In this lesson, you'll learn:

- Why fundamental factors are crucial for commodities

- What could influence commodities prices

- Why seasonality is an important factor while trading commodities

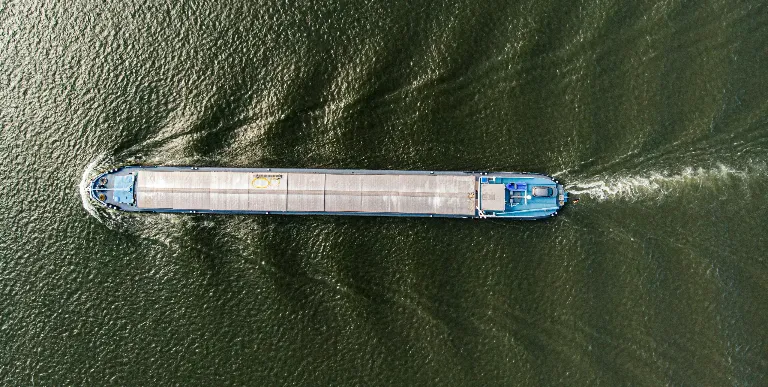

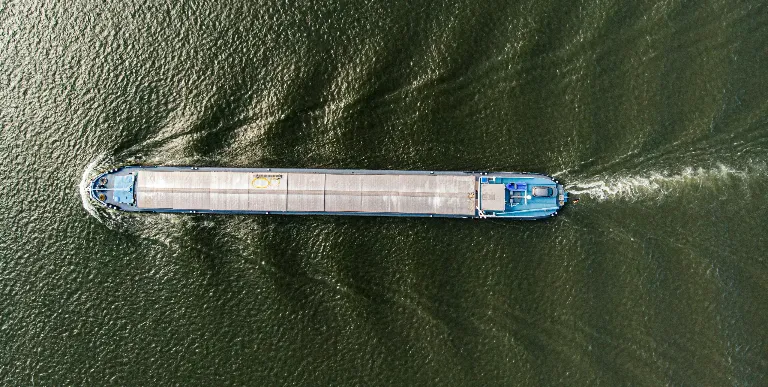

Commodities are a unique sector of the financial markets. One of the most interesting aspects of trading commodities is the complex relationship of supply and demand between economic factors and consumer habits, which give the potential for prices to fluctuate greatly.

While commodities are essential components of manufactured goods, their production and consumption depend mostly on factors like climate, seasonality, and resource. For example, oil prices have suffered greatly in the past few years as shale production rises faster than demand, which leads to an increase in oil inventories, thus leading to a fall in oil prices. This article explains all the important aspects when trading commodities.

What exactly is a commodity?

A commodity is usually a natural resource that can be processed and sold. These include things like agricultural goods, metals, energies, minerals, and much more.

It’s important to note that the sale and purchase of commodities is usually carried out through standardized futures contracts on multiple exchanges. That means that you don’t have to buy a barrel of oil and store it in your garden. All you have to do is to buy a futures contract to become a commodity trader. The most known and the oldest exchange is the Chicago Board of Trade [CBOT], on which a trader could buy futures in common commodities in agriculture, including wheat, corn, maize, oats, rice, soybeans and many more. Nevertheless, the fact that commodity trading is carried out mainly through contracts has its own implications. Futures allow a trader to buy or sell a commodity without the need to store it, which allows speculators to be a part of the market.

That is why we can divide commodity traders into two groups: real investors and speculators. The first group are physical buyers and producers of commodities that use commodity futures contracts for the hedging purposes for which they were originally intended. These traders actually make or take delivery of the actual commodity when the futures contract expires. The second type of commodities trader is the speculator. These are traders who trade in the commodities markets for the sole aim of profiting from volatile price movements. These traders never intend to make or take delivery of the actual commodity when the futures contract expires. That could have significant implications for prices. Going back to oil, prices fell sharply in the first quarter of 2016. The move had a fundamental backing, but was forced mainly by speculators that expected oil prices to fall to 10 dollars per barrel. As a commodity trader, you should take this aspect into consideration.

Fundamental analysis could be crucial

While technical analysis is useful when it comes to commodity trading, a lot of traders tend to focus on fundamental factors. But why is this?

The basis for fundamental analysis is supply and demand. Supply and demand amounts to a simple equation. However, things get more complicated when you try to forecast prices for the future. Commodities trade usually in cycles; sometimes supplies will be tight and prices high. Other times, there is just too much of a commodity and prices fall. In general, price movements in commodities using fundamental analysis can be broken down into just two simple formulas:

- If a demand is lower than supply, then prices should fall

- If a demand is higher than a supply, then prices should rise

Of course, those rules usually work, but it doesn’t mean that you won’t see any exceptions. The financial market is a complicated place with many factors that could influence prices, and this includes the prices of commodities.

