Markets have been focused recently on a battle between retail investors from Reddit WallStreetBets forum and hedge funds with big short positions on some US small-cap stocks. However, retail investors have a new idea - pump the price of a relatively cheap silver. Will silver be the next GameStop? Can silver rally really happen?

What goes around comes around

The answer is - yes and no. It is good to look in the past to see whether such a big rally could arrive at the silver market. Hunt Brothers became owners of around a third of global physical silver holdings via futures transactions with physical delivery at the turn of 1979 and 1980. Their actions pushed the silver price from $6 to almost $50 per ounce. Subsequent changes to how futures are traded (increasing margins) caused a massive sell-off on the silver market afterwards.

What is the strategy of US retail investors currently? They are investing in silver ETFs that hold physical commodity. Buying shares in those ETFs is expected to force them to buy physical silver and push prices higher. Silver has strong fundamentals and a solid outlook - rising demand and limited supply. Moreover, price gain potential towards highs from the 1980s or 2011 equals almost 100%. To put it into context, gold reached all-time highs last year.

How does GameStop market cap compared to silver market size?

Market capitalization of GameStop has reached almost $25 billion USD. Value of all silver held by ETFs sits slightly above $24 billion. Market capitalization of the SLV.US ETF that became the target of Reddit traders is $15 billion. This shows that this market could be in fact moved by their actions. Source: Bloomberg

Market capitalization of GameStop has reached almost $25 billion USD. Value of all silver held by ETFs sits slightly above $24 billion. Market capitalization of the SLV.US ETF that became the target of Reddit traders is $15 billion. This shows that this market could be in fact moved by their actions. Source: Bloomberg

ETF market size and silver market size

ETFs hold around 900 million ounces of silver currently. Demand increased by around 300 million ounces last year. Silver price increased from around $17 to $29 per ounce during the period. Annual demand for silver sits at around 950 million ounces. It should be noted that buying of ETF share does not lead to an immediate purchase of silver by the fund. Silver purchases are carried out by specialized entities, who trade silver for bloc of shares (1 bloc - 50k shares in case of SLV) and then fund shares are being sold to investors on exchanges. There are 600 million SLV shares available at the moment. Moreover, 150 million ounces of silver are available for delivery on COMEX exchanges and 250 million ounces that meet conditions of delivery. This means that retail investors would need to inject a few billion USD into the market in order to trigger a bigger price move.

ETFs hold around 900 million ounces of silver. Source: Bloomberg

ETFs hold around 900 million ounces of silver. Source: Bloomberg

Silver inventories on COMEX exchange. Source: Bloomberg

Silver inventories on COMEX exchange. Source: Bloomberg

Can retail investors trigger a rally on the silver market?

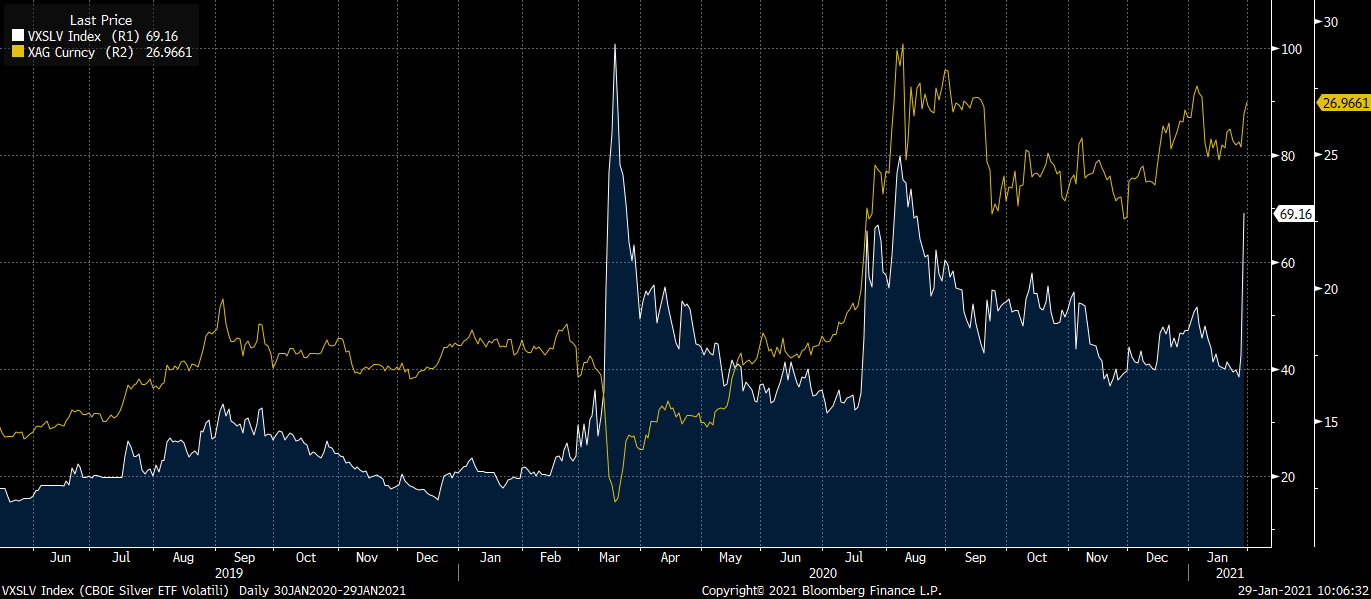

ETFs and physical silver purchases are just part of the market. We cannot forget about options market, that gives hints on the magnitude of potential moves. Volatility index for silver market (based on ETF options) jumped from around 40 to 69% yesterday. Reverse ratio index that shows difference between prices of 1-month out-of-the-money calls and puts jumped to a record high in 17 pts area.It shows that a lot of investors are just starting to build their positions for the final assault on the silver market.

Volatility on the silver market increased significantly. Source: Bloomberg

Volatility on the silver market increased significantly. Source: Bloomberg

As we can see, silver price bounced off the 50-period moving average and is looking to test an important supply area, marked with last year's highs. Silver bull case is backed by solid fundamentals and belief that it is an asset protecting against rise in inflation. Price gain outlook looks similar to 2008-2011. However, it should be noted that possible retail investors' rally may be used by institutional investors to take advantage of high prices and start shorting precious metal. Source: xStation5

As we can see, silver price bounced off the 50-period moving average and is looking to test an important supply area, marked with last year's highs. Silver bull case is backed by solid fundamentals and belief that it is an asset protecting against rise in inflation. Price gain outlook looks similar to 2008-2011. However, it should be noted that possible retail investors' rally may be used by institutional investors to take advantage of high prices and start shorting precious metal. Source: xStation5

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts