Cultural backgrounds recognise gold as a safe investment by many people around the world – even those who do not deal with the financial markets in terms of supply and demand for gold or price movements. Gold historically is seen as an asset that maintains its value despite economic uncertainty or price fluctuations due to its unique properties.

Investing in gold has always been an attractive option for investors looking to diversify their portfolios, hedge against inflation, or simply enjoy the beauty, value of gold and prestige of owning gold as a physical commodity.

Today, technological advances have created various ways and gold options to invest in the precious metal - even from the palm of your hand.

In this article you will learn how to buy and trade gold, how to trade gold CFDs and what is the best time to choose to start trading gold.

Cultural backgrounds recognise gold as a safe investment by many people around the world – even those who do not deal with the financial markets in terms of supply and demand for gold or price movements. Gold historically is seen as an asset that maintains its value despite economic uncertainty or price fluctuations due to its unique properties.

Investing in gold has always been an attractive option for investors looking to diversify their portfolios, hedge against inflation, or simply enjoy the beauty, value of gold and prestige of owning gold as a physical commodity.

Today, technological advances have created various ways and gold options to invest in the precious metal - even from the palm of your hand.

In this article you will learn how to buy and trade gold, how to trade gold CFDs and what is the best time to choose to start trading gold.

Recent Updates:

11 February 2025: Has the gold price found resistance and will it reach the $3,000 mark?

2025 has seen a shake up of financial markets. Stock market and FX leadership has changed, European indices are outperforming US indices for now. This is typical at this early stage of the year, with less loved parts of global financial markets playing catch up to 2024’s winners. The external picture is also complicated by geopolitical tensions and US trade tariffs. There are an unusually large number of risks in financial markets right now, below, we look at how these risks could impact gold.

