- Wall Street's mood in yesterday's session was mixed, but in the end buyers came to the fore. The S&P 500 Index and the DJIA rose 0.2%, while the Nasdaq 100 showed little change. Yields fell from 4.72% to 4.66% today, with some of the gains also given back by the still very strong US dollar. Today, the US stock market will be closed for to remember former US President Jimmy Carter.

- The market found no surprises in yesterday's December FOMC minutes; Fed officials indicated the need for more cautious action in the face of higher inflation risks. The Fed's Waller said yesterday that the impact of tariffs on inflation is not clear, and he does not expect Trump to impose particularly aggressive tariffs. He said he believes inflation will continue to fall toward the central bank's 2% target.

- Yesterday's ADP data came in weaker, with employment change at 120,000 versus 140,000 expected. On the other hand, however, benefit claims turned out to be much lower, falling almost to 200k against expectations of around 220k. The market is waiting for the December NFP report, which will indicate the final picture of the U.S. labor market tomorrow at 1:30 PM GMT. The market expects a change in non-farm employment of 220k against 160k in November. The options market is pricing in an implied volatility of S&P 500 of 1.2% in either direction following the report; the most since September

- November US Consumer Credit report came in much lower than expected, falling $-7.49 billion versus $10.5 billion estimate. Prior month credit came in at $17.32 billion vs $19.24 billion previously. Revolving credit came in $-13.726 billion versus plus $15.151 billion last month

- December inflation data from China came in slightly better than expected, though still weak. PPI producer inflation fell -2.3% y/y, while a -2.4% decline was expected, following a -2.5% drop in November. China's CPI inflation rose 0.1% y/y, in line with forecasts and slightly less than the 0.2% y/y increase in the previous month; monthly CPI growth turned out to be flat, although we saw a 0.6% decline in November. Hang Seng Index gains slightly

- Australia's retail sales rose 0.8% y/y in December, an increase of 1% was expected after a 0.6% rise in November

- U.S. index contracts lose slightly, with the VIX gaining almost 2% again after yesterday's decline. Oil gains slightly, and NATGAS retreats nearly 2% after yesterday's rise. Volatility in the agricultural commodities market is very limited today. Bitcoin continues to perform poorly and is trading at $94k; cryptocurrency market sentiment remains subdued. European index contracts are also trading slightly lower t

- 22V Research survey indicates, most investors are watching the situation in the US labor market more closely than usual. Only 26% of respondents think today's NFP data will improve risk appetite; 40% think it will press more on the 'risk-off; and 34% think it will be mixed. Several Federal Reserve officials will be speaking in the afternoon today

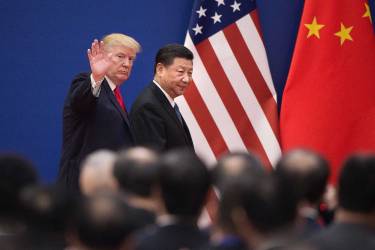

- Yesterday, Donald Trump once again stressed the need to, 'return the Panama Canal' to the United States, noting that China is profiting from it today. Yesterday, Taiwan announced that it is forming a military foreign legion, in case of war with China.

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.