Investing can be one of the most effective ways to build wealth and achieve financial independence, but it’s not without its pitfalls. Even the most seasoned investors make mistakes that can cost them time, money, and opportunities. Whether you’re new to the market or a seasoned trader, recognising common investment mistakes can help you make smarter decisions and avoid costly errors.

From chasing hot stocks to neglecting proper research, these missteps can undermine your investment strategy and long-term goals. In this guide, we’ll explore the five most common mistakes investors make and how you can avoid them, empowering you to approach the market with confidence and a clear plan. Avoiding these errors can make all the difference between financial success and missed opportunities.

Investing can be one of the most effective ways to build wealth and achieve financial independence, but it’s not without its pitfalls. Even the most seasoned investors make mistakes that can cost them time, money, and opportunities. Whether you’re new to the market or a seasoned trader, recognising common investment mistakes can help you make smarter decisions and avoid costly errors.

From chasing hot stocks to neglecting proper research, these missteps can undermine your investment strategy and long-term goals. In this guide, we’ll explore the five most common mistakes investors make and how you can avoid them, empowering you to approach the market with confidence and a clear plan. Avoiding these errors can make all the difference between financial success and missed opportunities.

Key Takeaways

- Investing successfully requires knowledge, discipline, and the ability to avoid common pitfalls.

- Recognising and understanding cognitive biases can help investors make more rational decisions.

- It’s natural that investors make mistakes and even the most known investment managers such as Warren Buffett, George Soros or Stanley Druckenmiller made a lot of mistakes during their career

- Common investing mistakes include lack of research, emotional decision-making, and wrong or lack of diversification practices

- Learning from mistakes and biases can lead to better investment strategies and outcomes. Lessons from the economic cycles - bubbles and crashes are also worthy to consider

5 common investing mistakes

Image source: Adobe Stock Photos

Understanding common mistakes from various perspectives helps investors recognise potential pitfalls and biases, enabling making better, more informed decisions in the stock market. Here is a breakdown of the most common mistakes.

1.Trying to Time the Market

Description: Market timing involves attempting to buy low and sell high by predicting market movements. This strategy often stems from overconfidence, the illusion of control, and the availability bias—where investors believe they can anticipate short-term price movements based on recent events or news. The fear of missing out (FOMO) and herd behaviour can further drive impulsive decisions to enter or exit the market at the wrong times.

Example: During the 2020 COVID-19 market crash, many investors sold off their stocks in panic, missing the rapid recovery that followed. Instead of timing the market, a disciplined buy-and-hold approach would have yielded better returns in this particular case.

Lack of (or wrong) Diversification

Description: Failing to diversify means putting too much of your investment in one asset class, sector, or individual stock. This mistake often arises from familiarity bias (favouring known stocks), home bias (over-investing in domestic companies), and overconfidence in specific investments. It increases exposure to specific risks and can significantly impact a portfolio’s overall performance. What’s even worse is a wrong diversification, giving investors a false safety. An example of it is collecting correlated assets into a portfolio (for example, a list of highly cyclical stocks).

Example: An investor who puts all their money in tech stocks may see significant losses during a tech sector downturn, as seen during the dot-com bubble burst in the early 2000s. A diversified portfolio across various sectors and asset classes would have reduced this risk.

Emotional Investing

Description: Emotional investing occurs when decisions are driven by fear, greed, or other emotional reactions rather than rational analysis. Common biases include loss aversion (strong preference to avoid losses over acquiring gains) and recency bias (placing too much weight on recent events). Emotions can lead investors to panic sell in downturns or overbuy in bull markets.

Example: The 2008 financial crisis saw many investors selling off stocks at steep losses due to fear of further declines. Those who maintained a calm, long-term perspective were better positioned to benefit from the market’s recovery in the years that followed.

