Looking to diversify your investments or find a stable income source? Learning how to invest in bonds could be the answer. Our guide cuts through the jargon to give you a clear path to purchasing bonds, investing in bond ETFs, understanding their returns, and integrating them into your financial strategy. Whether you’re a seasoned investor or new to the scene, we have the insights and tools you need to navigate the bond market with confidence.

Looking to diversify your investments or find a stable income source? Learning how to invest in bonds could be the answer. Our guide cuts through the jargon to give you a clear path to purchasing bonds, investing in bond ETFs, understanding their returns, and integrating them into your financial strategy. Whether you’re a seasoned investor or new to the scene, we have the insights and tools you need to navigate the bond market with confidence.

What is a bond, and how does it work?

Every day, thousands of investors from around the world want to manage risk and select the best possible bonds, with as attractive yields as possible. To understand those instruments properly, any investor can analyse bonds as an agreement between the lender (bond investor) and recipient of capital (a country or a company). One side gave the money, the other side promised to give it back with a fixed interest premium for giving a capital.

The one side can wait for the money and yield from borrowing it (depending on agreement it may be 2 months, 1 year, 10 years and so on). The other side has a capital to invest and prosper (and hopefully to give it back). That's the way investors are talking about bonds as debt securities and the debt market. The conditions of this market depend especially on central bank policy (interest rates), inflation and market cycle.

Things you should know about bonds

- On the bond market, investors can buy debt securities from entities like corporations or governments, which carry varying risk profiles, with fixed returns.

- Investors can invest in bonds ETFs through brokers on trading platforms, or directly from issuers. Bonds are especially recommended as the defensive side of an investor's portfolio.

