Intel shares are up 2% in pre-market today to $21.21, following the recent announcement of major restructuring plans. The stock has faced significant challenges, losing almost 60% of its value in 2024 prior to this news. The company's struggles stem from fierce competition in the chip manufacturing sector and lagging performance in AI chip development. This comes after Intel reported substantial losses, announced major layoffs, and unveiled plans to revamp its foundry business.

Key Financial Data (Q2 2024)

- Revenue: $12.8 billion (flat compared to Q2 2023)

- Net loss: $1.61 billion (down by 209% from $1.48 billion profit in Q2 2023)

- Loss per share: $0.38 (down from $0.35 profit in Q2 2023)

- Revenue missed analyst estimates by 1.1%

- Earnings per share (EPS) also missed analyst estimates significantly

Future Outlook

- Revenue is forecast to grow 5.4% p.a. on average during the next 3 years

- This growth forecast is below the 18% growth forecast for the US Semiconductor industry

Strategic moves and restructuring:

เริ่มเทรดทันทีวันนี้ หรือ ลองใช้บัญชีทดลองแบบไร้ความเสี่ยง

เปิดบัญชีจริง ลองเดโม่ ดาวน์โหลดแอปมือถือ ดาวน์โหลดแอปมือถือ- Spinning off chipmaking business as an independent subsidiary (Intel Foundry)

- Awarded up to $3 billion in funding from the U.S. CHIPS and Science Act

- Pausing fabrication projects in Poland and Germany for approximately two years

- Selling part of stake in Altera

- Cutting about two-thirds of global real estate footprint

- Layoffs affecting 15,000 workers (announced in August 2024, more than halfway complete)

Key business developments:

- Partnership with Amazon Web Services (AWS) for custom AI chip design and manufacturing

- Plans to produce an "artificial intelligence fabric chip" for AWS using Intel's 18A process

- Continuing U.S. manufacturing projects in Arizona, Oregon, New Mexico, and Ohio

- Potential issues with 18A chipmaking process (reported failures in early tests with Broadcom)

Intel, once the dominant force in chip manufacturing, continues to face significant challenges. The company's Q2 2024 results showed a substantial net loss of $1.61 billion, a stark contrast to the $1.48 billion profit in the same quarter of the previous year. This represents a 209% decline, highlighting the difficulties Intel faces in competing with rivals like Taiwan Semiconductor Manufacturing (TSMC) and Samsung.

The foundry business, a key focus of CEO Pat Gelsinger's turnaround plan, has been particularly troublesome, racking up $7 billion in operating losses in 2023. This led to the decision to spin off the foundry business as an independent subsidiary, allowing for greater flexibility and the potential to raise outside capital.

This spinoff is perhaps the most significant change in Intel's structure. The decision to turn the foundry business into an independent subsidiary with its own operating board marks a major shift in Intel's approach to chip manufacturing. This move is designed to give the foundry business greater autonomy and flexibility, potentially allowing it to compete more effectively with dedicated foundries like TSMC and Samsung. By separating the foundry from Intel's chip design business, the company aims to attract more third-party customers who might have been hesitant to work with a competitor. The independent structure also opens up the possibility of raising outside capital, which could be crucial for funding the expensive process of developing and implementing new manufacturing technologies. It will also result in the ability to cut costs for Intel as it has invested in foundry business.

The decision to pause fabrication projects in Poland and Germany for approximately two years reflects Intel's need to balance its global manufacturing footprint with current market demands and financial constraints. This pause allows Intel to focus its resources on its U.S.-based manufacturing expansion and the development of advanced processes like the 18A node. However, this move could have implications for Intel's long-term competitiveness in Europe and its ability to serve European customers. The company will need to carefully manage relationships with European stakeholders and ensure it can quickly resume these projects when market conditions improve.

The decision to sell part of its stake in Altera (a maker of programmable logic devices, acquired in 2015 for $16.7 billion) suggests that Intel is reevaluating its portfolio and looking to streamline its operations. This move could help raise additional capital to fund core operations and strategic initiatives.

The substantial workforce reduction, representing about 15% of Intel's total employees, is a clear indication of the company's determination to reduce costs and improve operational efficiency.

In a positive development, Intel secured a deal with Amazon Web Services to produce custom AI chips, providing a much-needed boost in the rapidly growing AI chip market. The company will use its advanced 18A manufacturing process for this partnership, although recent reports suggest potential issues with this process in early tests.

The U.S. government has shown support for Intel's efforts, awarding the company up to $3 billion in funding through the CHIPS and Science Act. This funding is earmarked for the "Secure Enclave" program, a project between Intel and the Department of Defense. This funding is part of the broader U.S. government initiative to boost domestic semiconductor manufacturing. It not only provides Intel with additional capital for its manufacturing efforts but also strengthens its position as a strategic partner for the U.S. government in semiconductor production. The funding underscores the geopolitical importance of chip manufacturing and could give Intel an advantage in securing future government contracts.

