The world of Exchange Traded Funds (ETFs) is vast and diverse and with the right strategy and gaining-knowledge approach, it can provide a lot of investment opportunities. Achieving financial goals through ETFs hinges on a well-crafted investment strategy. This article demystifies ETF selection and asset allocation, providing you with actionable insights to fine-tune your approach. Maybe after reading it, you will be ready to build or enhance your own ETF investment strategy? Let’s start and learn about ETF investment strategies.

The world of Exchange Traded Funds (ETFs) is vast and diverse and with the right strategy and gaining-knowledge approach, it can provide a lot of investment opportunities. Achieving financial goals through ETFs hinges on a well-crafted investment strategy. This article demystifies ETF selection and asset allocation, providing you with actionable insights to fine-tune your approach. Maybe after reading it, you will be ready to build or enhance your own ETF investment strategy? Let’s start and learn about ETF investment strategies.

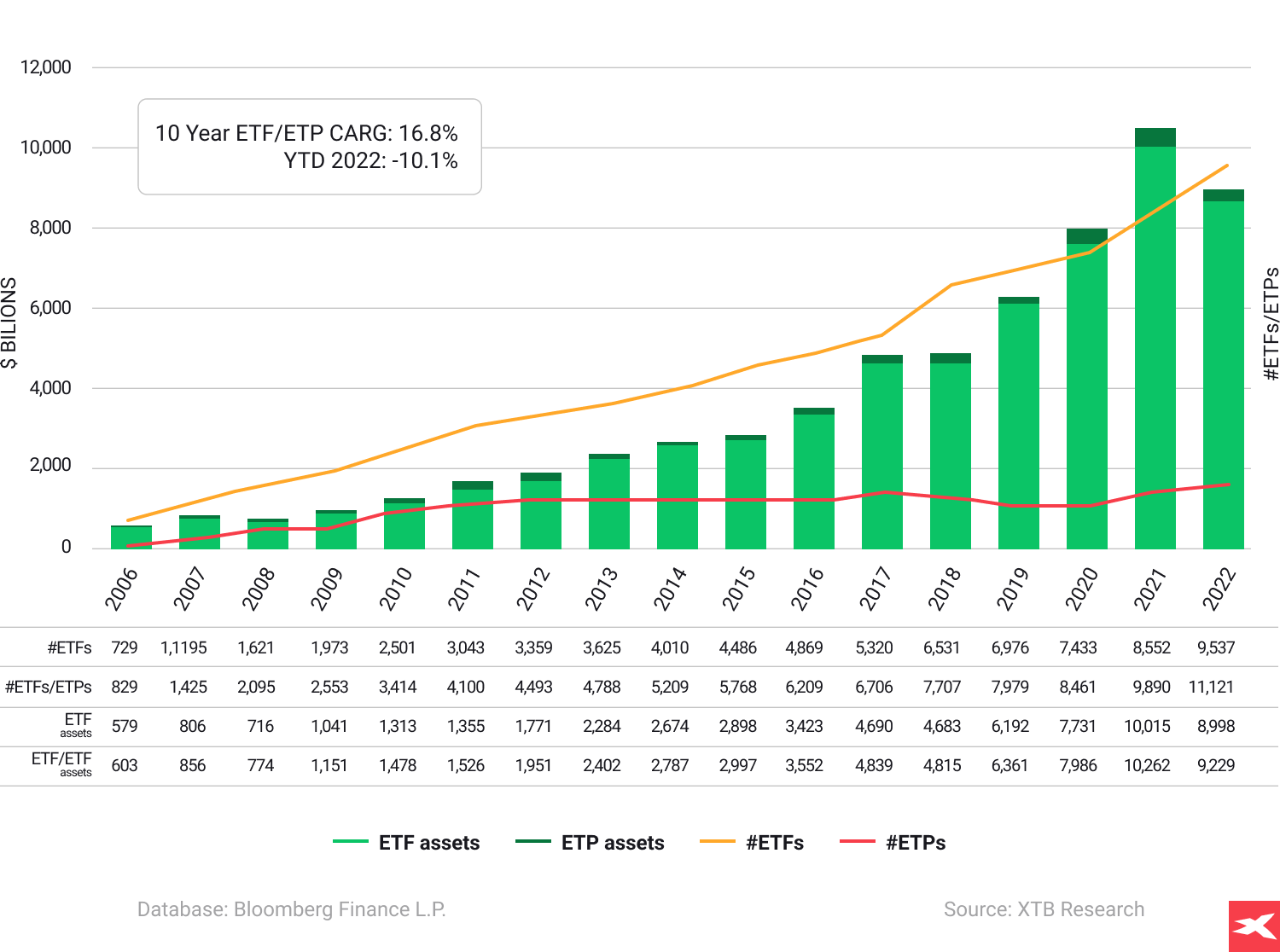

Chart 1: Despite a weak 2022 year for stocks, the global ETFs market gained $856 billion inflows, the second largest after $1.29 trillion in 2021. A 10-year average ETF/ETP assets under management CAGR is outstanding 16.8% rate The Global ETFs industry had 11,119 products, with 22,860 listings, assets of US$9.229 Tn, from 671 providers on 81 exchanges listed in 64 countries at the end of December 2022. Source: ETFGi from ETF/ETP sponsors, exchanges and regulatory filings

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Short ETF Characteristics

Exchange Traded Funds (ETFs) are diversified investment vehicles that offer exposure to various asset classes such as indices, precious metals, commodities or specific sectors, allowing investors to mitigate risk while seeking growth opportunities. ETFs are traded on global exchanges in the same way as stocks. Investors can choose index-tracking ETFs, bond ETFs, international ETFs, or mentioned sector-specific ETFs giving investors exposure to technology, dividend stocks or commodities markets.

