At the moment, the topic of raising the debt limit is the number one topic, not only in the US, but also worldwide, in view of the fact that a possible US bankruptcy would spell trouble for the global financial market.

Janet Yellen reiterates that debt service funding will run out on June 1, which is considered the so-called X-date. McCarthy, the speaker of the House of Representatives, indicates that a deal with the president on a budget bill is likely, allowing the debt limit to be raised before that date. On the other hand, McHenry, also from the Republican Party, indicates that the date of actual bankruptcy may be a long way off.

According to the Washington Post, the Treasury Department was expected to issue a request to various federal agencies to delay the upcoming payments as much as possible. This would reallocate funds to continue to pay down obligations. WP also reports that Wall Street analysts estimate that funding will not be exhausted until 8-9 June.

The key date in this case is June 15, when quarterly taxes will be coming in, so that after that date the Treasury Department will have the funds to make further repayments. Then, in all likelihood, the X-date will be pushed back to July or even much later. According to commentators in Washington, the Treasury Department still has a lot of 'tricks' and 'aces up its sleeve' to allow the US to function normally until June 15, when a lot of funds will flow into the country's accounts.

In addition, the Treasury Department or the President has a great many options to use, which, however, do not seem very likely. These include:

- Selling bonds held by some government trust funds. Once the new debt limit is reached, these funds would again be injected with debt securities

- Sale of fixed assets such as land, federal buildings

- The sale of $500 billion of gold belonging to the Treasury Department

- Delay or suspension of payment of bills, salaries by federal agencies

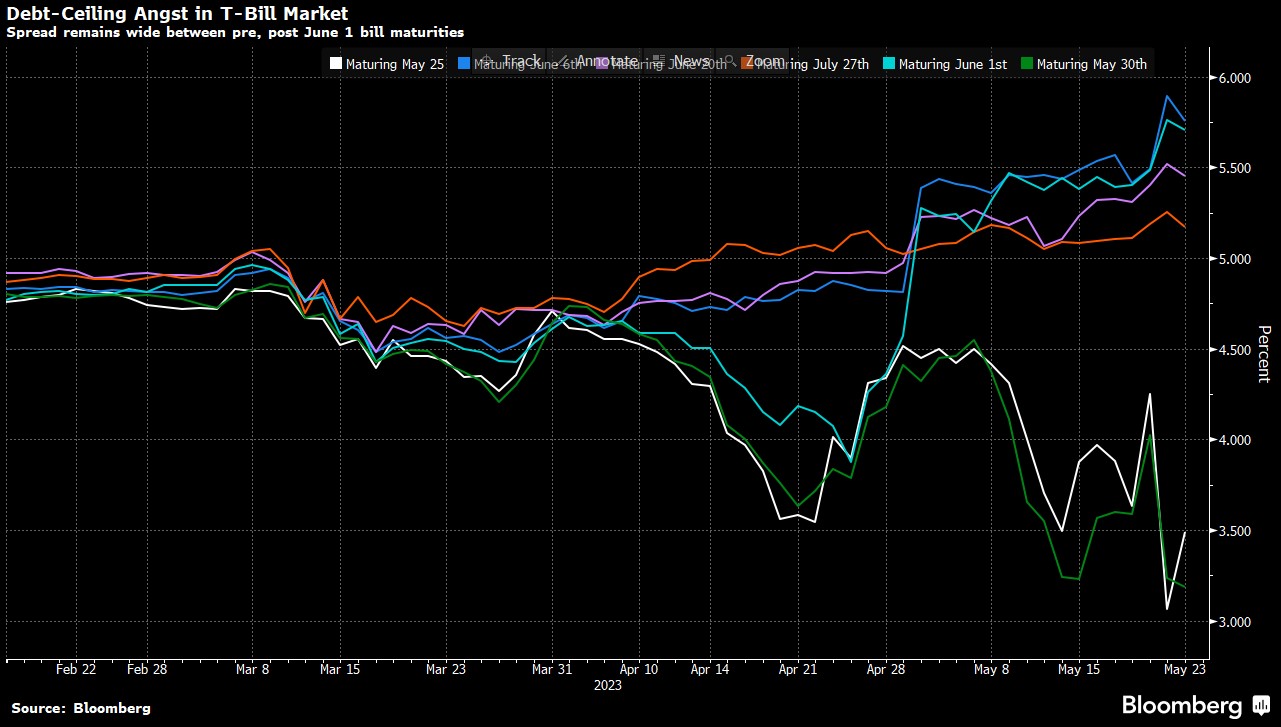

It is apparent that the market is still concerned that the US may have trouble repaying its obligations. Bonds with maturities after the X-date are trading at significantly higher yields. Source: Bloomberg

It is apparent that the market is still concerned that the US may have trouble repaying its obligations. Bonds with maturities after the X-date are trading at significantly higher yields. Source: Bloomberg TNOTE are continuing their decline after breaking out of a triangle formation and additionally breaking through support at the 38.2 retracement of the last upward wave. Here we had local lows marking the lower zone of consolidation. Key support is now the 50.0 retracement and then levels below 112 points, where the lower limit of the uptrend channel is located. These levels would be possible if the US actually misses the debt limit by June 1. On the other hand, it seems that technical bankruptcy is unlikely. If a new limit is set, a sizable bounce could be expected on TNOTE. Source: xStation5

TNOTE are continuing their decline after breaking out of a triangle formation and additionally breaking through support at the 38.2 retracement of the last upward wave. Here we had local lows marking the lower zone of consolidation. Key support is now the 50.0 retracement and then levels below 112 points, where the lower limit of the uptrend channel is located. These levels would be possible if the US actually misses the debt limit by June 1. On the other hand, it seems that technical bankruptcy is unlikely. If a new limit is set, a sizable bounce could be expected on TNOTE. Source: xStation5

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS