Will the Fed soften its policy?

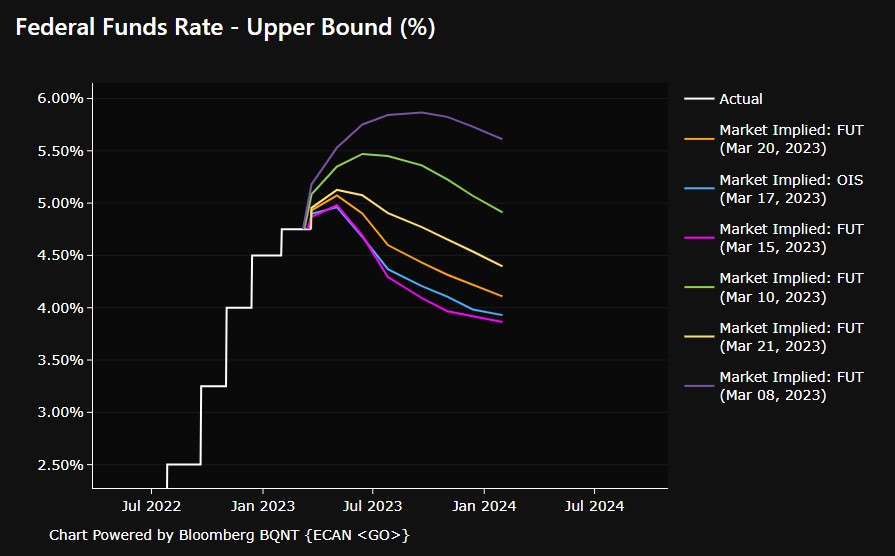

As recently as March 8, the market speculated that the Fed could raise by 50 basis points in March, and the forward rate could exceed 5.5% (this was the baseline scenario). The collapse of SVB and the takeover of Credit Suisse changed everything in the market. Although the crisis seems to have been averted this risk could theoretically return with redoubled force, which could repeat the 2008 crisis.

Interest rate expectations in the US have changed dramatically over the past two weeks. Currently, the market sees chances of incomplete two hikes in the current cycle looking at the implied change. On the other hand, it then sees fairly rapid and sizable reductions by the end of this year. Source: Bloomberg

What is worth paying attention to?

- The market is pricing in a more than 80% probability of a 25 basis point hike. We too believe that the Fed should continue to hike.

- However, there have been expectations that due to systemic risks, the Fed will decide to pause (not necessarily end the hike cycle). Goldman Sachs believes the Fed will not raise and will end QT

- The Fed has increased liquidity in the markets, so there are claims that it may also abandon QT or reduce its scale. Theoretically, it could even increase QT to offset the impact of the recent liquidity increase

- Liquidity is needed for smaller entities. Large ones have liquidity enough

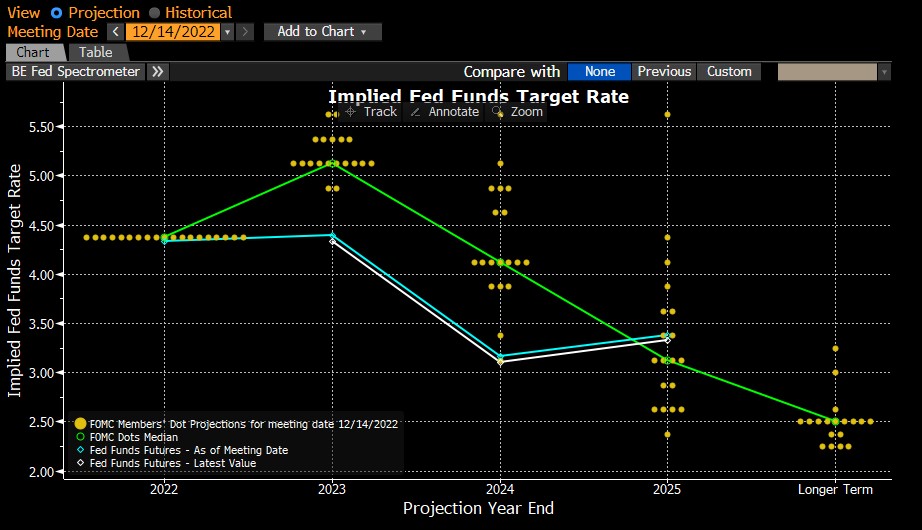

- The dot-chart, which will show what the Fed's expectations are for further moves, will be key

- The Fed has to decide between minimizing systemic risk and continuing to fight inflation hard

- The positive scenario for markets is to keep the forward rate forecast unchanged or raise it slightly. This would give room for one more hike

- An increase in the forward rate forecast above 5.5% could be considered a hawkish move by the Fed.

- The mix of the forward rate decision and QT will be key

- U.S. inflation slows, but remains high in Fed's view. Inflation remains mainly in services

- Commodity-related inflation should decline further. Oil prices have fallen significantly, so the base effect will have a very large impact on inflation in March and April

The market is much more cautious in its assumptions than the Fed was at its last meeting. Will the Fed decide to raise its rate forecast at the end of this year? Source: Bloomberg

The market is much more cautious in its assumptions than the Fed was at its last meeting. Will the Fed decide to raise its rate forecast at the end of this year? Source: Bloomberg

How will the markets react?

The US500 is roughly where it was just before the SNB collapse. The US500 broke the falling trendline in January and tested it again on March 10. There was speculation that a so-called "bull market trap" may have been set. Keeping the US500 above the falling trendline, however, may negate such expectations. Nevertheless, it is crucial for the bulls to break 4200 points, which could happen if the forward rate is kept unchanged and the assumptions of the balance sheet reduction program are changed. However, if the Fed maintained a sharp hawkish stance (raising the rate forecast and maintaining QT). Then the area around 3800 points could be tested.

US500

Source: xStation5

EURUSD

The Fed's increase in liquidity resulted in sharp declines in US yields, bringing EURUSD back to the 1.08 level. Maintaining the Fed's hawkish stance could bring yields back to the 3.75% area or higher, which could lead to a retest of the 1.05 area. On the other hand, if the Fed shows its dovish side (it is the tight monetary conditions that are partly responsible for the banking sector's troubles), then EURUSD could return to stronger gains towards 1.10. In addition, the euro has the support of a strong drop in gas prices. Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?