The key is to have a strategy and understand the risks. Consider risk tolerance, time horizon, and investment objectives when building a portfolio. Also, rebalancing it may be crucial for desired asset allocation. What’s important, ETFs make it possible to venture into sectors without requiring in-depth knowledge and research of individual stocks. Investors have access to a vast array of ETFs that follow prominent indexes such as the S&P 500 or the Nasdaq Composite, as well as those providing exposure to specific asset classes, regions, or sectors such as technology or banking. Let’s compare stocks investing to ETFs.

Investment tips

Armed with knowledge about ETF structure and types, you can now implement your own strategy. What are the fundamental 16 very important tips?

Armed with knowledge about ETF structure and types, you can now implement your own strategy. What are the fundamental 16 very important tips?

- Establishing your investment goal and time horizon are crucial

- Analyse your budget before investing to limit risk

- Invest limited amount in each ETF, to avoid market volatility consequences

- Asses a scale of your investments in a conservative way

- Always control your emotions during investing money

- Rebalance your portfolio regularly only if your knowledge and research focus are high

- Choose ETFs on market indices, which you want to have in your portfolio

- Try to balance aggressiveness and risk aversion strategies

- Always do some research about any ETF you invest in

- Passive or active investing? Analyse a potential and risks of both

- Be familiar with risk/reward and margin of safety concepts

- Try to ask yourself - why are you so optimistic about the future of a specific sector or index?

- Don’t panic during market corrections, but be ready to cut losses if necessary

- Don't try to “time the market” if your knowledge, confidence and understanding of risk are quite low

- With a long term investment view, you can use DCA (Dollar-Cost-Average) strategy

- Choose the best brokerage account to start a process but test it before investing