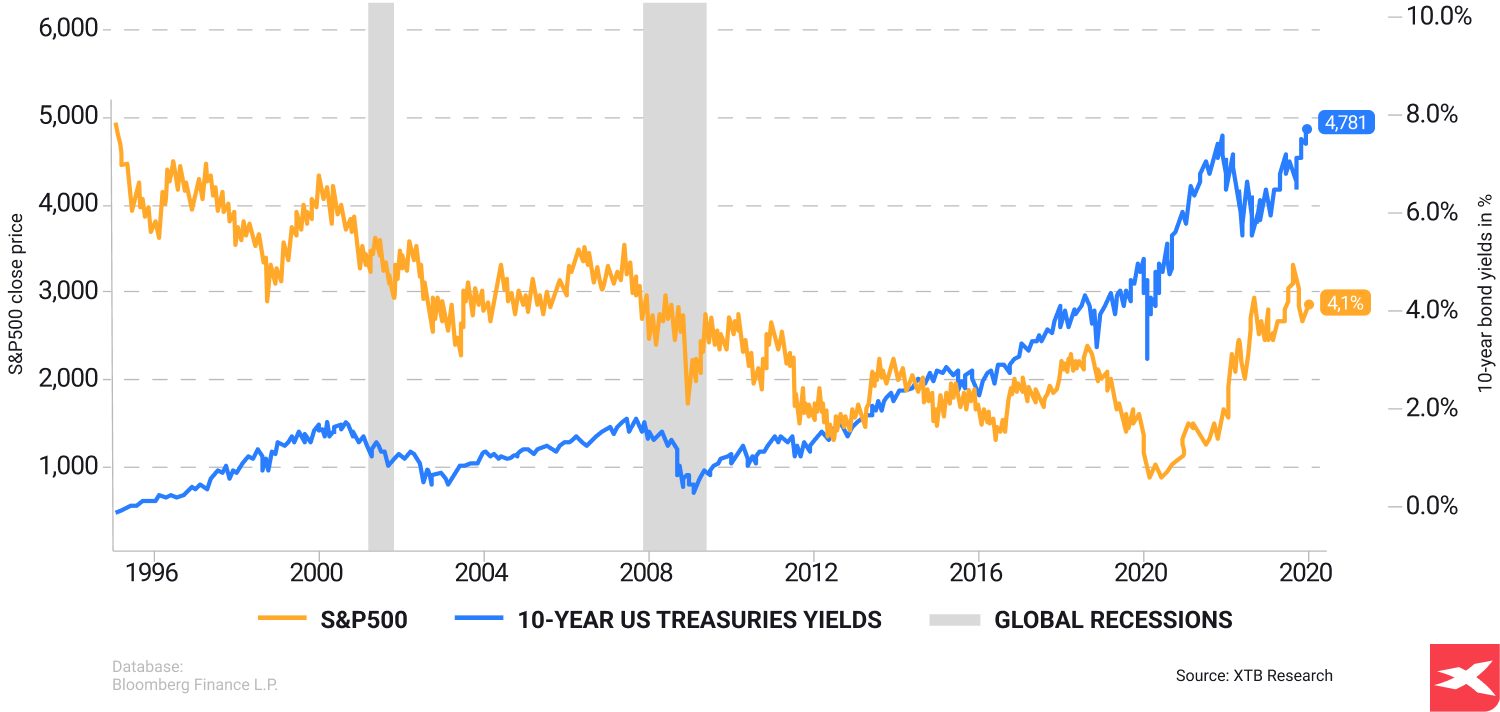

- Usually when interest rates are rising, bond yields also rise, and bond prices are falling. When central banks change policy to be less restrictive, bonds are trading higher and yields are down.

- Higher bond yields are profitable for new investors, who want to invest in fixed income assets, but essential is to understand that if yields rise, “current owners” of those bonds are losing.

- Even bonds may be risky. The highest yields are paid from distressed, corporate bonds, but it's a premium for higher investment risk. It’s crucial to understand a relation between risk and yield because more risky bonds (also long term bonds) usually have higher yield. Of course, there is no guarantee that, the same bonds in the future will be even more attractive, pressuring it prices on open market

- Understanding bond creditworthiness through ratings and market indicators, bond pricing and interest rates, diversification strategies, and maturity dates play a crucial role in making informed investment decisions.

Bonds vs stocks

Beginning with the basics, the bond market is a financial marketplace where investors buy debt securities, known as bonds. When you buy a bond, you essentially lend money to the entity that issued the bond, whether it’s a corporation or a government.

- In return, the bond issuer promises to pay you interest at predetermined intervals and return the principal amount when the bond reaches maturity.

- It’s like lending money to a friend who promises to pay you back with a little extra as a thank you for your help. Bond markets play a crucial role in this process, providing a platform for these transactions to take place.

- While bonds and stocks are both ways for companies to raise money, they work differently. With stocks, you buy a piece of ownership in a company, but with bonds, you lend money to the issuer. Unlike stocks, which are traded on exchanges, most bonds are sold over the counter.

Having grasped the basics, it’s time to explore the various types of bonds. The bond market is a vast landscape, home to corporate bonds, government bonds, and municipal bonds. Each of these bond types carries unique characteristics and risk profiles.

Corporate Bonds

Companies issue corporate bonds to raise funds for their business needs. When you buy a corporate bond, you’re essentially providing the company with a loan. In return, the company promises to pay you periodic interest and return your principal at maturity.

The issuing company partners with a bank or broker-dealer to assess its financial position and decide on the bond offering. While corporate bonds usually offer higher yields compared to government bonds, they do carry more risk. These risks include:

- Interest rate risk

- Reinvestment risk

- Inflation risk

- Credit and default risk

Higher risk may bring higher potential returns, which is why corporate bonds typically yield more than government bonds. There are ETFs, which are tracking corporate bonds prices, such as: iShares Corpbond EUN5.DE or iShares EUNW.DE High yield corp bond.

Government Bonds

Next up is government bonds, such US treasury bonds.These are issued by governments and are generally considered safer investments. Government bonds are backed by the full faith and credit of the issuing government, making them low-risk securities. Especially when the country controls its own currency and has the ability to ‘print money’ such as the US (Federal Reserve), it’s really hard to speculate about defaults (but of course, it has more than 0 probability, especially when debt is soaring).

- You might be thinking, “Low risk, low reward,” but not necessarily. The yield on government bonds depends on various factors, including the face value of the bond, its interest rate, and market-driven factors.

Familiar with the different types of bonds, you are ready to embark on your bond investment journey. You can buy bonds through full-service or discount bond brokers. You can think also about diversification, as an important factor to start choosing bond ETF investing, inside a trading platform. Whether you choose to buy individual bonds or bond funds, remember the importance of risk management. By spreading your investments across different types of bonds, issuers, and maturities, you can reduce risk and potentially increase returns.

