This term is closely related to the concepts of margin and leverage. Margin is the smallest amount needed to open a transaction with leverage, while leverage gives traders more exposure without having to fund the full amount of the transaction. It offers the potential for traders to magnify potential profits, as well as losses.

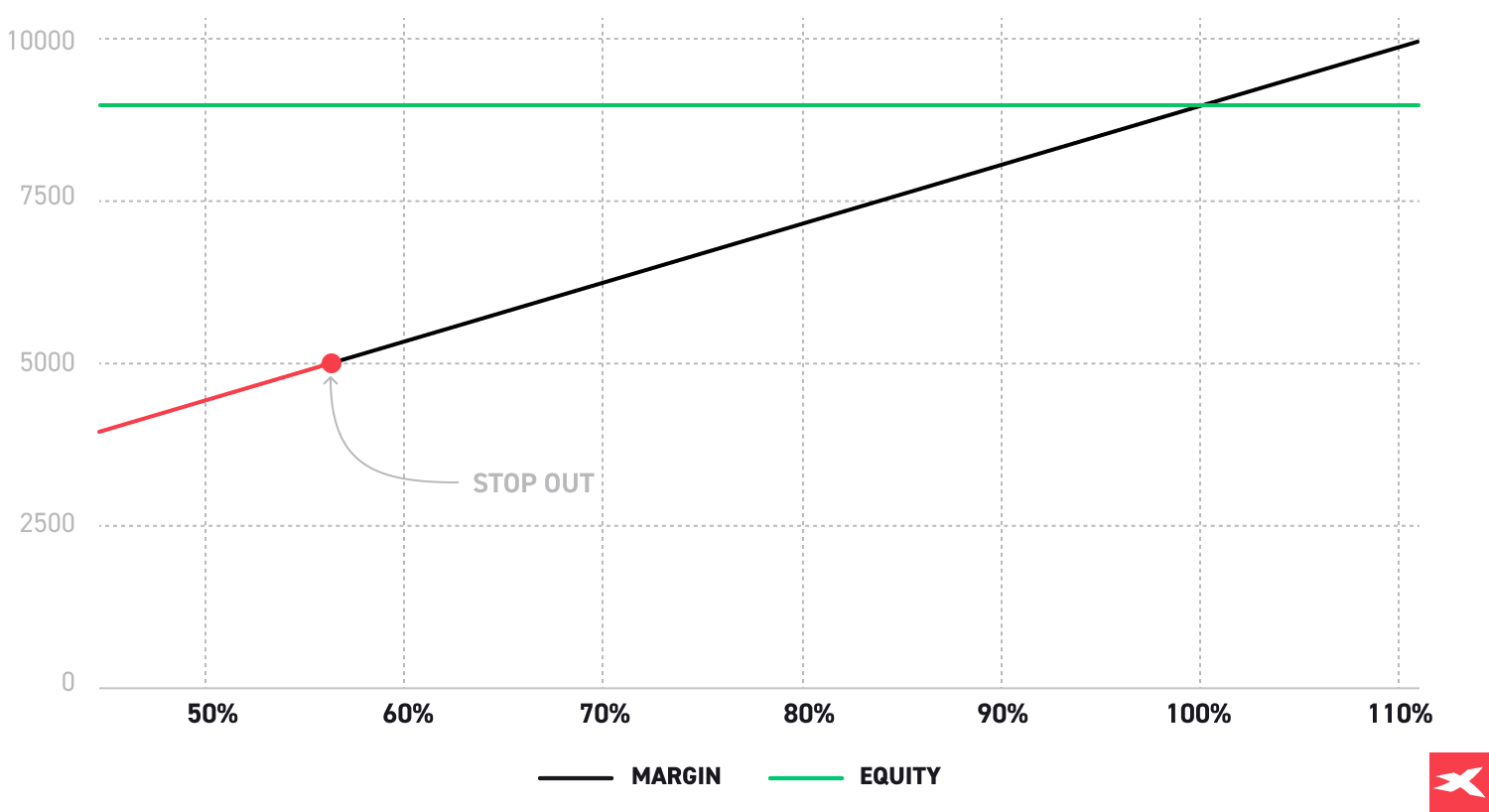

- The limit level is calculated by dividing your equity by the required margin and multiplying by 100%.

- Margin calls happen when the percentage of the equity in the account drops below the maintenance margin requirement.

- At XTB, a margin call occurs when your margin level falls below 100%.

- A Stop Out is the act of closing, or liquidating, your positions

- At XTB, a stop out occurs when your margin level falls below 50%.

- Once a stop out occurs, your open position with the biggest loss will be automatically closed until your margin level returns back above 50%.

- To avoid being closed out of your position by a stop out, you’ll need to ensure your margin level remains above 50% by depositing more funds.

What typically triggers a margin call?