Chasing Hot Stocks or Trends

Description: Chasing hot stocks involves investing in popular stocks based on hype rather than fundamentals. It’s often driven by recency bias, bandwagon effect (following the crowd), and FOMO. This approach ignores critical aspects like valuations, earnings stability, and long-term growth prospects, leading to speculative rather than informed investing.

Example: During the meme stock frenzy of 2021, stocks like GameStop and AMC surged due to social media hype. Many investors jumped in without understanding the companies’ weak fundamentals, resulting in significant losses when prices eventually corrected.

Ignoring Your Investment Time Horizon

Description: Neglecting the appropriate investment time horizon can result in mismatched assets and risk levels. This mistake often stems from anchoring bias (fixating on specific data points) and present bias (overvaluing short-term gains over long-term benefits). It can lead to inappropriate asset allocation, such as investing in volatile stocks when funds are needed in the short term.

Example: An investor saving for a house down payment within two years might invest in high-risk stocks, expecting quick gains. However, market volatility could result in losses, jeopardizing their ability to meet financial goals. Aligning investments with the right time frame would have minimised this risk.

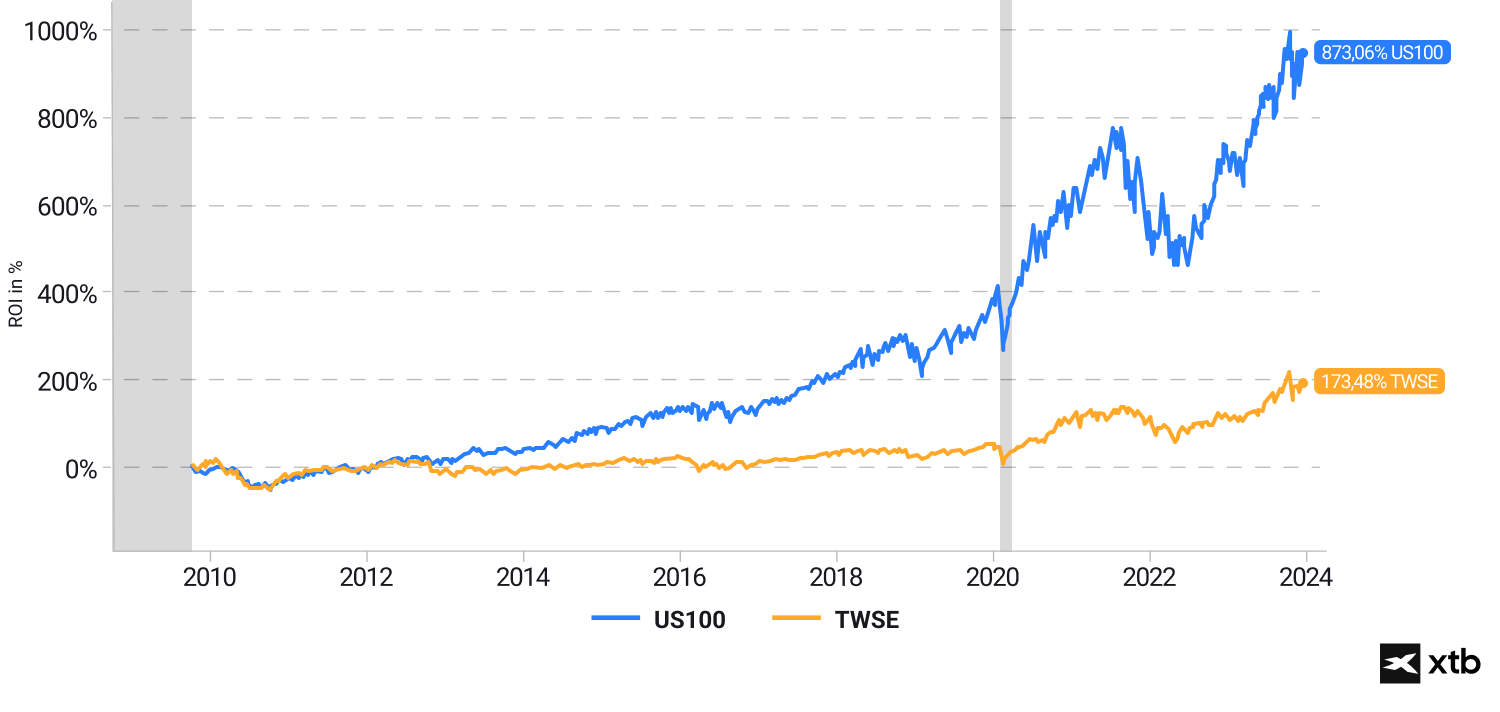

As we can see above, despite the GFC crisis and 2020 Covid-crash and multiple corrections, Nasdaq 100 (US100) gained almost 900% from 2008 to September 2024. Past performance does not indicate future returns. Source: XTB Research, Bloomberg Finance L.P.

Top 10 Tips to Avoid Common Mistakes

Develop a Long-Term Investment Plan

- A well-thought-out investment plan serves as your financial roadmap, guiding your decisions and helping you stay focused on long-term goals, regardless of market fluctuations. Your plan should define your risk tolerance, time horizon, and specific objectives (e.g., retirement, home purchase, education). By adhering to your plan, you avoid the temptation of reacting impulsively to market noise or short-term trends.

- Pro Tip: Regularly review and adjust your plan as life circumstances change, but avoid making changes based on short-term market movements.

Diversify Your Portfolio

- Diversification spreads your investments across different asset classes (stocks, bonds, real estate, etc.), sectors, and geographical regions, reducing the impact of a poor-performing asset on your overall portfolio. This strategy helps manage risk and smoothens returns over time, protecting against sector-specific downturns.

