Summary:

-

USD pulls back after earlier hitting 6-week high

-

GBPUSD back above 1.30

-

EURUSD recaptures 1.15 handle

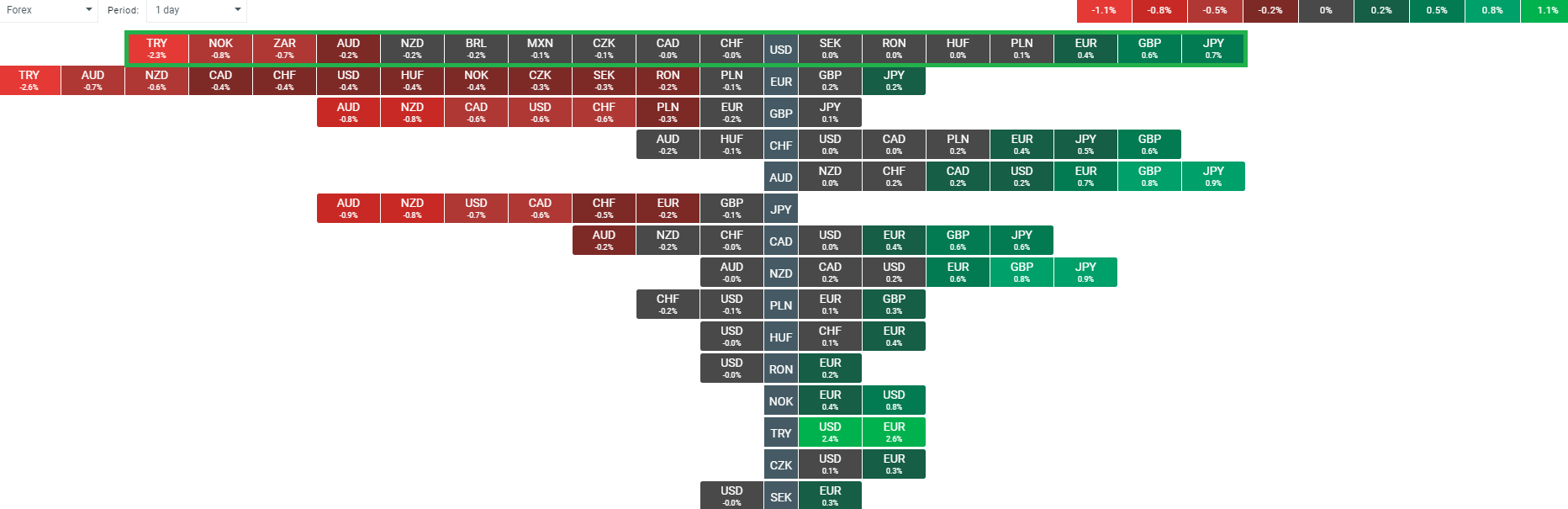

The strong break higher in US yields is dominating today’s trade and had provided a boost to the US dollar although, the buck has since pared those gains somewhat. The USDIDX hit a 6-week high not far from the 96.00 handle but has since experience a fairly sharp pullback. The heatmap on xStation reveals that the greenback is still higher against most of its peers, but its is perhaps telling that its 3 most widely crosses (EUR, JPY and GBP) are now showing declines on the day.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app

The USD has pulled back from its daily highs and while it still trades higher on the day against most of its peers, the most widely crosses are showing the buck being lower. Source: xStation

Two USD pairs in particular are attracting focus with the GBPUSD and EURUSD both showing signs that they are trying to bounce after the recent declines.

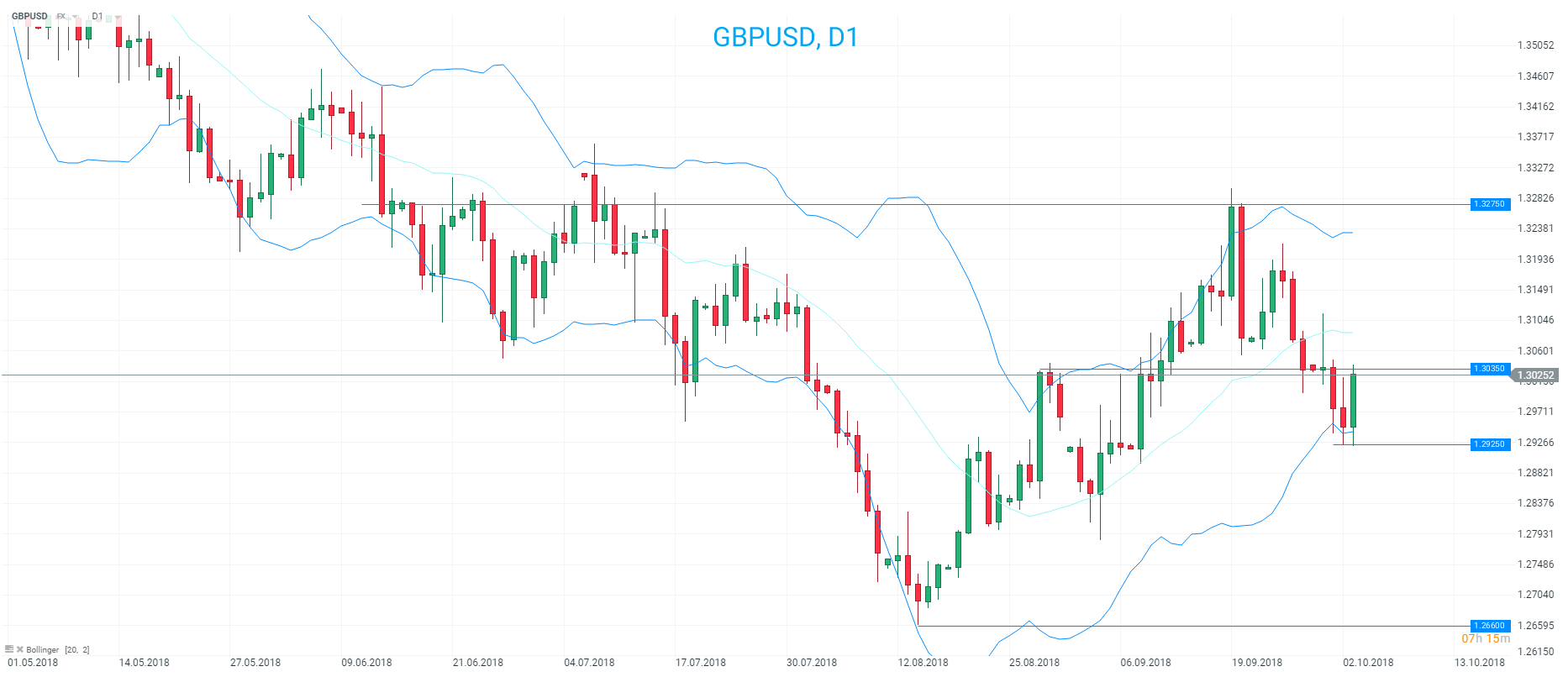

GBPUSD

Cable has experienced a large bounce as today’s session has wore on, with the pair on track for its largest daily gain in more than 2 weeks. The lows around 1.2925 now become potentially key support and also coincides with the low bound of the Bollinger bands on a D1 timeframe. A morning star formation of sorts could be forming but this would require a daily close back above the 1.3035 level to be confirmed.

The GBPUSD is looking to bounce strongly today from the lower Bollinger band and if the market can end above 1.3025 then a morning star formation of sorts will be printed. Source: xStation

EURUSD

We highlighted the possible significance of the 1.15 handle in a post earlier this week and while this was broken to the downside earlier the subsequent bounce may have rendered the break as false. Similar to the GBPUSD there’s been a pretty strong bounce this afternoon and recent lows around 1.1465 now become a possible level to look for support. In breaking below the 1.1505 level the potential inverse S-H-S formation has been apparently negated - although if this break proves to be false then it could still occur. On a daily closing basis the 1.1505 level is a key line in the sand and with prices above here, all is not yet lost for longs.

EURUSD broke lower yesterday and in doing so seemingly negated the inverse S-H-S by breaching the right shoulder. However, all is not lost quite yet for longs and a daily close back above the 1.1505 level would be a positive development. Source: xStation

EURUSD broke lower yesterday and in doing so seemingly negated the inverse S-H-S by breaching the right shoulder. However, all is not lost quite yet for longs and a daily close back above the 1.1505 level would be a positive development. Source: xStation