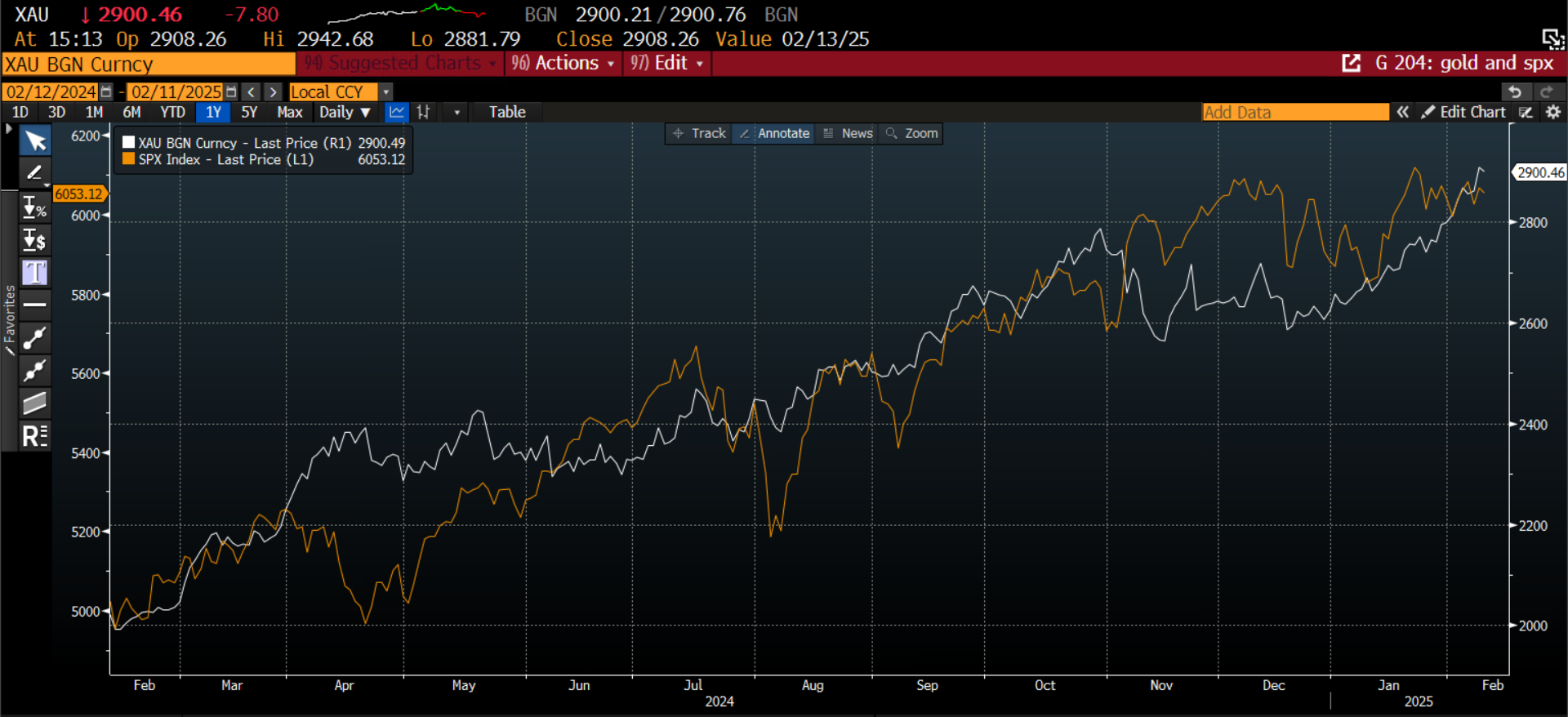

The gold price reached a fresh record at the start of this week, and is higher by more than 10% YTD, easily outpacing US equities and most global equity indices. The gold price has soared through $2,900 on Monday and is higher by $40. Gold is usually driven by central bank policy and inflation concerns. However, the surge to a fresh record high is also linked to Donald Trump’s trade tariff threats. Trump’s latest round of tariffs on steel and aluminum were not country specific, so it could be harder to negotiate a reversal. Also, the fact that tariffs are now a reality for industrial metals means that precious metals could be next. Thus, there is a rush to bring gold back onshore. Gold is also acting as the most reliable haven in this new era of tariffs and global trade wars, it has avoided the tariff fatigue that has set in among other markets, such as stocks.

Chart 1: Gold price in $/ounce

Source: Bloomberg & XTB

Past performance is not a reliable indicator of future results.

Gold is benefitting from safe haven demand, and geopolitical and trade tensions, it is also soaring at the same time as the dollar is strong. In the past this has been a headwind for gold, however, the fact it is rallying alongside the greenback is a sign of the strength of demand for gold right now. The strength of the gold price is also boosting gold miners, and South Africa’s FTSE JSE index is close to a record high, as gold miners benefit from the rise in the price of the precious metal.

Chart 2: Gold price and S&P 500.

Source: Bloomberg & XTB

Past performance is not a reliable indicator of future results.

This is an interesting junction for gold. $3,000 is now in focus, but what happens next? Could this be buy the rumor and then sell the fact? If Trump doesn’t levy tariffs on gold in the coming weeks, will investors start to sell? Added to this, gold tends to trade sideways around key psychological levels. For example, it moved in a range between $1600- $2,000 between 2022- late 2023, and we could see similar range bound activity if investors push the gold price above $3000 anytime soon.

For now, gold is the clear winner of the trade wars.

10 October 2024: Why is gold underperforming?

The gold price has stalled in recent weeks. Although the yellow metal is higher by more than 28% YTD, it has failed to attract safe haven flows in October, even though geopolitical risks have surged. There are a few reasons that the gold price has been unable to make fresh record highs above $2672, the daily record high from 26th September.

Firstly, gold is considered an inflation hedge. As investors ramped up bets that the Federal Reserve would cuts interest rates aggressively this year, the gold price rallied. This was because the market feared a revival of inflation on the back of Fed rate cuts. However, after the monster US payrolls report for September, the market is recalibrating the prospect for Federal Reserve rate cuts for the rest of the year. There is now less than 25bps of cuts priced in for the FOMC meeting in November, and the chance of no rate cut in November is increasing. Added to this, there are only 50 basis points of cuts priced in by year end, and 6 further cuts priced in for the next 12 months, in late September, 8 further cuts were expected. The interest rate futures market is boosting expectations that the Fed will need to reduce the number times that it cuts interest rates to try and tame inflation pressures. Typically, gold rallies when inflation threats rise.

Gold is also a safe haven; however, it has not reacted to increased geopolitical tensions between Israel and Iran. We think this is because the Federal Reserve and US interest rates are a more important theme for financial markets right now. For now, the recalibration in US rate cut expectations is neutral to negative for the gold price, and this is why it has not attracted safe haven flows so far in October.

Another factor weighing on the gold price is the US dollar. Gold is priced in US dollars, when the dollar rallied this can limit the upside in the gold price. So far in Q4, the US dollar is the best performing currency in the G10 FX space, and the dollar index is higher by more than 2% on a broad basis, which is also thwarting the price of the yellow metal.

