative investments to mitigate stock market risks.

Volatility may be risky, but market fluctuations are a regular part of investing. Understanding this can help to remain calm and make more informed decisions. Keep abreast of financial news and market trends, but avoid making decisions based on emotions. Reacting impulsively can harm any investment strategy. Investors should understand crucial factors such as uncertainty and risk of every investment decision;

Focus on long-term financial goals rather than short-term market performance. Historically, the market has shown a tendency to grow over time. Dollar-cost averaging, the strategy of regularly investing a fixed amount, can help you to buy more shares when prices are low and less when prices are high.

Remember that nothing is guaranteed, the future is unknown and many random events hit global markets, every day. What's more, another bear market is highly probable in the future, but that doesn't mean that you should prepare for it now and always be defensive. Defensive portfolios usually underperform more aggressively during bull runs. Think about diversification.

Understanding market volatility

Image source: Adobe Stock Photos

Volatility is the heartbeat of the stock market. A rhythm that ebbs and flows with the pulse of global events and economic news. The term “market volatility” refers to the range of price changes that stocks and other securities experience over time. It’s an expression of the market’s temperament, swinging between periods of rapid growth and sudden decline.

High volatility means the price of a security can change dramatically over a short period in either direction, while low volatility means the price is relatively stable. Usually, market panics are much more volatile (and shorter) than bull market trends. That’s why volatility usually increases, when investor sentiments weaken. It’s also the reason why VIX is named “fear index”, however it doesn’t measure fear. It measures the stock market's expectation of volatility based on S&P 500 index options. But what causes these waves of market risk to rise and fall? And how can we quantify their impact on our investments?

- Catalysts: Market volatility can be triggered by economic data releases, geopolitical events, changes in fiscal policy, natural disasters, pandemics, large bankruptcies, bank runs, investment scandals and cyclical shifts in investor sentiment,

- Volatility vs Risk: While volatility and risk are closely related, they're not the same. Volatility is about the frequency and magnitude of price movements, while risk is the potential for losing some or all of an investment.

- Creating opportunities: For savvy investors and traders, volatility can present opportunities to buy assets at lower prices or to sell when prices are unusually high. Also, short term traders and speculators may use “return to mean” strategies measuring standard deviation anomalies

- Impact on portfolios: Volatility spike can affect the overall performance of investment portfolios. Especially if it causes so-called “Margin call” (Archegos capital collapse in 2021). Diversification is a key strategy used to mitigate the negative effects of volatility, as it spreads out the risk across different assets.

- Long-term vs. Short-term: Short-term volatility can be unsettling for investors, but viewing investments from a long-term perspective often provides a clearer picture of the potential for growth and recovery.

- Psychological effects: Volatility can also have psychological effects on investors, leading to panic selling or overconfidence, both of which can harm investment outcomes. Emotional discipline and a well-defined investment strategy are critical during volatile periods.

- But… It also may not be a sign of trouble: Volatility does not necessarily indicate that a financial market or economy is in trouble. Markets can be volatile during both upswings and downturns. Also, downturns may lead to strong market rebound.