Pricing and Interest Rates

After evaluating a bond’s creditworthiness, you can proceed to understand bond pricing and interest rates. These two factors are closely interlinked. When interest rates decrease, bond prices generally increase due to the attractiveness of the fixed interest rate, leading to higher demand. Conversely, when interest rates increase, bond prices usually decrease as the fixed interest rate becomes less appealing, leading to a decrease in demand.

The yield of a bond represents the return you can expect from the bond. It is determined by dividing the bond’s face value by the interest it pays. But keep in mind, the yield isn’t the only factor to consider when investing in bonds. Other factors, such as the bond’s nominal yield, current yield, and yield to maturity, can also affect your investment decision.

Bond Creditworthiness

Prior to immersing yourself in bond investing, assessing the creditworthiness of a bond is vital. This is where credit ratings come in. Credit rating agencies, like Moody’s, Standard & Poor’s, and Fitch Ratings, evaluate the creditworthiness of a bond and assign a grade on a scale ranging from AAA to D or Aaa to D. These ratings can give you an idea of the bond’s risk level, helping you make an informed investment decision.

But remember, credit ratings aren’t the be-all and end-all. They’re just one tool in your toolkit. It’s also important to independently assess the creditworthiness of a bond by observing market indicators and using credit ratings provided by other agencies. This can help you avoid potential pitfalls and make the most of your bond investments.

Strategies for Investing in Bond Funds

While buying individual bonds can be a great way to dip your toe into the bond investing pool, bond funds offer a more convenient method for achieving diversification. Bond funds provide access to institutional pricing, which enables better pricing on individual bonds. Plus, they offer a more convenient method for achieving diversification compared to investing in individual bonds.

While buying individual bonds can be a great way to dip your toe into the bond investing pool, bond funds offer a more convenient method for achieving diversification. Bond funds provide access to institutional pricing, which enables better pricing on individual bonds. Plus, they offer a more convenient method for achieving diversification compared to investing in individual bonds.

Diversification in bond investing can help you manage risk and take advantage of potential opportunities.

Here are some ways to diversify your investments:

- Spread your investments across different financial instruments, for example ETFs

- Integrate not-correlated assets into your portfolio to control risk strategy

- Diversify investments across various asset classes

By following these strategies, you can mitigate volatility and risk in your bond investments.

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Diversification in Bond Investing

Diversification holds significant importance in bond investing. Some ETFs offer a bunch of different bonds inside the fund. Any investor can spread investments across different:

- Types of bonds

- Geographic localisation

- Sectors

- Maturities

- Credit qualities

You can manage risk and optimise returns. A diversified bond portfolio may consist of a variety of fixed income investments, including:

- Government bonds

- Corporate bonds

- High-yield bonds

- Inflation-protected securities

- Emerging market debt

This approach helps mitigate volatility and risk by ensuring that the performance of the bond fund is not solely reliant on a single bond or bond type. When investing in bonds, the critical elements to consider are maturity dates and redemption. A bond’s maturity date is the specific date when the principal amount of the bond is scheduled to be repaid. This date is established at the time of bond issuance and signifies the deadline for the repayment of the principal amount. When a bond matures and is redeemed, the issuer repays the bondholder the principal amount of the bond.

This process of repayment is referred to as bond redemption. Understanding bond maturities and durations can help you develop a more effective investment strategy and potentially maximise your returns. Remember that investing in ETFs, you are tracking an exchange traded bond price. You can sell and buy wherever you want, without looking at maturity.

Buying bonds: Direct Purchase vs. Bond ETFs

Purchasing bonds presents you with two primary options: a direct purchase or bond Exchange-Traded Funds (ETFs). Each method has its own set of advantages and drawbacks.

- Bond ETFs provide intraday liquidity and enable you to quickly diversify your portfolio. However, they may incur trading commissions, making them more suitable for larger and less frequent trades. Some of the biggest brokerage firms make investing in stocks and ETFs fee-free for Clients, but any ETF also has so-called TER (the yearly costs of holding). Usually, TER is lower than 0.1% (for 1 year).

- For example, the popular iShares USD Treasury Bond 20yr+ (DTLA.UK) has 0,07% TER. Directly buying bonds, on the other hand, offers full ownership of the bond, which means you’ll receive regular interest payments and the return of principal at maturity. But keep in mind, direct bond purchases may require a larger investment and may not offer the same level of diversification as bond ETFs, which are also used for hedging the portfolio.