Fundamentally, the demand picture for gold remains intact. The World Gold Council has reported that physically backed gold ETFs saw their fifth consecutive month of net inflows in September, attracting $1.4bn of funds. Demand was driven by North America, with Europe the only region that registered net outflows. Central banks are also still purchasing gold, although their purchases for August were at their lowest levels since March. They bought 8 tonnes of gold in August, which is significantly lower than the 12-month average of 33 tonnes. Buying activity was highly concentrated in Emerging Market central banks. EM central banks make up 70% of reported central bank purchases YTD, with Turkey alone accounting for 25% of purchases. The World Gold Council believes that the slowdown in central bank purchases of gold was down to the consistent uptrend in the price of gold, i.e., central banks do not want to continue to buy gold at the top of the market. The World Gold Council expects central banks to remain net buyers of gold for the rest of this year, however the total amount of gold bought by central banks this year could be below 2023 levels.

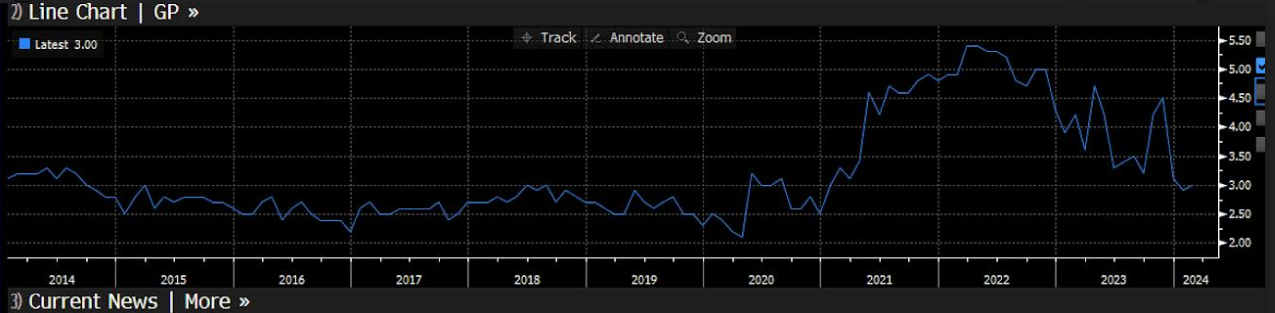

Chart 1: Gold priced in dollars, and the 10-year US Treasury yield tend to move in the opposite direction to each other.

Source: XTB and Bloomberg

Past performance is not a reliable indicator of future results.

14 March 2024: What is going on with the gold price?

The gold price reached a record high on 11th March 2024 at $2,182. This occurred after a spectacular rally in the gold price in the first half of March, which rallied more than 6% in less than two weeks. This is unusual for gold, which tends to move in a slower and steadier manner and had been stuck in a relatively tight range since October, as you can see in the chart. Below we will examine what could be driving the gold price, and where it may go next.

Chart 1: Gold price

Source: xStation5

Source: xStation5

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

According to the World Gold Council, annual gold demand was the highest on record in 2023, and things got off to a good start for 2024. In Q4 2023, demand for gold was 8% above the 5-year average. The key buyers of gold in recent months has included central banks. They have been large purchasers of gold in recent years, and this continued in 2023. Annual purchases by central banks reached 1.037 tonnes, which is just shy of the record for central bank purchases that was set in 2022.

The jewelry industry is an important source of demand for gold. Although demand from the jewelry sector fell in 2023 compared to 2022, it was only a slight decline. The jewelry industry accounted for 2,168 tonnes of gold consumption last year.

Gold mining production increased by 1% last year, however, this is below 2018 levels. This suggests that some of the rise in the gold price is down to the supply/ demand balance.

Gold the ultimate inflation hedge

However, this still does not answer why gold rallied so sharply in March. One theory is that gold is being used as an inflation hedge. Although inflation is falling across the world, there may be concerns that central banks, particularly in the US and Europe, will cut interest rates too quickly, before inflation is under control. Gold is the world’s oldest inflation hedge, so if there are concerns about the longevity of global inflation pressures, it is understandable that the gold price is rising. Although inflation data has been declining across the world, inflation expectations remain elevated. For example, the US 1 year-ahead Inflation Expectations Index, measured by the University of Michigan, is currently 3%, which is higher than the Federal Reserve’s 2% target rate. This suggests that there is a perception that inflation will remain stubborn, and that price pressures remain alive and well in the financial system.