Intel faces several challenges and opportunities moving forward:

- Rebuilding its manufacturing capabilities to compete with TSMC and Samsung

- Regaining market share in its core PC and data center business

- Catching up to Nvidia in the AI chip market

- Managing the restructuring process, including significant layoffs and real estate reductions

- Navigating geopolitical tensions and their impact on the global semiconductor industry

The success of Intel's restructuring efforts, particularly the separation of its foundry business and the development of advanced manufacturing processes like 18A, will be crucial in determining the company's future in the highly competitive semiconductor industry. Investors will be closely watching the progress of these initiatives, as well as Intel's ability to deliver on its partnerships with major players like AWS.

Valuation:

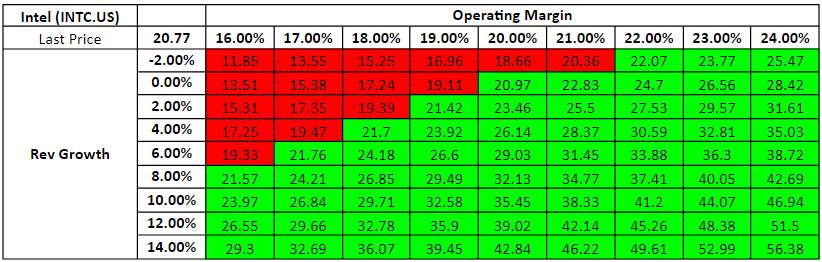

We decided to base our assumptions on peer growth, taking into account the costs of offsetting foundry business. We have assumed a 6% revenue growth and 20% operating margin for the 5 years of forecasts. Decision to make 5 years of detailed forecasts comes based on relevant data and historical averages.

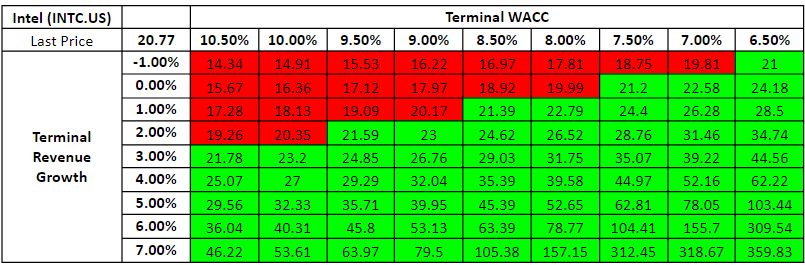

As terminal value tends to account for a significant part of DCF valuation, especially with shorter periods of detailed forecasts, we have decided to take a very conservative approach here. For the terminal value calculations we have used a 3% revenue growth (as the business is developed) as well as 8.5% terminal WACC, down from 9% WACC used for 5 years of forecasts. The decrease in terminal WACC comes from a point of Intel soon being a developed company which won't be able to grow that fast and could become more financially stable due to lower costs of foundry business.

Such a set of assumptions provides us with an intrinsic value of $29.03 per share which offers around 39.7% of possible upside to current market value. What is noteworthy is the fact that valuation takes into account decreasing costs of foundry business.

A point to note is that the intrinsic value obtained via the DCF method is highly sensitive to assumptions made. Two sensitivity matrices are provided below - one for different sets of Operating Margin and Revenue Growth assumptions and the other for different sets of Terminal WACC and Terminal Revenue Growth assumptions.

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

Next, let's take a look at how Intel compares with peers. We have constructed a peer group consisting of 4 companies, whose business model and growth might be similar to Intel: Broadcom, Nvidia, AMD and Qualcomm. As can be seen Intel is below the mean in every category, however is slightly below forward P/E.

Source: Bloomberg Finance LP, XTB Research

We have calculated mean, median as well as cap-weighted multiples for the peer group. Three different Intel valuations for each of those multiples were later calculated. As one can see in the table, the vast majority of those suggest that Intel shares are undervalued at current prices. However the multiple valuation might overvalue the company as peers operate on higher margins.

Recommendations: Intel has 50 recommendations, with 7 "buy" and highest price of $66, 37 "hold", and 6 "sell" ratings with lowest at $18. The 12-month average stock price forecast is $25.07, implying a 20.6% upside potential from the current price.

Technical analysis:

The price of Intel stock is trading 11% above its yearly lows. Currently, the first resistance in the uptrend is at the 23.6% Fibonacci retracement level of $22.91. Breaking through this level might allow bulls to test the 50-day SMA at $24.42. In a bearish scenario, the stock could fall through the lows at $18.52 and test the 2010 bottom at $17.60. A strong support level may be established at the Tangible Book Value per Share of $19.51, which has repeatedly helped stop downside momentum. The RSI is showing a strong bullish divergence, with higher highs and higher lows since August. The MACD is also gradually confirming the bullish case.

Source: xStation

Source: xStation