- Pro Tip: Use diversified mutual funds or ETFs to achieve broad market exposure with a single investment, ensuring you don’t rely too heavily on one company or sector.

Practice Discipline and Patience

- Successful investing requires the discipline to stick with your strategy, even during market downturns, and the patience to allow your investments to grow over time. Avoid making changes based on fear, greed, or short-term news. Remember, reacting to every market movement can lead to buying high and selling low, a recipe for poor returns.

- Pro Tip: Set reminders to review your portfolio periodically (e.g., annually) instead of constantly watching the market, which can reduce emotional responses and help maintain a long-term focus.

Avoid Market Timing

- Timing the market—trying to predict when to buy or sell based on market forecasts—is a losing strategy for most investors. Studies show that even professional investors struggle to time the market correctly. The cost of missing just a few of the market’s best days can significantly impact your returns.

- Pro Tip: Use a dollar-cost averaging strategy, investing a fixed amount regularly regardless of market conditions, which helps you buy more shares when prices are low and fewer when prices are high.

Conduct Thorough Research and Due Diligence

- Invest based on solid research and an understanding of a company’s fundamentals, including its financial health, competitive position, and growth prospects. Avoid relying solely on tips, headlines, or social media hype, which can be misleading or biased.

- Pro Tip: Use reputable sources like company financial statements, analyst reports, and independent research platforms to validate your investment decisions.

Set Realistic Expectations and Goals

- Unrealistic expectations about returns can lead to frustration and impulsive decisions. Understand that average long-term returns for stocks are typically around 7-10% annually, including periods of market downturns. Recognising this helps you stay grounded and avoid high-risk investments that promise quick, outsized gains.

- Pro Tip: Regularly assess your portfolio’s performance against realistic benchmarks, not just market highs, to keep expectations in check.

Control Emotional Reactions

- Emotional investing often leads to buying high during market euphoria and selling low during panic, a counterproductive cycle. Recognise that markets are cyclical, and volatility is normal. Establishing a clear strategy helps you detach emotionally from your investments.

- Pro Tip: Practice mindfulness techniques such as deep breathing or taking a walk before making any investment decisions during volatile periods. This pause can prevent rash actions driven by fear or excitement.