Chart: US 1-year ahead inflation expectations

Source: Bloomberg

Source: Bloomberg

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Interestingly, although gold-backed ETFs account for a significant part of the overall gold market, global gold ETFs collectively saw an outflow in February, extending a 9-month losing streak. So far in 2024, outflows from gold ETFs have added up to $5.7bn, according to the World Gold Council, although the gold price has risen by approximately $150 per ounce since the start of the year. It is strange that ETF investors have such a different outlook on gold compared to other parts of the market, and ETF investors are selling gold even as central banks increase their purchases. There are a number of reasons why this may be happening, perhaps ETF investors are selling gold to get exposure to other asset classes that are rallying at an even faster rate, for example bitcoin or Nasdaq stocks?

Whatever the reason, if ETF flows start to reverse course, then it could prolong the rally in gold. The World Gold Council reported that February’s outflows were the smallest since October 2023. It added that the contraction in outflows was mostly driven by Germany, and that a poor economic outlook could be turning the bearish tide, as investors look to hold gold as a safe haven during times of economic gloom. This might be the start of a trend, particularly if we see a global economic downturn, so ETF flows are worth watching when it comes to the future of the gold price.

Overall, the gold price has had a tremendous run in recent weeks, even if ETF investors are shunning the yellow metal.

27 November 2023: Gold markets attempt to break out

Gold managed to break above the psychological $2,000 area as well as above the upper limit of a short-term triangle pattern. Source: xStation5

Gold managed to break above the psychological $2,000 area as well as above the upper limit of a short-term triangle pattern. Source: xStation5

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Gold prices are attempting to break out of a recent trading range above the $2,000 area, with analysts pointing to a number of factors that could support further gains in the precious metal.

The dollar has been falling in recent weeks, which is making gold more attractive to investors who hold other currencies. It is worth noting that November and December are softer months for the dollar and the financial markets in general. It seems that the USD drop is the result of the Federal Reserve’s interest rate hike cycle in an effort to combat inflation with the central bank possibly starting to cut rates in the near future.

In addition to that, treasury yields have also been falling, which is reducing the opportunity cost of holding gold.

European index futures point to a lower opening of the cash session on the Old Continent today. USD is the weakest G10 currency at press time, while JPY outperforms. Cryptocurrencies as well as energy commodities pull back, while precious metals gain.

Economic calendar for today is light with only some second-tier US data scheduled for release in the afternoon. Traders will also be offered a speech from ECB President Lagarde today. Things get much more interesting in the later part of the week with release of flash CPI data from Europe as well as OPEC+ meeting.

Inflation remains a major concern for investors, and gold is often seen as a hedge against inflation.This is because gold is a tangible asset that has a history of holding its value during periods of inflation. As a result, gold prices tend to rise when inflation is high.

As gold is a global asset that is not tied to any country or other asset, it can be used as a hedge against currency fluctuations and economic instability.

UBS Expects Gold to Reach New Heights in 2024 and 2025

UBS has released a new report in which it predicts that gold prices will reach new heights in 2024 and 2025. The bank expects gold to hit $2,500 per ounce in 2024 and $3,000 per ounce in 2025. UBS cites a number of factors that could support higher gold prices, including:

- Continued weakness in the U.S. dollar

- Rising inflation

- Increased geopolitical uncertainty

WORLD GOLD COUNCIL : Gold Demand Trends Q3 2023

The World Gold Council has released its latest report on gold demand trends. The report shows that global gold demand rose by 7% in the third quarter of 2023 to 1,102 tonnes. This was the highest level of quarterly demand since the first quarter of 2021.

The report also found that retail investment demand for gold rose by 12% in the third quarter of 2023 to 413 tonnes. This was the highest level of quarterly retail investment demand since the first quarter of 2021.

The report is a positive sign for the gold market and suggests that demand for the precious metal is likely to remain strong in the coming months.

How to Purchase Gold

First and foremost, it's important to understand the different ways in which you can invest in gold and how gold demand works on gold markets, and what gold options are available. Physical assets, such as gold bars, coins, and jewellery, are the most common form of investment for individuals. Other options include gold exchange-traded funds (ETFs), gold mining stocks, and gold futures contracts.

Gold Bars

Gold bars, also known as bullions, are a popular choice for investors looking to buy physical gold. Bullion is typically sold by gram or ounce. Gold purity, manufacturer and weight should be stamped on the face of the bar.

When buying physical gold bars, purity is crucial as it confirms the value of gold. Investment-quality gold bars must be at least 99.5% pure gold. This is especially important if you're hoping to store bars in a specialised individual retirement account (IRA), as less pure gold cannot be held like so.