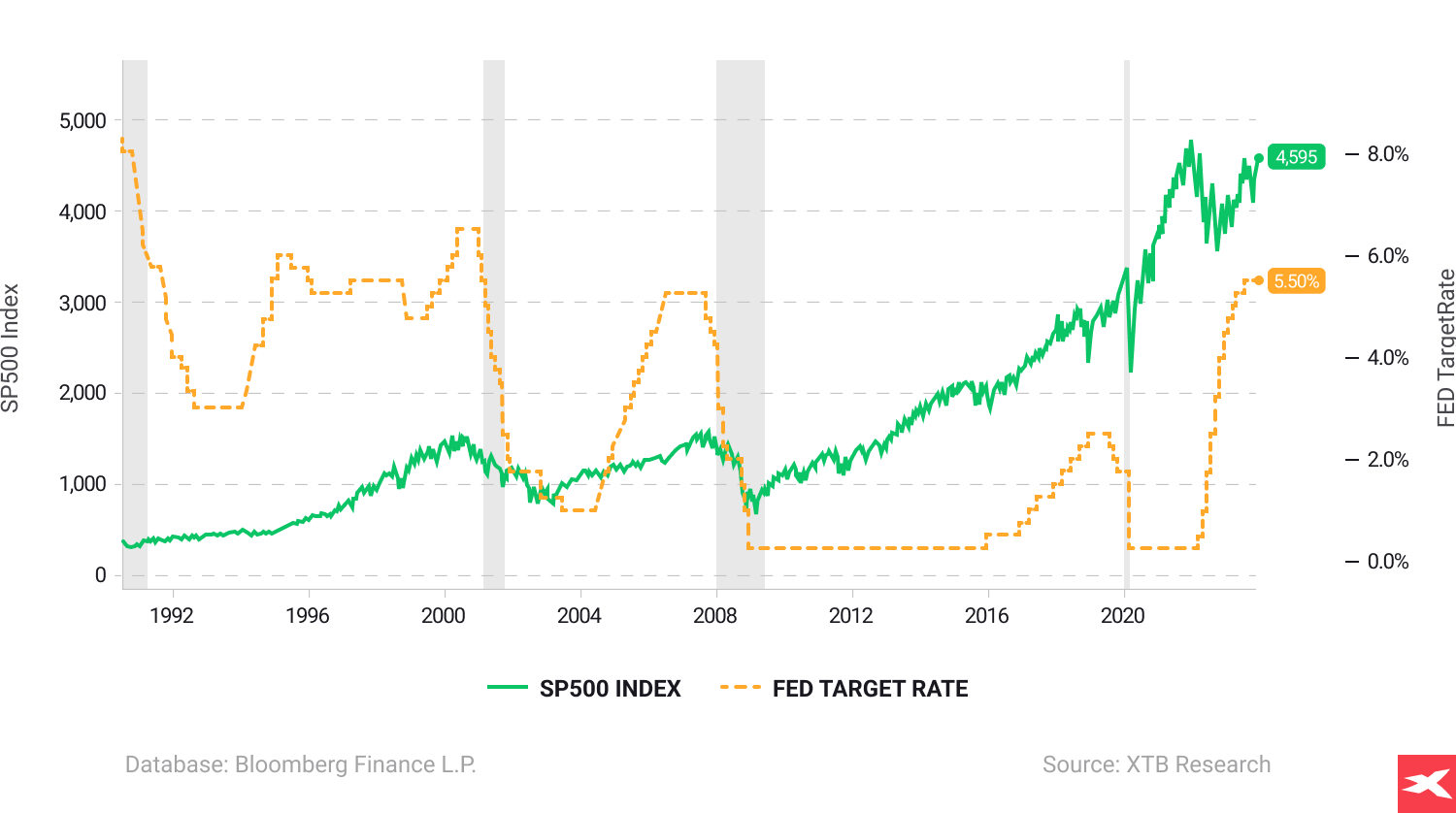

Chart 2: The most popular ETF is the American S&P 500. The chart below reflects its performance (green line) from 1990 to 2023 with Federal Reserve interest rates levels (orange line). As we can see, the correlation between Fed interest rates level and stock market performance is not obvious and defined. After the 2000s so-called dot-com bubble and GFC in 2008, S&P weakened as the Fed cut rates. At the same time, despite three stock crashes (2000, 2008 and 2020) and a long term performance of S&P 500, the biggest global stock market index is outstanding (rising from 400 points to 4600 points between 1990 and 2023). Source: Bloomberg Finance LP, XTB Research

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

7 ETF investing strategies

Long term investing / holding

ETFs are an instrument that is primarily used by long-term investors for a number of reasons. One strategy popular among ETF investors is simply long-term investing. In a nutshell, it is based on the belief that the stock market or other asset that the ETF fund tracks is in a long-term uptrend. Long-term investors, so-called “holders”, do not pay attention to temporary market corrections and are not inclined to sell their holdings in ETFs. They tend to use periods of decline when sentiment is weak to buy and increase their positions.

Speculating

As a rule, speculators have a short to medium-term investment horizon. Often the assumption is to play out a specific scenario. This could be, for example, buying a gold price ETF in anticipation of an economic slowdown and weakening of the US dollar. It could also be buying ETFs on emerging markets and China, expecting sentiment to improve after a disastrous period for Chinese stocks. On the other hand, speculators can also choose ETFs that offer exposure to specific market sectors like new technology or healthcare.

Trading

Active traders use not only speculative conviction but also a number of other indicators, including technical analysis, to open positions. Traders are usually in the market for the shortest time and keep positions open for one to several days. They often choose CFD instruments on ETFs, which are characterised by leverage. Leverage increases investment risk while allowing them to open larger positions and reap greater profits (or losses).