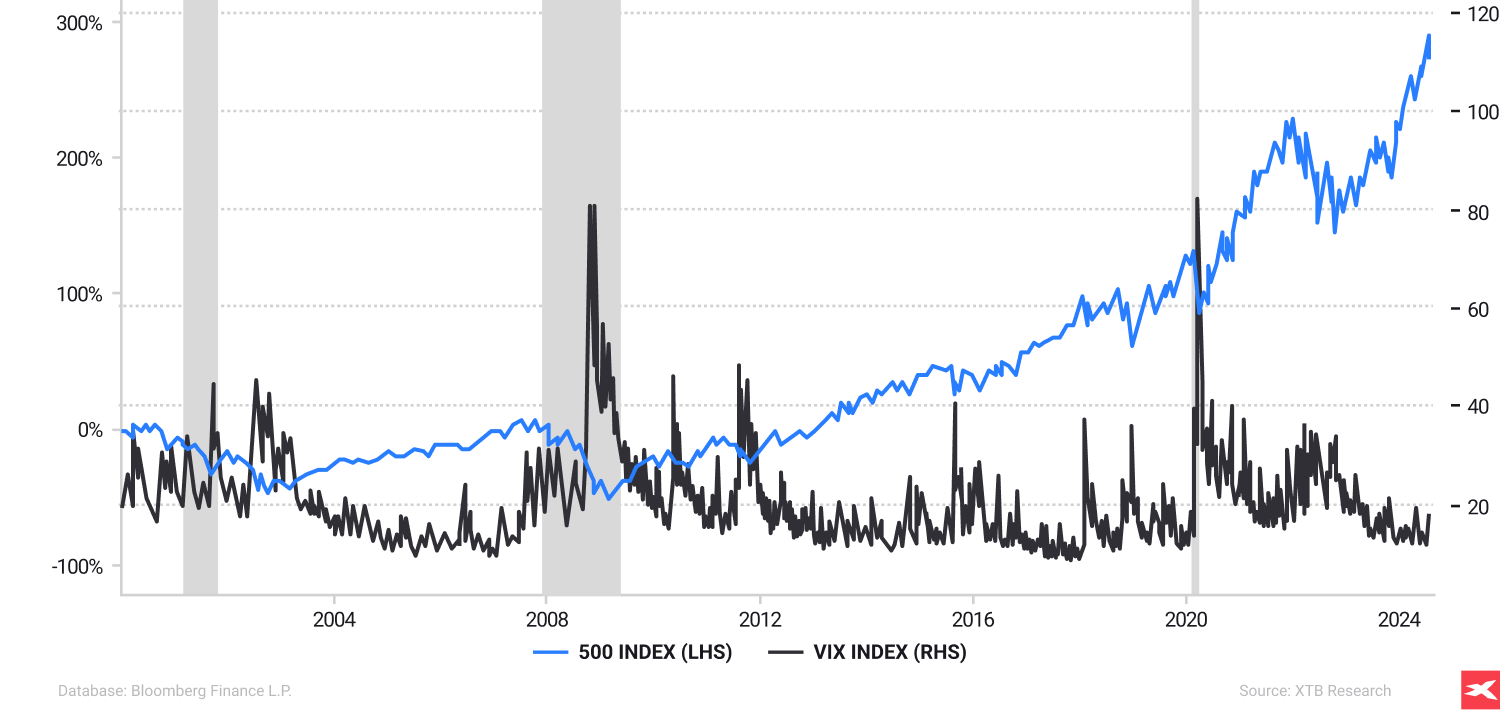

SP500 total return and VIX volatility index from 2000

Historically, CBOE Volatility Index (VIX) rose along with downtrends seen in the S & P 500. VIX is also analysed as a very good benchmark of expected volatility, across the broad financial markets. Past performance does not guarantee future results. Source: XTB Research, Bloomberg Finance L.P.

Utilising risk management techniques

Image source: Adobe Stock Photos

Navigating the investment waters also requires a keen understanding of risk management techniques. In volatile markets, it may be pivotal to investment success as spotting a profitable opportunity. There are no magic formulas, but some strategies may support overall portfolio performance, by limiting downside risk. Remember that financial markets are created by human (buyers and sellers) reactions to data and news. Those reactions are hard to predict. Unexpected events happen every day in the world, potentially hitting companies' valuations and risk perception. Uncertainty leads to market excesses - panic and euphoria.

Stop-Loss orders

Defensive orders are akin to a safety net, designed to protect your trades from falling too far. By setting a specific price at which a stock is to be sold, by setting a sell stop order as well as stop-loss orders on the futures market can significantly reduce the potential for large losses. These orders work automatically, providing peace of mind and convenience for investors who cannot monitor their stocks daily.

- However, not all securities offer stop-loss orders, and during periods of high volatility, they must be managed carefully to avoid selling at a loss due to short-term fluctuations.

- Trailing stop orders offer a dynamic alternative, automatically adjusting the stop price as the market price fluctuates, ensuring gains are locked in while potential losses are minimised.

Hedging Strategies

Hedging strategies are the financial equivalent of weatherproofing your portfolio. By using instruments such as options and inverse ETFs, investors can shield their investments from market downturns and even enhance profits during periods of high volatility. The protective put, for instance, is a popular hedging mechanism used to guard against losses in an existing stock or portfolio.

Instruments that track the VIX (for example Amundi S&P 500 VIX Futures Enhanced Roll UCITS ETF Acc) are particularly useful in hedging strategies, as they:

- Reflect market volatility

- Provide a barometer for the need to adjust portfolio protection

- Influence options pricing

- Allow investors to leverage higher time premiums during volatile times for added profit or protection.

Important: Diversification doesn’t mean exposure to stocks from the same sector or with the same supplier. For example, if any investor invests in companies, which have almost 100% factory capabilities in China, they are all exposed to the same risk. Diversification should mean collecting assets from different sectors, which may be uncorrelated or give a hedging potential if any risk event attempts. As an example, we can use exposure to technology companies, which may lose among geopolitical tensions. A well diversified investor may also have oil companies in such a portfolio, which may limit losses on technology or even outperform, during that period; with limited downside potential if geopolitical tension eases.

Swing Trading

Swing trading is the strategy of choice for those looking to profit from short-term price movements. By identifying potential reversal points in the market, swing traders can ride the waves of market volatility to their advantage.

- Technical indicators such as Bollinger Bands and the relative strength index (RSI), along with an analysis of volume and support and resistance levels, serve as the compass for this trading approach.

- Classic patterns like double and triple tops, as well as head and shoulders, often signal market reversals. Swing traders can exploit these patterns, particularly at the end of the distribution phase, to position themselves for profitable trades.

- It’s a strategy that requires a good grasp of market trends and the discipline to act when the time is right. Some investors use moving averages such as EMA200 to recognise the trend and so-called ‘death-cross’ patterns, as well as the Wyckoff distribution/accumulation or head and shoulders technical signals for trend reversal.

Dollar-Cost Averaging

Dollar-cost averaging serves as a steady hand in the unpredictable seas of market volatility. By consistently investing a fixed amount of money at regular intervals, investors can avoid the dangers of market timing and benefit from purchasing more shares when prices are low.