There are many companies selling gold bullion, but we strongly advise choosing reputable ones only. Keep in mind that you may be on the hook for some extra fees - such as insurance - to assure the safe transport of your bullion.

Gold Coins

Gold coins are popular collectibles and an attractive option for investors. However, unlike gold bars, you'll likely pay a premium price of gold over what you would for the same amount of gold in the form of bullion.

Coins typically have lower gold content than gold bars. For example, a popular one-ounce American Eagle coin is only 91.67% gold. The rest of the weight is made up of silver and copper. Make sure to research the gold content of the coins you're interested in before buying.

You can buy gold coins through dealers, pawnshops and individual sellers that you trust. If you choose to buy your gold coins online, make sure to go through a dealer listed in e.g mint databases. Whether you buy your gold coins in-person or online, you don't want to waste money on forgeries or gold that's less pure than you're led to believe.

Jewellery

Jewellery, especially antique pieces, can provide another avenue for buying gold. However, like gold coins, you'll probably be paying extra for the amount of gold you're actually getting. The premium can be anywhere from 20% to 300%, depending on the manufacturer.

It's important to keep in mind that not all that glitters is gold. Manufacturers use alloys that combine gold with other metals to make their pieces more durable or adjust their colour. The quality of gold in jewellery is measured in karats, and higher karat gold is more valuable than lower karat gold. Look for pieces with a karat stamp to ensure you're getting what you pay for.

Factors to Consider When Buying Physical Gold

When buying physical assets, there are several factors to consider:

Storage

Gold bars or coins require a secure storage location. While you can certainly keep your gold at home, many investors prefer a custodian. Make sure to research secure options for storing your gold before purchasing, and keep in mind that safe storage adds to the cost of your investment.

Insurance

Whether you choose to store your gold at home or with a custodian, it's important to insure your investment against theft or natural disaster. This may add to the cost of your homeowners or renters insurance, so be sure to check with your insurance provider.

Manufacturer

To ensure the value of your investment grows over time, make sure to purchase gold from reputable sources. Before you purchase anything, you should definitely verify them by checking official records of gold resellers.

Purity

The gold content in the coin, bar, or jewellery piece has a significant impact on its value and worth as an investment. Ensure any gold you purchase as an investment has a high enough purity level to stand the test of time. Aim for gold items that are at least 91% pure, if not 99%.

Modern methods of Gold Investing

The world has changed a lot in the past few decades. The liberalisation of capital movements and new technology made gold trading strategy unbelievably simpler than buying a gold bullion. Apart from that, the financial markets have enabled investors to buy the golden ore with incredibly low fees, or even with no transaction costs at all.

Trading Gold CFDs

CFD trading is one of the most popular gold options for investors. It has many advantages compared to investing in physical gold, such as low fees and the opportunity to use leverage in particular. With CFDs, you can track the movements of the commodity or the underlying asset without owning gold in a physical form. As leveraged gold trading techniques require only a certain percentage of the whole position, it is usually associated with experienced gold traders or gold day trading due to high levels of risk. Moreover, trading CFD also gives investors a chance to open short positions for CFDs trades, which could be particularly useful in various gold trading strategies.

The process of trading gold CFDs is usually simple and convenient, as world's top brokers enable gold trading online through their one-stop shop apps and platforms with a trading account.

On trading platforms, gold is traded with the code XAU, and one of the most popular exchange interest rates is denominated in US Dollar per troy ounce, known as XAU/USD.

Other CFD exchange rates vary by broker but may include denominations in Euro (XAU/EUR), British pound (XAU/GBP), Japanese yen (XAU/JPY), and Swiss francs (XAU/CHF).

Note: although trading gold CFDs is similar to forex trading, therefore some people may use phrases like “gold forex” or “forex gold trading” for gold trading, which is wrong by definition (FX or forex refers to currency trading).

Why Trade Gold CFDs Online?

Gold trading accessibility

While purchasing physical commodities can involve some time-consuming processes, setting up a CFD trading account is relatively simple and quick. Buying gold is also quite expensive - the price of one gold bullion averages upwards of €40.000 regardless of supply and gold demand. Unless you have a lot of money at your disposal, CFDs are a cost-effective way to access and participate in the commodity market.

Liquidity in gold trading

It's estimated that daily gold trading volumes are around €58 billion and exceed those of most currency pairs except EUR/GBP, GBP/USD, and USD/JPY. The high trading volume gives gold CFDs high liquidity on gold markets. This high liquidity means that gold CFDs are less expensive to trade compared to other financial instruments and the commissions charged are usually very small. Additionally, the high liquidity means selling CFD contracts is easy, which brings us to the next benefit.