As previously mentioned, changes in supply could play a crucial role for commodities. The supply of a commodity is the amount that is carried over from the previous years of production and the amount that is being produced during the current year. For example, the current supply of soybeans include the crops in the ground and the amount that is left over from past crop year. The higher they are (with a stable demand), the lower the prices should be. Supply could be influenced by many factors like weather, the total amount of acres planted, production strikes, crop diseases, and technology.

Demand is the other side of the equation. It is the amount that is consumed at a given price level. In general, demand will increase when the price of a commodity moves lower. On the other hand, it will decrease as the price of a commodity moves higher. Think about a simple example. The more expensive petrol is, the less people can afford it, so the lower demand for it. In a situation where prices of gasoline double, you would probably choose to travel by bus or on a bike rather than by a car. That means that your demand for petrol, thus for oil, will be lower.

So if the main aspect of analysis of commodities refers to demand or supply, let’s see at what data you should look to judge whether prices will fall or rise.

Data to watch

As mentioned previously, the relationship between demand and supply could be crucial for the prices of commodities. That’s why it’s important to keep a close eye on data releases. For example, oil traders look at the Department of Energy weekly change in oil inventories to see whether supply or demand is dictating the direction of the market. A rise in inventories is a bearish sign as it signals that supply is greater than demand. Here are the two most important types of reports to watch:

- Changes in inventories - as shown on the example with oil, changes in inventories are an interesting way to see whether a demand or forecast plays a greater role on the market at the moment. Each commodity has its own type of report and each has its frequency of publication, so it’s important to be up to date with them. Here are some reports worth looking at: Oil - API, DOE published every week; agricultural commodities - USDA report published at the end of every month.

- Reports on the balance - While changes in inventories could indicate which side drives the market at the moment, reports on balance could confirm or negate those indications. They are published more rarely than reports on changes in inventories, but could carry more important information. For example, OPEC’s monthly report on the situation on the oil market is a type of report on balance. It shows changes in demand, supply and production and includes forecasts for the future months.

Each commodity has its own reports that are worth looking at, so you should acquaint yourself with them before you start trading commodities. The moment of publication is usually a moment of solid increase in volatility, so be aware of when those reports are published.

Seasonality and weather

Seasonality is an important part of the fundamental analysis of commodities. While currencies and indices tend to move randomly all over the year, commodities could see a specific move at a specific time of a year.

Some commodities such as corn and wheat experience price tendencies resulting from annual growing cycles. For example, the markets are inclined to push prices lower during harvest time because supply is abundant and risk of the unknown weather interference in the yield has dissipated. Conversely, grain prices are often pressed higher during the planting and growing seasons as speculators price in weather risk premium. Other commodities such as crude oil, natural gas and precious metals don't have pre-defined production cycles based on season, but the consumers of these products do. For instance, oil prices are often higher in the spring in anticipation of a busy summer driving season, and natural gas sees a bump in price in the fall as energy providers stockpile for the winter months.

Let’s look at a specific example. Late January is often the beginning of a bull run in grains such as corn and soybeans. In the case of soybeans, the seasonal rally generally extends into the early summer months. On the other hand, corn often runs out of steam in March. The strength in grains is usually the result of risk premiums being built into the markets as uncertainty regarding the upcoming crop-planting season builds. Plenty of things can go wrong during planting, and traders know that a bullish call on grains can be the trade of the year should the crop-planting season not go in line with expectations. On the chart below you could see each month’s performance of wheat over the last five years.

Source: Bloomberg

Source: Bloomberg

That leads to another factor worth looking at. Weather, as shown previously, could also play an important role on the commodity market. The colder it gets, the more expensive natural gas could be. What’s more, cold weather could be harmful to crops, which could send prices higher in wheat and other agricultural commodities. So it’s not only seasonality itself that should be taken into consideration, but also weather.

So is there a regular pattern that could be applied to a commodity market regarding seasonality? Not exactly. Seasonals are simply a tool that indicates what markets have done most often in the past, but they don't necessarily dictate what will occur this year, nor does history guarantee to repeat itself on average in the future. With that said, the odds are that history will repeat itself and that there could be an edge to consulting with seasonal patterns before taking action.

An exciting market

The commodities market is slightly different to others. The most important are fundamental aspects, but technical analysis could also play a role. However, while trading commodities a trader has to take into account various aspects, including seasonality or weather. What’s more, you should also remember that each commodity is governed by its own laws. That means that something that works on the oil market could be useless when applied to wheat or other agricultural commodities. After all one thing could be said - the commodities market is definitely one of the most exciting to trade.

Commodities (definitions)

The history and future of Natural Gas

Understanding Contango and Backwardation: Key Concepts in Commodity Futures Markets

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.