- A margin call is triggered when there is no useful/free margin left on the investor's account and requires additional funds to be deposited. This usually happens when your trading losses reduce the useful margin below an acceptable level set by the broker.

- A margin call is more likely to occur when investors spend a large proportion of their capital on used margin, leaving themselves with a very small margin of error. As a result, if the transaction does not go their way, the free margin is not able to cover the losses.

Main reasons which lead to margin call

- Sticking to a losing trade for too long, coupled with excessive leverage.

- Not sufficient funds, which forces the trader to over-trade with not enough usable margin.

- Lack of stop losses and position monitoring, especially when the price is moving sharply against the trader’s position.

What happens when a trader receives a margin call?

In this case, the trader's positions are liquidated or closed because he or she no longer has sufficient funds on the account to allow him or her to maintain losing positions, which also poses a threat to the broker. It is worth remembering that when trading with leverage, there is a possibility that losses will be greater than the original deposit.

Limiting losses is one of the most important aspects of trading and many traders choose to use stop loss orders as a protective measure. On the other hand, some traders decide to manage their risk manually by monitoring their open transactions.

Your margin level is the deposit required to maintain each open trade on your account. To open and maintain your trade, you must have sufficient trading resources to cover the margin requirement at all times.

Free margin represents the amount of capital you have remaining to place new trades or cover any negative price moves in your open trades.

The margin stop is a protective measure, particularly for traders who do not use stop loss orders. When the margin level falls below 50%, your open position with the biggest loss will be automatically closed as an in-built safety mechanism.

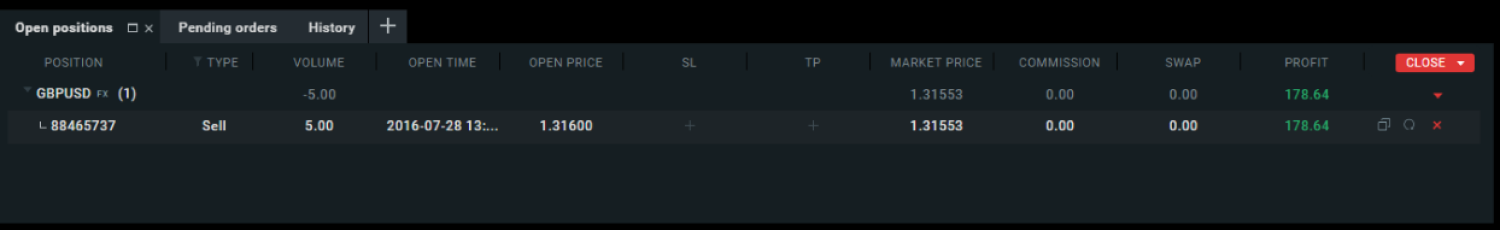

Source: xStation

In the example above, a 5 lot position has been opened and the margin level is currently over 2000%. If the margin level falls to under 50%, then the system will automatically close out the trade to prevent further losses.

Below is example of a trader that runs a high chance of receiving a margin call on their forex trading account:

- Deposit: $10 000

- Number of standard (100k lots traded): 4

- Margin percentage: 2%

- *Used margin: $9 000

- Free margin: $1 000

- *The used margin is calculated as follows with the EUR/USD at 1.125:

- Trade size x price x margin percentage x no. of lots

- $100 000 x 1125 x 2% x 4 lots = $9 000

Source: dailyfx.com

Source: dailyfx.com

Let us assume that the trader has only one open transaction, which uses the greater part of the available margin. In this case, the free margin is only USD 1,000.

Less experienced investors may mistakenly believe that the funds in the account are not at risk. However, the use of leverage creates a risk that the account may be wiped out in the event of large movements in opposition to the trader's position. In the analysed situation, if the currency pair rate changes by more than 25 points (excluding the spread), then a margin call will appear and the position will probably close ($ 40 per point x 25 points = $ 1000).

How can margin calls be avoided?

Margin calls always cause a lot of stress and often lead to serious financial consequences. Therefore, it is worth to familiarise yourself with these suggestions that may help you avoid this painful experience:

Take into account periods of increased volatility on the markets and always have some sort of cash cushion;

- Check your account balance on a daily basis and set up alerts which will inform you when the amount of free margin decreases sharply;

- Use online tools which will help you with calculating margin requirement impact due to trading activity and/or price fluctuations of securities in your account;

- Do not over-lever your trading account and implement proper risk management system;

In conclusion, it is worth remembering the words of the famous investor Jesse Livermore - “Never meet a margin call. You are on the wrong side of a market. Why send good money after bad? Keep the money for another day.

Hawkish Vs Dovish: Differences Between Monetary Policies Explained

Bull and Bear Markets - Everything You Need To Know

Chart Patterns: A Detailed Guide

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.