The ability to go long or short in trading gold CFDs

When using CFDs, you don't have to worry about timing your trades for when the market is rising. The high liquidity of gold CFDs means you can capitalise on movements of gold price in both rising and falling markets. If you think that the price of gold will increase against a currency, you go long (buy) and if you think that the price of gold will weaken against a currency, you go short (sell).

Stability in trading gold CFDs

Since CFDs allow traders to benefit even when the markets are falling, gold CFDs are an advantageous instrument. They can offer traders some stability and a chance to succeed even in unstable markets.

Leverage in gold trading

CFDs are leveraged financial products. You don't need to deposit the full amount required to open a position. Gold CFDs tend to come with high levels of leverage, which translate into low margin requirements. For example, if you get 50:1 leverage on a 39.000 US Dollar position, you will be required to deposit only U$780 into your account to open the full U$39.000 contract. Likewise, you would only need to deposit U$390 with 100:1 leverage.

Volatility in gold CFDs

The gold market is highly volatile and its price tends to fluctuate more than traditional currency pairs such as the EUR/GBP, which sees price movements of around 50-100 pips almost every day. This volatility gives traders more opportunities to succeed in the gold market.

In summary, CFDs for gold online can provide accessibility, liquidity, the ability to go long or short, stability, leverage,and volatility. These benefits make it an attractive option for traders interested in the precious metal.

What Are The Disadvantages of Trading Gold CFDs?

While engaging in gold CFDs provides a number of benefits, there are also some risks involved.

Risk associated with margin usage

Trading gold CFDs on margin using leverage can amplify a trader’s gains. However, the same leverage that increases profits can also magnify losses, which is why it should be used with caution.

Challenges of market volatility

Although gold is often regarded as a safe haven during unpredictable stock market conditions, the high volatility of the market may not always be advantageous. Even a small market movement can have a significant impact on the price of gold vs. demand for gold, resulting in substantial losses.

Furthermore, during times of high market volatility, the chances of experiencing sudden downturns increase, which means that traders need to closely monitor and maintain their margin levels. They may also be required to satisfy margin calls at short notice, failure of which can lead to the position being closed without notice and at a loss.

Costs of holding a position for a prolonged period

Although the CFD market typically involves trying to profit from short-term fluctuations of the price of gold, some traders may opt to hold their positions for extended periods. When this occurs, brokers may apply rollover rates for maintaining the positions, which can sometimes become quite expensive.

It is important to assess the true cost of holding a position before doing so, as the results may not justify the expenses.

How to Begin to trade CFDs for Gold Online

If you're looking to start to trade CFDs online, you'll need to understand how to navigate the market. Trading in the complex CFD market can take some time to understand, but here are a few steps to get started.

Understanding the Market

Trading CFDs involves dealing with both the commodity market and CFD trading. To successfully navigate the market, it's crucial to have a proper understanding of both.

Take the time to learn the gold CFD market, including the different factors that affect the market and value of gold, as well as the fundamentals needed to make informed decisions. This includes how to analyse the market, demand for gold, and common mistakes to avoid.

Creating a Plan

As the saying goes, "failing to plan is planning to fail." A solid plan is critical when trading gold CFDs. Your plan should include your trading goals, risk tolerance, preferred analysis method, trading strategy, and risk and money management tools.

Analysis Method

There are two main methods for analysing the price of gold: technical and fundamental analysis.

Fundamental analysis involves studying macroeconomic data and market sentiment to predict price movements. Traders analyse economic factors such as inflation, political uncertainty, and negative real interest rates to make informed decisions about the market.

Technical analysis, on the other hand, involves studying past price movements and patterns to predict future movements and trends. This can be done using price action, chart patterns, and technical trading indicators. Choose the analysis method that best suits your trading style and preferences, or consider a combination of both.

Risk and Money Management

Once you have identified your entry and exit levels, it's important to have risk and money management rules in place. These should include the amount of capital you will risk per trade, the maximum loss you are willing to incur, and your risk/reward ratio to ensure a balanced investment portfolio. Plan how to minimise risk by using stop-loss and limit orders to avoid large losses, especially during periods of high volatility.

A good plan depends on your knowledge of the market. If you're not familiar with how slippage affects trailing stops, for example, your plan may not include using guaranteed stops to minimise risk. It's also important to stick to your plan, as discipline is a crucial element for consistently profitable trading.