- This strategy ensures that not all money is invested at peak price levels, providing a balanced approach to building an investment portfolio over time.

- This method of investing offers a disciplined framework for capitalising on lower prices during market dips, smoothing out the average cost per share over time.

- It’s a strategy particularly well-suited for those who wish to avoid the stress and uncertainty of trying to time the market, especially during volatile periods.

Economic Indicators

To steer a steady course, investors need to familiarise themselves with a range of economic indicators that act as navigational stars.

- The Consumer Price Index (CPI) or retail sales or manufacturing and services data, provide invaluable insights into the economy and market trends. These indicators, including the Dow Jones Industrial Average, range from leading to lagging, helping investors discern the undercurrents that may affect their portfolios.

- In conjunction with other economic reports such as labour market data or retail sales figures, these indicators can confirm trends that necessitate adjustments in investment strategies.

- By regularly reviewing these economic indicators in the context of investment performance, investors can determine if the returns and risk levels are on course with their objectives. Clear, well-presented information, such as graphs or dashboard summaries, can facilitate quick assessments and decisive action.

Rebalancing portfolio

Sailing through the investment seas requires not just setting a course, but also making periodic adjustments to maintain the desired direction. Rebalancing a portfolio is the act of realigning the weight of each asset class to match the targeted asset allocation. This process often involves selling assets that have grown disproportionately and buying underrepresented assets to ensure the portfolio continues to align with an investor’s risk tolerance and financial objectives.

Investors typically rebalance their portfolios using set time intervals or when the percentage change in asset class weights reaches a predetermined threshold. However, rebalancing doesn’t necessarily require selling existing assets; it can also be accomplished using new funds or reinvested dividends. Regular rebalancing not only manages risk levels but also ensures that investments remain in sync with long-term goals, adjusting to realistic market expectations as necessary.

Summary

As our voyage through the fluid landscape of market volatility comes to a close, we reflect on the key strategies that have been charted. Understanding and measuring market volatility allows investors to anticipate and prepare for the capriciousness of the stock markets. The auction-driven market has the tendency to excess: panic and euphoria. Both reflect in asset prices. Constructing a resilient portfolio through diversification and incorporating fixed income and alternative investments creates a bulwark against market upheavals. Embracing a long-term investment perspective, underpinned by discipline and risk management techniques, provides a stable path through the tempests of market swings.

- Diversify your investments across various asset types(stocks, ETFs) to reduce risk. It may help to mitigate the impact of a poor performing investment on your overall portfolio. But usually it also lowers investment return potential to consider investing in uncorrelated assets.

- Assess how much risk you're comfortable with. This understanding guides your investment choices and helps you stay calm during market downturns. What’s more, if your risk tolerance is low, choosing very volatile assets such as low cap stocks or technology companies may not be suitable for you. As Peter Lynch once said, investing is not only about brain, but also about stomach.

- Understand volatility, which is not risky itself. Your response to it may make it risky, as volatile prices hit psychologically. On the other hand, for short term traders, volatility may be risky with higher probability of hitting stop loss or margin stop out mechanism;

- Consider dollar-coast averaging (DCA) strategy, which involves regularly investing a fixed amount of money, regardless of the market's condition, which can lower the average cost of your investments over time.

- Maintain a long-term perspective and focus on your long-term financial goals. Historically, markets have recovered and grown over time, so patience often pays off.

- Stay Informed and keep up with financial news and market trends, but avoid making impulsive decisions based on short-term fluctuations and emotions.

- Utilsing risk management techniques like stop-loss orders and hedging strategies if you are a trader. Financial markets are sometimes driven by randomness, and don’t be fooled by it.

By adopting these strategies, investors can better manage their reactions to market volatility, making it a part of their investment journey rather than a roadblock. Remember, volatility is a normal part of investing; embracing it with a well-thought-out strategy can even uncover opportunities for growth.

FAQ

Emotions such as optimism, excitement, fear, and panic can lead to buying high and selling low in investments. This emotional impact can cause investors to make suboptimal decisions and underestimate risks, ultimately affecting their investment outcomes.

To take the emotion out of investing, diversify your portfolio to reduce the impact of market swings and avoid getting emotionally attached to your investments.

An example of emotional investing is when investors make decisions based on what others are doing, such as buying a particular stock just because everyone else is doing it, even if it doesn't align with their long-term investment plan.

Having a solid investment plan is crucial, as it provides structure and reduces the likelihood of making impulsive financial decisions. It guides your choices and helps to minimise emotional influence.

Reducing volatility can be achieved by diversifying investments across different assets, which helps smooth out returns and lowers unnecessary risk. On the other hand, there is no one, guaranteed strategy, which limits volatility, without limit potential investments returns. Volatility is especially a dilemma for active traders, then long term investors.

Diversification strategies help during bear markets by spreading investments across different assets, industries, and regions, which minimises the impact of a downturn in any single area on the overall portfolio. This helps to reduce risk and protect against significant losses.

Climate change investments: Maximising impact

Best ETFs to Look Out For

Building Balance: How to Diversify Your Portfolio with XTB

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.