Reading the Yield Curve

The yield curve serves as a valuable instrument for a bond investor. This graphical representation of bond yields can offer valuable insights into future interest rates and economic conditions. For example, a steep upward-sloping yield curve suggests expectations of higher future interest rates, leading to increased bond yields and decreased bond prices.

Conversely, a flat or inverted yield curve suggests expectations of lower future interest rates, leading to reduced bond yields and increased bond prices. Understanding how to interpret the yield curve can help you make more informed investment decisions and potentially maximise your returns.

This is just one of the many ways you can leverage market data to your advantage when investing in bonds.

Bonds and Inflation: Managing the Risks

Another crucial element to consider when investing in bonds is inflation. Rising inflation can lead to higher interest rates, which can reduce the value of existing bonds. This can eat into your returns and potentially lead to losses.

One way to hedge against inflation risk is by investing in Treasury Inflation-Protected Securities (TIPS). These bonds adjust their principal value in accordance with inflation, offering protection against the eroding impact of inflation.

High Yield vs. Investment Grade Bonds

Investing in bonds frequently presents a choice between high yield (or junk) bonds and investment-grade bonds. High yield bonds offer higher returns due to their elevated risk profile. They can be a good option for aggressive investors who are willing to take on more risk in exchange for potentially higher returns.

Investment grade bonds, on the other hand, have a high-quality rating and a relatively low risk of default. They may be a better fit for conservative investors who value safety and stability over high returns.

When to Sell Bonds: Timing and Market Value Considerations

Understanding the right time to sell bonds holds equal importance as knowing the optimal time to buy. Changes in interest rates, credit risk, and market value can all influence your decision to sell. For example, when interest rates increase, bond prices usually decrease, potentially prompting some investors to sell.

However, selling bonds isn’t just about timing the market. It’s also about managing your overall investment strategy. Whether you’re rebalancing your portfolio, adjusting your risk level, or locking in gains, selling bonds can be an important part of your investment journey.

Investing Beyond Borders: Foreign Bonds and Currency Exchange Rates

While foreign bond investments present numerous opportunities, they also come with unique risks. Changes in currency exchange rates can have a significant impact on the performance of your foreign bond investments. While a strong domestic currency can hurt your returns, a weak domestic currency can boost them.

Investing in foreign bonds isn’t for everyone. It requires a solid understanding of foreign markets and currency exchange rates. But for those who are willing to take on the challenge, it can offer an exciting way to diversify your portfolio and potentially boost your returns.

Bonds: Balanced Investment Portfolio

In a well-diversified investment portfolio, bonds play a significant role. They can help manage risk, provide a steady source of income, and offer a buffer against market volatility. Whether you’re a conservative investor seeking safety and stability or an aggressive investor chasing high returns, bonds can be a valuable addition to your portfolio.

Remember, investing in bonds isn’t just about buying low and selling high. It’s about:

- Understanding the market

- Assessing risks

- Making informed decisions

- Building a balanced portfolio that aligns with your financial goals and risk tolerance.

In the world of bond investing, knowledge is power. Understanding the bond market, decoding bond types, and navigating through fixed income assets can help you make informed investment decisions.

Whether you’re buying bonds directly or through bond ETFs, evaluating bond creditworthiness, or reading the yield curve, every step of your bond investing journey plays a crucial role in shaping your investment portfolio. Remember, the ultimate goal isn’t just to make money. It’s to build a balanced portfolio that aligns with financial goals and risk tolerance, which is a very individual posture.

FAQ

Bond ETFs provide intraday liquidity and can be traded at market prices, while direct bond purchases offer full ownership of the bond and the certainty of regular interest payments and return of principal at maturity.

The main types of bonds are corporate bonds, government bonds, and municipal bonds, with each type having its own distinct characteristics and risk profiles.

When interest rates increase, bond prices generally decrease, and vice versa. This relationship is known as an inverse relationship. Some investors use inversion signals (especially 10 year and 2 year US treasuries) as a recession risk signal.

Hawkish Vs Dovish: Differences Between Monetary Policies Explained

Bull and Bear Markets - Everything You Need To Know

Chart Patterns: A Detailed Guide

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.