Focus on the Bigger Picture, Not Short-Term Noise

- Daily market news, headlines, and stock price fluctuations can distract you from your long-term investment goals. Short-term market movements are often driven by factors that have little to do with a company’s fundamental value.

- Pro Tip: Limit your consumption of financial news to avoid becoming overwhelmed by market noise. Instead, focus on quarterly or annual performance reviews.

Rebalance Your Portfolio Regularly

- Rebalancing involves adjusting your portfolio back to its target asset allocation, which can shift over time due to market movements. This disciplined process helps you sell high-performing assets (taking profits) and reinvest in underperforming ones, maintaining your desired risk level.

- Pro Tip: Set a specific timeframe for rebalancing, such as annually, or rebalance when your asset allocation deviates by a set percentage, like 5%.

Educate Yourself Continuously

- Investing is a dynamic field, and staying informed about market trends, economic indicators, and investment strategies can help you make better decisions. Educating yourself also builds confidence and reduces the likelihood of making decisions based on fear or misinformation.

- Pro Tip: Dedicate time to read investment books, attend webinars, or follow credible financial education platforms. The more knowledge you gain, the better equipped you’ll be to navigate the complexities of investing

Summary

Investing is a powerful tool for growing your wealth, but it’s easy to fall into traps that can derail your financial progress. By understanding and avoiding common mistakes, such as chasing trends, failing to diversify, or letting emotions drive decisions, you can set yourself up for long-term success. Remember, successful investing requires patience, discipline, and a strategic approach. By learning from these common pitfalls and making informed decisions, you can enhance your investment strategy and achieve your financial goals with greater confidence.

- Avoid Market Timing: Trying to predict market movements often leads to missed opportunities and poor decision-making. Staying invested and focusing on long-term goals is usually more effective.

- Diversify Your Portfolio: Diversification spreads risk across various assets, reducing the impact of any single investment’s poor performance and protecting your portfolio from market volatility.

- Control Emotions: Emotional investing, such as panic selling or buying in a frenzy, can result in buying high and selling low. Stick to your plan and avoid letting fear or greed dictate your actions.

- Don’t Chase Hot Stocks: Investing in trendy or “hot” stocks without thorough research can be dangerous. These stocks are often overvalued and highly volatile, leading to significant potential losses.

- Have a Clear Investment Plan: A well-defined investment strategy helps you stay focused, avoid impulsive decisions, and align your portfolio with your risk tolerance, time horizon, and financial goals.

These takeaways highlight the importance of disciplined investing, proper research, and strategic planning to achieve long-term success in the stock market.

FAQ

Timing the market involves predicting short-term price movements to buy low and sell high. The most common mistake is buying during market highs out of excitement or selling during market lows out of fear, leading to poor returns. Staying invested with a long-term strategy often yields better results.

Lack of diversification means putting too much money into a single asset, sector, or market. This strategy increases exposure to specific risks, which can significantly impact your portfolio’s performance if that asset underperforms. Diversifying helps spread risk and provides a buffer against market volatility.

Emotional investing, driven by fear or greed, often leads to impulsive decisions such as panic selling or overbuying. This behaviour disrupts your investment strategy and can result in buying high and selling low, damaging your long-term financial goals.

Chasing hot stocks often involves buying into market hype without conducting proper research. These stocks can be overvalued and highly volatile, leading to significant losses when the hype fades. It’s important to focus on fundamentals and avoid being swayed by short-term popularity.

Ignoring your investment time horizon can result in choosing investments that are misaligned with your financial goals. For instance, investing in high-risk stocks for short-term needs can lead to unexpected losses. Aligning your investment strategy with your time horizon helps manage risk and ensure you meet your financial objectives.

Climate change investments: Maximising impact

Best ETFs to Look Out For

Building Balance: How to Diversify Your Portfolio with XTB

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.