📅 At 01:30 PM PCE inflation data is released, which may determine Fed policy for the coming months

- Market expects lowest PCE inflation reading this year

- Core inflation is expected to slow to as low as 2.6% y/y, monthly readings are expected to be in line with achieving the inflation target on time

- There will be a smaller base effect in the second half of the year

- The reading should indicate that inflation remains under control

Market expectations

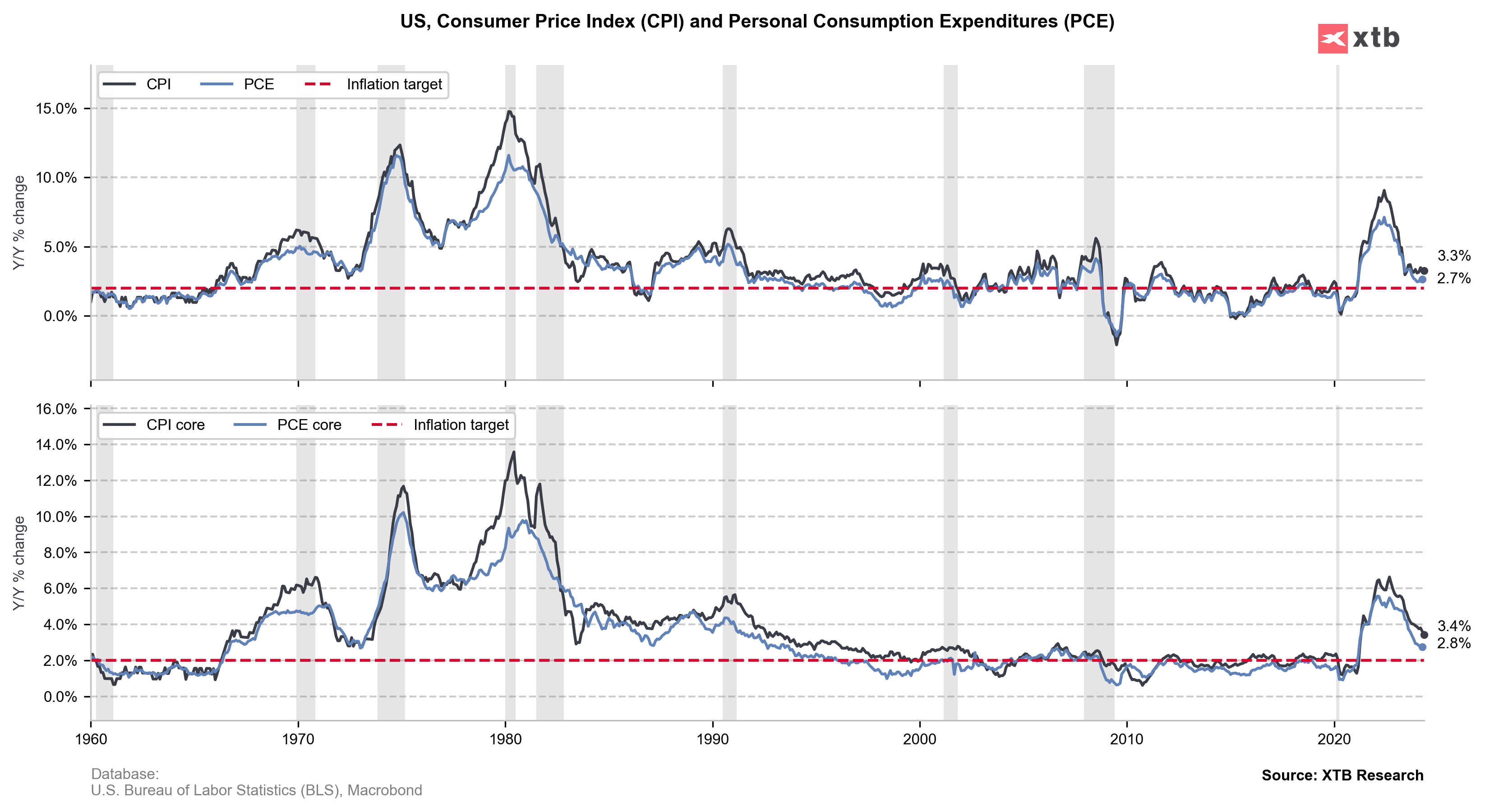

Inflation is finally expected to show that it remains under the control of the monetary authorities. The preferred measure of inflation is expected to show the lowest reading this year. PCE and core PCE inflation are expected to slow to 2.6% y/y, but it is core inflation that is expected to slow all the way from 2.8% y/y. Monthly expectations are also optimistic: 0.0% m/m for the headline reading and 0.1% m/m for the core reading. The Fed is assuming 0.2% growth, which is consistent with meeting the inflation target within the forecast timeframe. However, it is worth bearing in mind that this is data for May.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appWe are most likely to see less of an impact from transport and financial services, which have previously had a fairly pronounced impact on the inflation rebound. It is worth noting, however, that health-related services are a big influence in PCE inflation, which, due to underlying factors, is rebounding this year.

