Europe and the US have been the pillars of the global economy for hundreds of years and despite the emerging power of China. Both economies are closely linked in terms of commodities, although the US Federal Reserve conducts monetary policy independent of the European Central Bank. The EURUSD is one of the most actively traded currencies in the world and the Forex market is the largest in the world, with total daily volumes of up to $6.5 trillion and an estimated total market value of over $2.4 quadrillion. For comparison, the value of the market capitalisation of all listed companies is about 100 trillion USD, of which more than half is the value of companies listed on the stock exchange in the USA.

The EURUSD quotations are influenced by many macroeconomic and currency pair specific factors. In this article we will present the main ones that shape the EURUSD exchange ratio and tell you how to start EURUSD trading.

What is a Forex CFD?

Forex is a name for the global currency exchange market. CFD forex market instruments are known for the highest leverage available, which allows for high investment volatility even with relatively small price movements, which multiplies your opportunities for success, as well as the risk of losing more money. Because price fluctuations on currency exchanges aren't very high, the high financial leverage provides investors and traders high portfolio volatility even when prices are changing 1% or even 0,5% during 24 hours.

CFD stands for 'Contract for Differences' and currency CFDs are financial instruments. When trading CFDs on Forex you don't become an owner of any currency you are trading, but only own a contract for its price difference. So when you trade CFDs you are only speculating on the price action - it can always go up and down.

This, combined with financial leverage, may give you bigger and faster earnings, as well as losses. Price fluctuations are even stronger when the critical economic data or decisions are being given, so this can give special occasions for bearish or bullish traders, who are speculating with ‘short’ positions. In the end, your main task as a trader is to predict the future price movement direction of the currency you are speculating on.

CFDs are risky because in this type of trading you have access to financial leverage. That’s also why your reaction time can be limited.

What affects the EURUSD pair?

Currency pairs compare the strength of economies by aggregating all information about them, valuing individual risks and prospects. The EURUSD pair compares the economies of the European Union (countries that are in the European Monetary Union and have adopted the Euro) with the United States of America and therefore anything that affects either economy is reflected in the EURUSD pair.

Moves and decisions that strengthen the dollar can cause the EURUSD pair to fall.

Moves and decisions that strengthen the euro can cause the value of the EURUSD pair to rise.

Publications providing traders with important economic data that affects the strength of currencies include:

- Central banks decisions (FED, ECB) (interest rates, treasury bond yields)

- Inflation CPI for USA, EMU (European Monetary Union)

- GDP Growth data

- Purchasing Managers Index

- Labor market data

- NFP (NonFarm Payrolls) and ISM Manufacturing Index

- US Consumer sentiments Index by University of Michigan

- ZEW Economic Sentiment, IFO Germany Business Climate Index

- Conference Board

We offer access to key economic data published daily in our market calendar.

Any moves, political decisions and the geopolitical situation can affect the euro and cause EURUSD to rise. Geopolitical uncertainty affects both currency pairs in a powerful way. This has been shown by the war in Ukraine and the energy dependency that weighs on the European Union economy in 2022.

Another factor that can affect this currency pair is geopolitical uncertainty. The United States and the European Union are major trading partners, and traders often pay attention to the relationship between these blocs when tracking currency prices. Instability can have a significant impact on the value of EURUSD.

Finally, since the US and EU economies are highly dependent on private industry, even the performance of major regional stock market indices in the US and Europe can cause the euro to rise or fall in value against the dollar. The EURUSD may also be indirectly affected by the health of stock market indices.

Speeches of heads of central banks and their members can have a very significant impact on EURUSD, because central banks set the direction of monetary policy. Central banks also set interest rates, which, according to Fisher's Economic Theory, affect exchange rates.

For example, if interest rates in the US are rising and are at higher levels than the Eurozone, the USD should be stronger than the EUR, which will be reflected in the exchange rate.

Every trader should see that trading sessions affect the volatility of currency pairs. The most important data is published during the American and European sessions, the volatility during the Asian session is low, similarly around noon local time, when investors have their lunch break. Volatility also increases at the beginning of the US cash session and at the end of the European session.

Short selling

Short selling is taking positions on falling prices. With this position you can make money when the prices of the instruments go down. Alternatively, should the price of the instrument go up, you would incur a loss. Normally, traders lose money when prices fall. However, CFD trading allows you to trade under all conditions, even in the face of falling prices.

In the 'short selling' strategy, price behaviour is the most important factor. The downturns are usually more dynamic and much shorter than the 'upward movement' also known as a bull market. You can see how US company prices and indices behaved in 2008 in the face of the Lehmnan Brothers bankruptcy or in March 2020 during the Covid crash. On the forex market, you can see what happened with Turkish Lira USDTRY during the autumn of 2021 because of central banks decisions. You can also look into the EURUSD pair and look how different central banks policies (FED vs EBC) and geopolitics affected the prices.

It was thanks to the possibility of 'short selling', i.e. betting on price drops, that Michael Burry, the current owner of the hedge fund Scion, who criticised the American credit system, made a fortune during the Wall Street panic of 2008. This story is also depicted in the film 'The Big Short'.

Short selling on the xStation5 platform

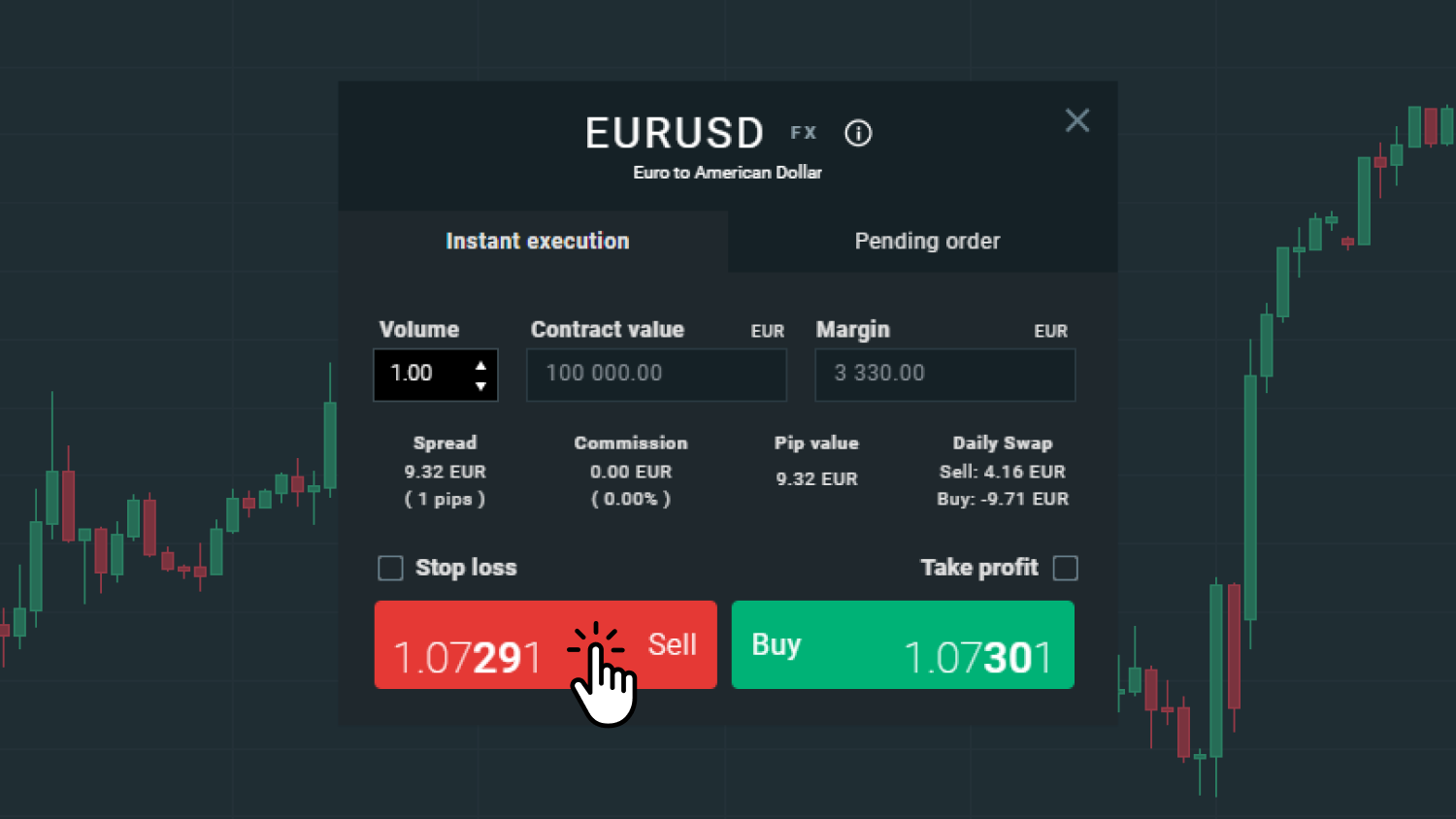

You open a short position on the platform in the same way as you would open a long position. Instead of clicking on the green BUY button you select the red SELL button.

Position for rising prices 'long position' green BUY button

Position for falling prices 'short position' red button SELL

Defensive orders SL and TP

When trading CFD instruments, you have to take into account the high volatility of the price and the result of the position. By analysing the chart and the changing situation, some traders decide to use automatic defensive orders, so that they do not have to follow the chart all the time.

Stop Loss

As the name suggests, a Stop Loss order can protect against deepening losses; the position will be closed automatically when the price falls below your specified level. Another type of a stop loss order is a trailing stop loss, which tracks the price of an instrument at a distance set by you. Using a trailing stop loss may allow you to hold a position for a longer period of time, maximising your profits and limiting the risk arising from a sudden price movement.

Take profit

A Take Profit Order, on the other hand, will allow you to automatically close a profitable position at a price level that you deem appropriate. The closing level can be based on, for example, the technical analysis that is available at xStation5 or your own analysis of the market situation.

You can find more information about defensive orders along with the instructions for setting them in this article on Stop Loss and Take Profit, and in the xStation5 platform, in the 'Education' tab, where we present instructional videos.

Financial leverage

The use of leverage carries with it both a chance to open a large position with a small amount of capital employed and greater responsibility and risk.

When trading CFD instruments, the amount you invest to open a position is called a margin. The amount necessary to open a position depends on the instrument you are trading and the leverage assigned to it. Let us use an example.

If you were to open a minimum position of 0.01 lot (1 lot equals 100,000 units of the base currency) on the EURUSD currency pair, it would cost you approximately EUR 33, because the available leverage on the EURUSD pair is 1:30, meaning that in order to open a position you would need 3.33% of the nominal value of the margin. Thus you would open a position of EUR 1,000 (0.01 x 100,000) on a margin of EUR 33.

It is also important for you to become familiar with the terms Balance, Equity (Account value) Free Margin and, most importantly, Margin Level.

The account balance changes only when you deposit, withdraw, close or open a position.

Equity is the amount in your balance plus the current result on your open positions.

Margin is the sum of your margins - the total amount taken to open positions in CFDs.

Free Margin is the amount you can still use to open new trades.

Margin Level is an indicator that counts the % of your margin. The formula is Equity / Margin x 100%.

Thus if your Equity is 3,300 EUR and the margin in a CFD position is 33 EUR, your Margin Level will be 1000%.

However, if your account value is 35 EUR and the margin is 33 EUR, your margin level will be almost 106% (35 / 33 x 100 % = 106) .

If on an open CFD position you have recorded a loss of 18 EUR, your account value is only 17 EUR. In this case, your margin level will only be around 51.5% which means that an automatic Margin Stop defence mechanism will be triggered, which will close your position in order to stop further losses if your margin level falls below 50%.

The mechanism's existence is a legal requirement and is a result of the regulations we are subject to as regulated by financial institutions such as ESMA and the FCA.

If the margin level falls below 80%, we will send you a Margin Call warning, which means that your margin level has fallen to dangerous levels and may result in closing your position.

If you wish to keep your CFD positions open while the Margin Level is falling, you can simply deposit funds into your account which will cause the Equity (account value) to increase and the Margin Level to rise. The information about the current level of % Margin Level is displayed in the platform, so you do not have to make calculations on your own.

You can read more about the Margin Call here.

How to start trading EURUSD

To start trading EURUSD on a real account you need to go through the registration process where you will answer knowledge based questions and fulfil some account conditions. Here is the link to a form where you can apply for a real account.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

A live account will give you the opportunity to trade CFDs on dozens of different currency pairs from both major and emerging exotic markets.

You can also open a free DEMO account, valid for 30 days, from the level of which you will start trading for virtual money and get acquainted with the xStation5 platform. You can read about the xStation5 trading platform here.

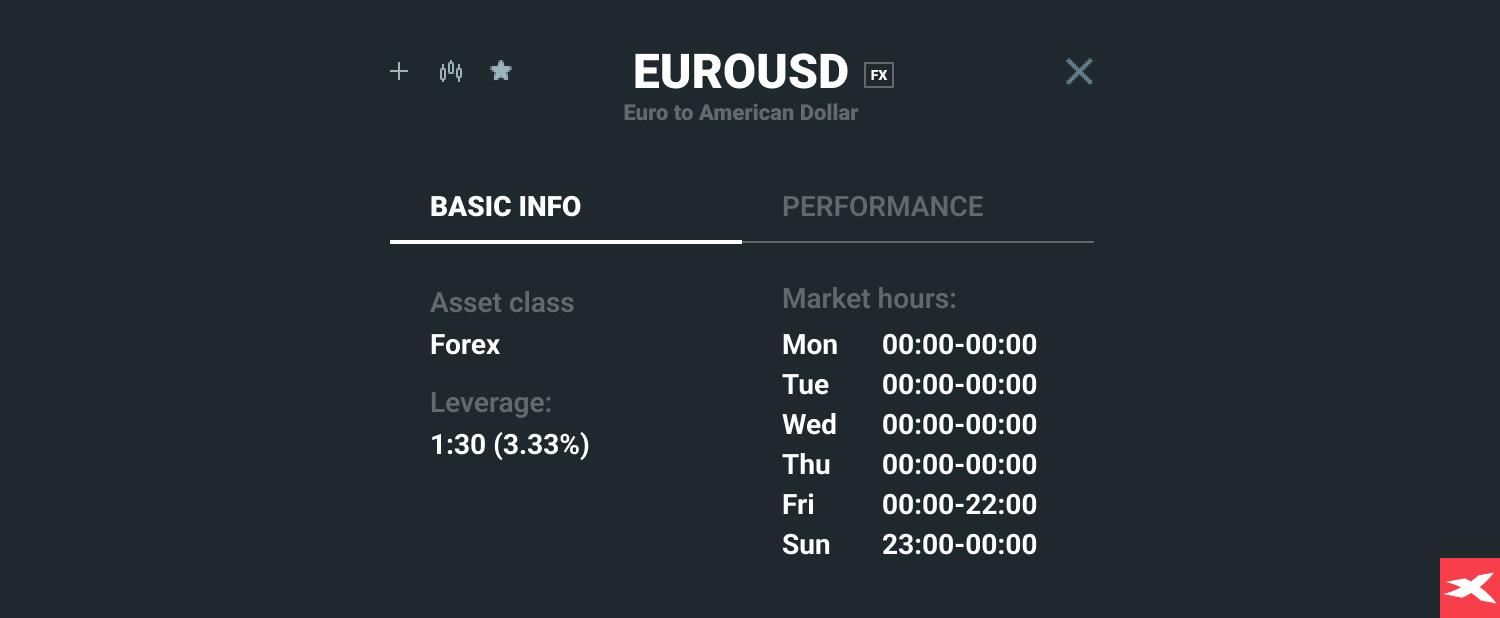

The leverage available on the EURUSD is 1:30. You will need only 3.33% of the contract value to open a contract with a margin for an increase or decrease in the price of the currency pair.

A volume of 1 lot is equal to 100,000 units of the base currency. A 0.1 lot Mini lot is equal to 10,000 units of the base currency. A 0.01 lot is equal to 1000 units of the base currency.

For example, to open a 0.1 lot position on EURUSD you would only need 333 EUR with a leverage of 3.33% margin commitment.

Additionally, the xStation5 trading platform provides tools for technical analysis, thanks to which you will be able to implement your own trading strategies, access to the preview of the real EURUSD volume, as well as professional Client Service and a friendly graphical interface.

The accounts of XTB Clients are protected against negative balance, thanks to which, when trading at xStation5 on the Forex market, you cannot lose more than you decided to deposit on your trading account. The mechanism of Margin Stop will partly protect you during extreme market conditions and will close your position when your Margin Level falls below 50%.

Forex trading hours

What about available trading hours? This information is especially important for forex (EURUSD) traders. The forex market is open 7 days per week with two breaks on Fridays and Sundays. On Fridays, trading is closed from 22:00 CET to 00:00 CET. On Sundays, trading is closed from 00:00 to 23:00 CET. Spot price is static when the market is closed. At all other times the prices are constantly fluctuating.

Of course, the best time to start trading forex CFDs is during periods of very high liquidity, when market volatility is higher. When there is high turnover in the market and trading volume increases, volatility also increases. This can be influenced by the publication of important news about economics data, central banks decisions or in face of geopolitical reasons.

How to Choose the Best Forex and CFD Broker

What Is Leverage in Trading?

Forex Trading - How to Invest in Forex CFDs

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.