Choosing a Reliable CFD Broke

Choosing a reliable broker is essential to achieve your trading goals. Be sure to look for a broker that offers quality service and support. When choosing a broker, consider the following:

- Regulation: Choose a regulated broker to ensure your funds are secure and your personal and financial information is protected.

- Trading costs: Look for a broker that offers competitive commissions and ultra-tight spreads without compromising quality.

- Trading platform choices: Choose a broker with a selection of robust platforms and tools to enhance your trading experience.

- Margin and leverage requirements: Choose a broker with deposit and leverage requirements that align with your trading abilities and goals.

- Customer support: Look for a broker with responsive and efficient customer support to help you solve problems quickly and effectively.

Gold Trading via ETFs

Gold exchange traded funds have become popular these days, as they offer an interesting alternative to accessing gold. Some say that buying ETFs to trade gold might be a good way to invest in gold for beginners or for people who want to buy gold as a long-term investment, since the construction of ETFs is easy to understand. They are also an excellent option for those looking to trade gold online.

So, how does one purchase ETFs for gold? It's very simple, as ETFs act like individual stocks, and they trade gold on an exchange. This means that investors do not actually own the physical gold as one of precious metals, but they still gain exposure to the commodity, as most standard ETFs (vanilla ETFs) hold a certain number of gold bars for each share of the exchange traded fund issued. As a result, ETFs track the value of the gold market and any change of gold price rises or falls is reflected in an exchange traded market price.

What are Gold ETFs?

ETFs trading gold are similar to mutual funds and are traded on stock exchanges. As with an equity mutual fund, an asset management company (AMC) gathers money from investors to invest in shares. However, with Gold ETFs, the underlying asset is pure gold. The AMC then allots units to investors that can be traded on the exchanges. The price of the ETF is correlated with the underlying gold price, adding flexibility to physical gold investment.

How Gold ETFs Work

Each unit of a Gold ETF represents one gram of gold with a purity of 99.5%. This gold is stored in the vaults of custodian banks, and its value determines the unit's price. For example, if the AMC allots the value of one gram of gold to each unit, the price of each unit will be approximately the same as the price of one gram of gold.

Benefits of Trading Gold ETFs

There are several benefits to trading ETFs for Gold, including:

- No price variation: ETFs are bought and sold at the same rate, unlike allocated gold, which operates at different prices in different locations.

- Gold Purity: The purity of ETFs is assured, with 99.5% purity being the standard. The physical gold market lacks the transparency to generate trust in purity.

- Liquidity: ETFs are listed and traded on recognized stock exchanges, providing convenience and liquidity.

- No fear of theft: Gold being stored in a demat form ensures the security of the investment, rescuing investors from worries associated with physical gold. It also saves on locker charges.

- No entry and exit load: ETFs of Gold do not charge any entry or exit load as they are traded on the stock exchange.

- No indirect taxation cost: ETF transactions are exempt from indirect taxes, such as GST at the rate of 3% on the purchase and sale value, which are charged on tangible gold assets.

Ways to Invest in ETFs to trade gold

There are two ways to invest in ETFs for Gold. One is the direct route, where investors buy units of ETFs and can store their shares and securities in an electronic format using a demat account, which is also referred to as a dematerialized account opened through a stockbroker. This account allows individuals to conveniently monitor all of their investments in one place, including shares, exchange-traded funds, bonds, and mutual funds.

The second is the indirect route, where investors invest in gold funds that indirectly invest in ETFs.

ETFs Compared With Other Investment Products

Comparing ETFs with physical gold investment is not straightforward, as tangible gold assets serve the jewellery demand as well as the investment demand. Physical gold investment has different buying and selling rates, which is not the case with ETFs. However, the traditional usage benefits of gold holdings have historically outrun the benefits of the digital product. Investors must understand the return requirements and purpose of investment before choosing between the two options.

Gold Stocks

Instead of purchasing physical gold, another way to start trading is to purchase stocks of gold producing companies. In this case, investors invest in gold by gaining indirect exposure to the gold markets as producers who sell gold are heavily dependent on gold market price. The outlook for such firms is usually bright when the price of gold soars, as it is expected that sales and earnings of gold miners will advance as well.

Therefore, there is a significant positive correlation between gold prices and certain gold stocks. It is worth pointing out that gold mining companies may also pay dividends, which is a huge advantage compared to a direct investment in precious metals. This factor could be particularly critical for long-term dividend investors and it implies that in some cases buying gold stocks could be an even better idea than the traditional way to invest in gold - buying the precious metal.

