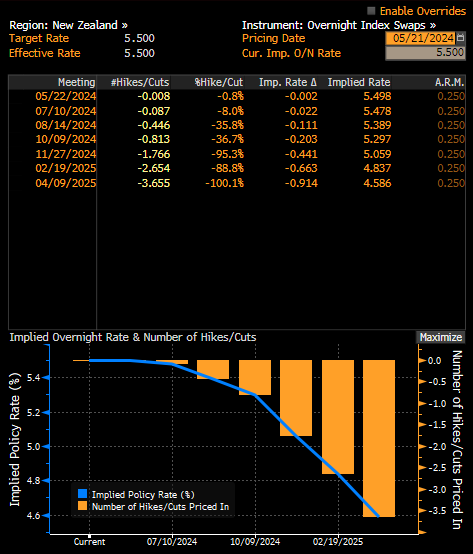

The market is not pricing in any interest rate change from the RBNZ at tomorrow's meeting, during the Asian session. In fact, the market is not pricing in any move from the Reserve Bank of New Zealand until as late as November this year. In fact, that's when a full cut is priced in, although there is a combined chance that rates could be cut in October.

Expectations for tomorrow show that RBNZ will keep interest rates unchanged but may soften its stance. The market is not pricing in the first possible cut until October, although the probability could increase after any dovish commentary, which could open the door for cuts to begin in August. Source: Bloomberg Finance LP

What are the predictions?

- It is suggested that the RBNZ will be the first to communicate the possibility of a cut this year, getting ahead of the RBA. The RBA may not start cutting until 2025.

- The New Zealand economy is very weak. Q3 and Q4 2023 saw quarterly declines, which means a technical recession.

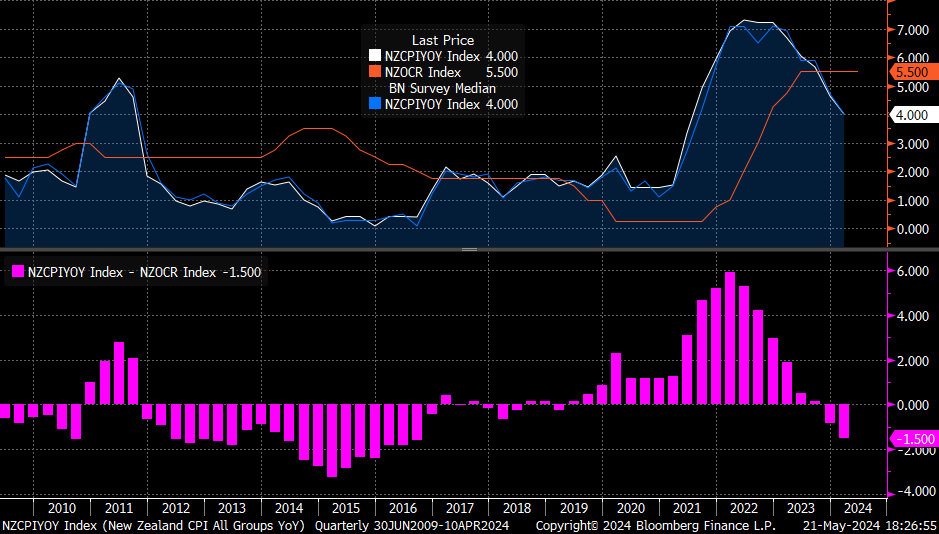

- New Zealand inflation is falling, although it was hoped that inflation could fall a bit more in Q1 and came in line with expectations. The difference between inflation and rates is not yet as wide as it was in 2015 when the rate cut cycle began.

- The real rate has only been positive for two quarters.

- Since the RBNZ's last meeting in April, inflation expectations have fallen to their lowest in almost three years, and the unemployment rate has edged higher. This opens the door to a somewhat more dovish stance.

Difference between interest rate and inflation in New Zealand. Source: Bloomberg Finance LP, XTB

Difference between interest rate and inflation in New Zealand. Source: Bloomberg Finance LP, XTB

How could AUDNZD react?

If there is indeed dovish communication from the RBNZ, then the pair could again break above 1.10. Of course, we are observing an interesting situation in which AUDNZD is at the upper limit of its multi-year consolidation. On the other hand, we have recently seen significant increases in industrial metal prices, which should benefit the Australian economy, although there is no significant correlation between AUDNZD and copper.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)