DCA

Some investors believe that the key strategy to reap long-term investment benefits is called Dollar Cost Averaging, or DCA for short. This means buying selected ETFs on a regular basis, without paying attention to market sentiment or current market conditions. Instead of opening one large position, investors who practise DCA open a series of smaller investments, at regular intervals, regardless of price. The strategy also often means so-called 'loss averaging.

Momentum

Momentum investors wait for the right moment to start investing. This is usually when the mood is very negative or some event happens that they believe will trigger additional demand. In the markets, this could be, for example, the reversal of the “hawkish” narrative of Fed members and the associated expectation of monetary easing through rate cuts (usually positive for stocks and bonds). It could also be the expectation of news that improves sentiment around a particular sector or the stocks of selected companies, e.g. the rise of Chat-GPT and the associated euphoria in technology stocks and chipmakers.

Following the trend

Investors who are uncomfortable with buying when the stock market is losing tend to choose the strategy of investing along with the trend. Following the “trend is your friend” principle, such investors plug in to ongoing market trends. Typically, the sooner they define them, the more profits they can record from the ongoing trend.

Contrarian

So-called contrarian investors believe that the majority in the market is usually wrong. Even if the consensus is right, contrarians can expect a moment when the market's optimism or pessimism is exaggerated.

They tend to sell stocks at a time when optimism is very high and the market becomes convinced that indexes will only go up again. On the other hand, when the mood is slowly waning and stocks are getting cheaper, contrarian investors are more likely to buy overvalued stocks. They are usually very active during stock market panics and crashes.

The problem here, however, turns out to be determining the time when the mood is exaggeratedly tilted in either direction. The basic problem of contrarian strategies is not only knowledge, emotion control and professionalism. Above all, a contrarian opinion not only has to be different from common investor beliefs. It must also be more accurate and better, which makes this strategy extremely difficult.

ETFs vs Stocks

ETFs usually offer exposure to dozens or hundreds of different listed companies, by tracking index or specific sectors. Investing in individual stocks involves buying shares of only one company (or more if an investor buys more than one company stock). Because of the larger number of stocks that ETFs accumulate, usually they have lower volatility compared to stocks. They are also not as prone to the risks associated with investing in only one company. Some index funds track the price movements of entire stock market indices, which include dozens to hundreds of stocks of different companies. Individual stocks are usually much more volatile than ETFs.* XTB offers 0% commission on Stock & ETF investing.

*For monthly turnover equivalent up to 100,000 EUR. Transactions above this limit will be charged a commission of 0.2% (minimum 10 GBP).

Stocks

- Analysis and research may require more time

- Higher volatility

- Risk that the stock you own will not beat the return of the overall index

- Risk associated with events and the valuation of a single company

- Risk premium may be higher

- Possibility of beating markets performance

ETFs

- Diversification of investments and lower volatility

- Time savings, exposure to stocks of dozens or hundreds of companies at once

- Ability to choose from funds focused exclusively on a particular region

- Freedom of exposure to a selected market sector

- Lower volatility

- Risks associated with a broader decline in equity market sentiment

- Risk that a particular ETF will perform much more poorly than the strongest stocks

- Investment means agreeing to performance that reflects the “market average”

- Additional investment costs (TER)

Note: It is not true that ETFs are not risky. It is difficult to expect the valuation of a fund accumulating dozens or hundreds of shares of different companies to depend on one of them. The risk is of a possible broader weakening of stocks sentiment, which could lead to declines in almost all listed stocks and index tracking ETFs.

Pros and cons

Pros

- Great for long-term and passive investing

- For both beginners and professionals

- Low entry barrier, low fees (TER) and high liquidity

- Limited risk and possibility of portfolio diversification

- Due to diversification, volatility may be lower compared to single stocks

- Possibility of investing in a bunch of assets like indices, bonds or commodities

- Investor may be sure that index fund prove exactly same performance with stock indices for example S&P 500 or Nasdaq 100

Cons

- May not be appropriate for traders and short-term investors who prefer an aggressive investment style

- Lower risk is balanced by possible lower returns

- Investor-selected exchange traded fund may underperform compared to top companies or indices during bull markets

- Diversification does not guarantee returns and can also lead to losses

- In a portfolio, a few exchange traded funds can spoil the performance of those that are doing great

- Risk of misalignment of ETF in a portfolio

- Excessive concentration of capital in passive investments can limit allocation options toward riskier assets (possibility of outstanding returns)

Risk and diversification

Now, let’s examine the process of balancing risk and reward within your portfolio. This is where smart asset allocation comes in. Diversification is a key element of any successful investment strategy. ETFs provide investing in a mix of asset classes. It may reduce overall investment risk, volatility and optimise returns.

Important: Younger investors, in particular, are often advised to allocate a larger portion of their portfolios to stocks index funds. To maximise returns during their pre-retirement years. This heavy tilt towards stocks, however, should be balanced by investments in other asset classes to ensure a well-diversified portfolio. Some other asset classes to consider include:

- Bonds

- Commodities

- Alternative assets

ETFs give all of that; a stocks' exposure composed by bond, commodities and sector specific exchange traded funds.

Risk tolerance and investment horizon

Risk tolerance and time horizon are two crucial factors that should influence your ETF investment strategy. Your risk tolerance is your willingness and ability to handle potential fluctuations and losses in the value of your ETF investments. Various factors such as age, tolerance for risk, and available investment amount should be considered when assessing your personal risk tolerance for ETF investments. A prolonged time horizon allows you to withstand market fluctuations and reap the rewards of the selected ETFs’ long-term performance.

Rebalancing and adjusting

Besides diversification and comprehending your risk tolerance and investment period, regular portfolio review and adjustment to uphold your preferred asset allocation may be crucial, if you are a professional. This process involves selling certain assets and purchasing others to uphold the desired asset allocation. Determining the ideal asset allocation requires the following steps:

- Do some research about financial market sentiments

- Look at indices, bonds, specific branches, sectors, commodities or precious metals

- Think about the strategy you want to have

- Analyse and choose the best ETFs to achieve your goals

- Create smart budget for investments

- Identify your target allocation

- Establish the tolerance for volatility and portfolio results

- Execute the buying or selling ETFs sometimes, to achieve the ideal asset allocation

Important: Rebalancing the portfolio is not crucial, and long term investors may deny doing it. Regular rebalancing, typically every six months or when the portfolio has deviated 5 percentage points or more from its target allocation, ensures your investment strategy stays aligned with financial objectives. Some brokerages give investors special tools for ETF passive strategies, such as ETF investment plans. Remember that rebalancing may carry some risks too! The assets you will sell and buy may underperform your previous portfolio results.

FAQ

Yes, investing in ETFs is a good strategy due to their low costs, diversification, and ability to get started with a range of stocks. They are ideal for beginner investors and offer long-term investment potential, even for professional investors. Creating a diversified portfolio should be a goal for any long term investor. ETFs are usually much cheaper than mutual funds. Any mutual fund may be much more expensive than popular ETFs investing, with uncertain results as well.

Yes, there are downsides to investing in ETFs, including commission charges for buying and selling, and potential market risk leading to losses. ETFs can also be more expensive than investing in individual stocks due to management fees (TER). Indices ETFs are definitely not as “safety” as fixed income securities such as bonds or fixed income funds. The valuation of any ETF depends on investors' sentiments, which are changing constantly.

ETFs, or exchange-traded funds, are financial instruments that function similarly to stocks, offering a diversified portfolio of assets and catering to various investment strategies, usually at a low cost of holding it (TER). As assets addressed mostly to long term investors, ETFs usually reflect stock market indices performance (such as Nasdaq100, S&P 500, DAX etc.), or stocks performance from specific, tracking sectors such as a technology, healthcare or consumer discretionary.

Asset allocation is important in ETF investing because it helps to balance risk and reward in any investment portfolio. It happens by dividing investments among different asset classes based on a risk tolerance, knowledge and goals. It may be crucial for optimising strategy, but two things are also important. The first is a long term view on holding ETFs - sometimes doing nothing is a better (and tax effective) strategy, similar to Warren Buffett investing philosophy. The second one is that every investor makes mistakes. It’s hard to avoid them. What's more, usually any active investor usually accepts more risk than an investor with long term investing goals.

There is no concept of the best ETFs because any ETF future results are unknown. At the same time, we can see the highest quality ETFs, which may be a part of personal finance. Their fee (TER) are usually very low, with outstanding results thanks to f.e. growth stocks tend. This asset class may be a part of personal finance. But remember, performance of stock market ETFs depends on underlying companies results. Not only the stock market but also gold ETFs are very popular.

Climate change investments: Maximising impact

Best ETFs to Look Out For

Artificial Intelligence ETFs - Smart Investing in AI

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.