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Gold stocks are positively correlated with gold prices, which means that the shares of gold miners gain along with rising gold prices. On the other hand, gold stocks tend to fall when the price of gold dives. Barrick Gold Corp (GOLD.US) may be found among the largest gold producers in the world. Source: xStation5

The Best Time to Trade Gold

Many market participants wonder what the best time to trade gold is. Many traders refer to gold as a “safe haven” asset. This means that it is regarded as a relatively safe asset during tough times, such as during financial crises or recessions. There is no coincidence that central banks hold gold as a reserve asset, as it is widely expected that gold will preserve its value. Such reasoning also affects retail investors' decisions, which is why gold is often found in investors' portfolios.

Apart from that, the precious metal may become particularly popular during high inflation periods. As rising inflation usually makes people concerned about the shrinking value of their money, gold is expected to serve as an inflation hedge. Even though the relationship between price of gold and inflation is not as significant as earlier (we have not experienced elevated inflation for many years now and quantitative easing programmes had their effects on this phenomenon, too), buying gold may still be a wise move in countries with relatively high inflation.

Gold is also regarded as an asset class, which could help investors build a balanced portfolio. This idea may be particularly compelling for risk-averse investors, as portfolio diversification may reduce risk and volatility.

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Following the global financial crisis, the negative correlation between gold prices and US 10-year Treasury yield has become very apparent. Therefore, rising US yields usually lead to falling gold prices. Source: fred.stlouisfed.org

Gold Trading Hours

So far, we have discussed several aspects of gold trading. What about gold trading hours? While this shouldn't really matter for long-term investors who have a time horizon of several years, it could be particularly important as far as gold day trading and gold price is concerned.

In general, there are two peak times of the day to trade gold when gold demand is on the spot – European markets open and US markets open. The European peak occurs around 8 am GMT (9 am CET) and that could be a moment when the price of gold rises, or falls.

However, most activity in the trade gold markets usually occurs following the US market open – by some estimates this peak can be even twice as big as the European one. The elevated volatility lasts from around 1 pm GMT (2 pm CET) until around 4 pm GMT (5 pm CET). This time may be a good period to look out for e.g. US Dollar gold price fluctuations, or when gold demand rises and when it might be the best moment to buy or sell gold.

FAQ

Tangible gold assets can be purchased from authorised dealers or online retailers. Before buying, you should research the seller's reputation and ensure that the gold you're buying is authentic. You may also want to consider the current market price of gold and the dealer's pricing.

When buying physical gold, you should consider the purity of the gold, the weight of the gold, and the design or shape of the gold product. You should also check the seller's reputation and compare prices from different sellers.

Modern methods of gold investing include investing in ETFs, buying stocks of gold mining companies, investing in gold mutual funds, or trading gold CFDs online. These methods allow investors to gain exposure to gold without owning physical gold.

Gold CFDs are financial instruments that enable traders to speculate on movements of the price of gold without the need to own the physical commodity itself. In other words, CFDs allow traders to bet on the rise or fall of the price of gold, without having to take ownership of the underlying gold asset.. CFDs enable traders to trade gold with leverage, which means they can control a larger position with a smaller investment.

CDFs trading for gold online offers several advantages, including lower trading costs, greater liquidity, and the ability to trade gold 24/7. Additionally, CFDs allow traders to take both long and short positions, which can potentially increase profits.

The main disadvantage of trading CFDs for gold is the high level of risk involved. Because CFDs are leveraged products, traders can lose more than their initial investment if the market moves against them. Additionally, some CFD brokers may charge high fees or offer poor customer service.

When choosing a CFD broker, you should consider factors such as regulatory compliance, trading fees, customer service, and trading platforms. It's important to research different brokers and read reviews from other traders before opening an account.

To trade gold via ETFs, you need to open a brokerage account and buy shares of an ETF. Golden ore ETFs track the price of gold and can be bought and sold like stocks. However, ETFs may have management fees and may not provide the same level of price transparency as gold holdings.

Gold stocks are shares of companies that mine or explore for gold. Investing in gold stocks allows investors to gain exposure to the gold industry without owning gold holdings. However, gold stocks are subject to company-specific risks and market volatility.

The best time to trade depends on several factors, including market volatility and economic events. Gold is typically more volatile during times of economic uncertainty, such as during a recession or geopolitical tensions. Additionally, gold is more actively traded during the Asian and European trading sessions. It's important to stay up-to-date on market news and analysis to identify potential trading opportunities.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.