US indices extend recent gains ahead of US jobs data for October

NFP report for October is a key release of the day! Report will be released at 12:30 pm BST today and is expected to show a weaker jobs growth than in September. Data for September was very strong and while expectations for October are lower, they are still pointing to a decent growth in US employment. However, some worrying signs can be spotted in other US labor market reports.

ADP report released on Wednesday pointed to a lower-than-expected jobs increase of 113k (exp. 150k) while the employment subindex in the US services ISM report unexpectedly dropped below the 50 points threshold in October, signaling that employment in the sector is contracting. However, it should be noted that NFP reports have been constantly defying market concerns over the past months and kept beating expectations. Having said that, it cannot be ruled out that we will once again see solid jobs data today even as other labor market measures are flashing warning signs.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appWhat market expects from the NFP report for October?

- Non-farm payrolls. Expected: 180k. Previous: 336k

- Private payrolls. Expected: 150k. Previous: 263k

- Unemployment rate. Expected: 3.8%. Previous: 3.8%

- Wage growth (monthly). Expected: 0.3% MoM. Previous: 0.2% MoM

- Wage growth (annual). Expected: 4.0% YoY. Previous: 4.2% YoY

Other US labor market data for October

- ADP report: 113k vs 150k expected (89k previously)

- Challenger report on lay-offs: 36.84k vs 47.46k previously

- Services ISM employment subindex: 46.8 vs 50.6 expected (51.2 previously)

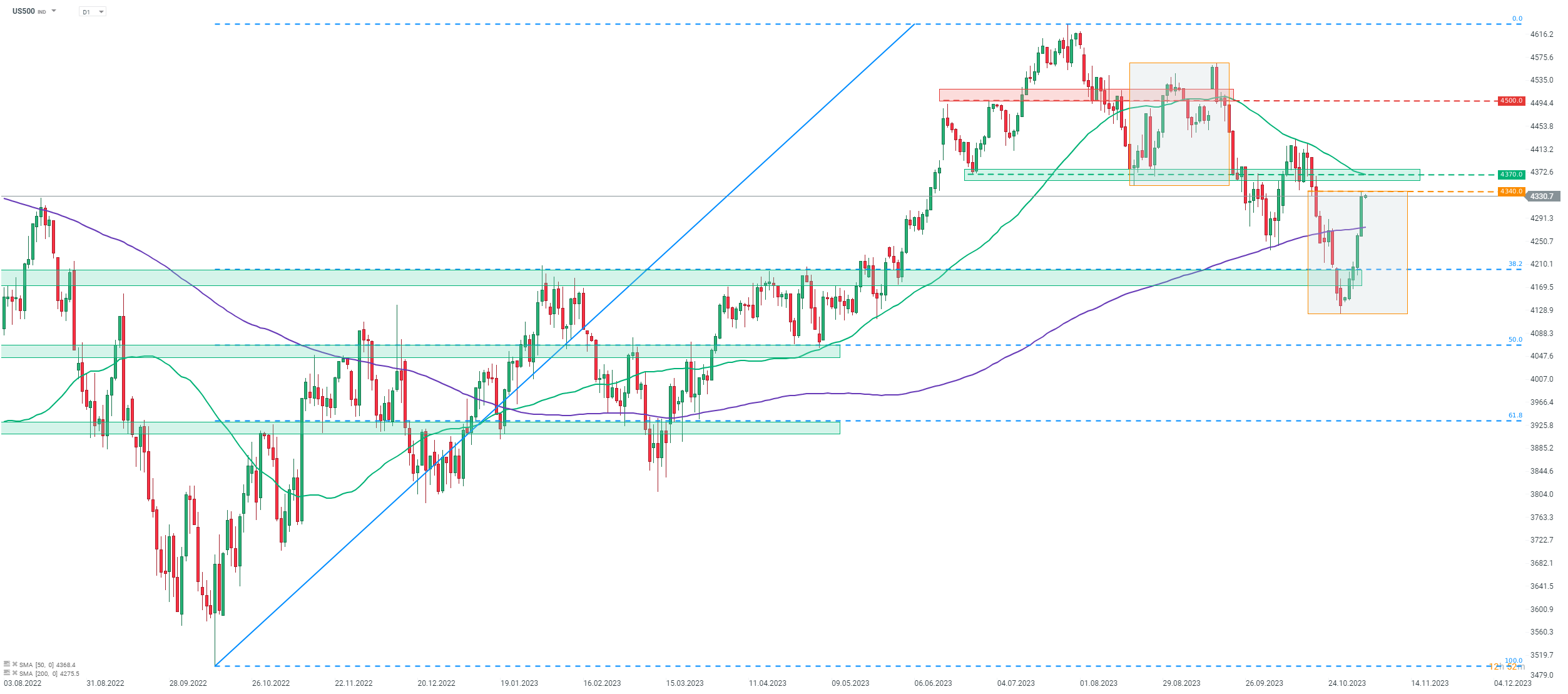

S&P 500 futures (US500) are trading in a strong upward move this week. The index is trading around 5% higher week-to-date and at the highest level in two weeks. Recovery rally has encountered the first major obstacle - the upper limit of the Overbalance structure in the 4,340 pts area. A break above would hint at trend reversing from bearish to bullish. However, the attempt at breaking above this area made yesterday failed to result in a breakout and whether the index 'makes it or breaks it' will likely depend on today's NFP data.

Source: xStation5

Source: xStation5