Fed Chair Powell delivered a speech on the economy outlook at the Stanford Business, Government and Society Forum today. As topic of the speech was related to the economy, there were some hopes that Powell may offer some new insights into the outlook for US monetary policy. Unfortunately, no such surprise was offered and speech from Fed Chair has largely reiterated recent message that it is likely that rates will be cut this year but it is also too soon to say when. Key takeaways from Powell's speech can be found below.

- If economy evolves as central bank expects, most FOMC members see it as likely appropriate to begin cutting rates at some point this year

- Too soon to say whether recent inflation readings are more than just a bump

- Recent readings on job gains and inflation higher than expected, but do not materially change overall picture

- Fed has time to let incoming data guide its policy decisions, central bank is making decisions meeting by meeting

- To keep public's trust, Fed must avoid a mission creep

- Fed continues to believe policy rate is likely at its peak for this cycle

- Outlook still quite uncertain, Fed faces risks on both sides of its mandate

- Risks continue to move into better balance

- Labor market rebalancing seen in data on quits, job openings, employer and worker surveys and continued decline in wage growth

- Too soon to saw whether recent inflation readings are more than just a bump

Given lack of surprises in Powell's speech, one should not be surprised by lack of major reaction on the markets. USD has been largely muted during the speech and so has US equity indices. Money markets see an around-55% chance of the Fed delivering the first rate cut at June meeting.

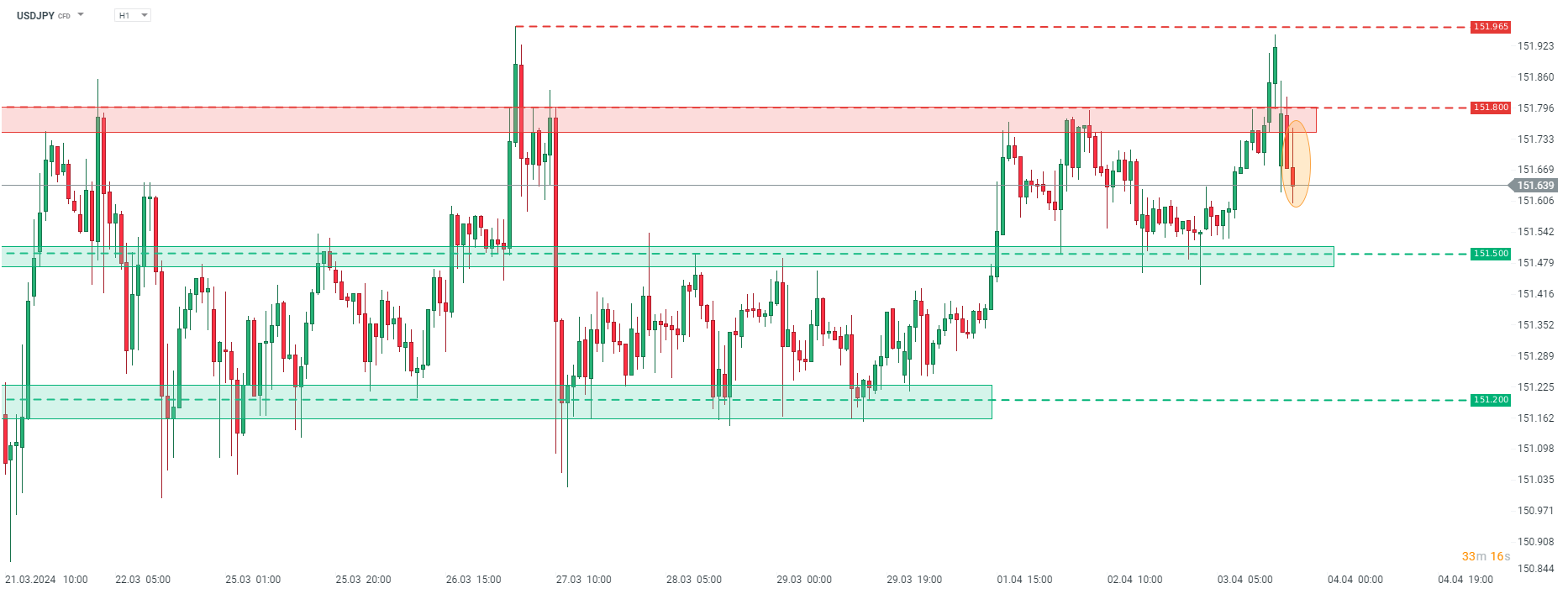

USDJPY ticked lower during Powell's speech, but scale of the move did not exceed 0.1%. Source: xStation5

USDJPY ticked lower during Powell's speech, but scale of the move did not exceed 0.1%. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)