In addition to the inflation data itself, we will learn about earnings and spending data. High wages and spending may somewhat reduce the positive perception in the context of the Fed decision. However, inflation in line with expectations or lower should lead to positive comments on inflation from the Fed, which could result in opening the door to an interest rate cut in September, which could be communicated in July. Of course, by that point we will also know labour market data and then CPI data as well, which will complete the view on inflation trends.

PCE inflation shows a better inflation picture than CPI, which surprised with a lower reading recently. Source: Bloomberg Finance LP, XTB

How will the market behave?

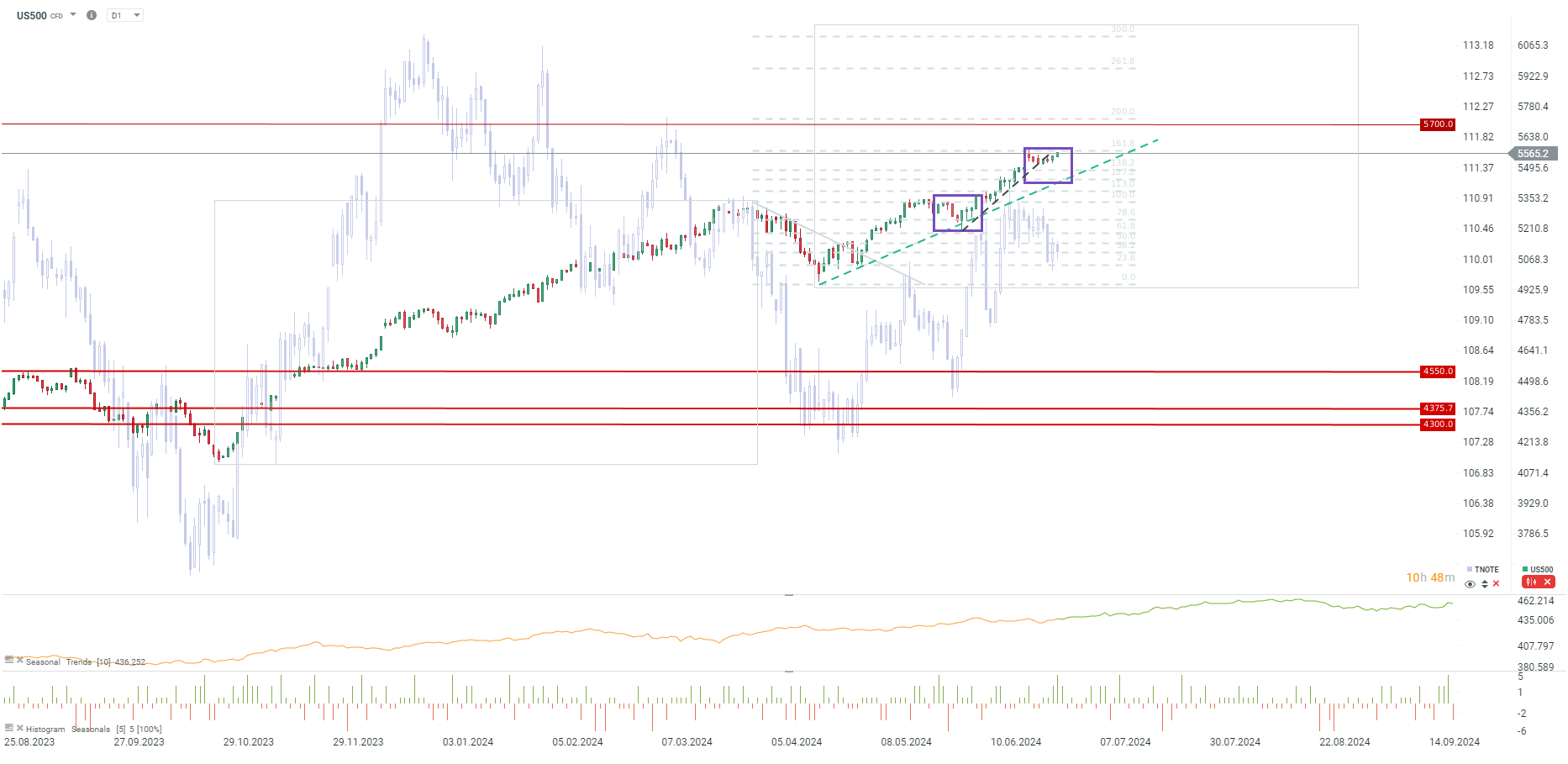

Investors are optimistic about today's reading, which creates some risk when the reading comes out significantly higher than expectations (in which case the correction could be deeper than the nearest support - the 5200 level was an important level to watch). Nevertheless, if inflation shows that it is under control, this will open the way for the US500 to test recent local highs. Although the upside on the US500 has been driven in 30% by the rise of Nvidia and largely AI-related companies, expectations of rate cuts could open the way for further upside on the US500. The 5590-5600 zone is a short-term resistance zone and a profit-taking attempt at this level cannot be ruled out (especially looking at the close of the quarter). Key support is located at 5500 and then at 5430. In the longer term, there is a chance that the US500 will continue to rise not only to 5700, but also to the 6000-6200 zone.

Source: xStation 5