At 1:30 PM GMT the consumer inflation report from the United States for October is released 💡

Key Predictions:

-

Market expectations indicate a decrease in inflation dynamics to 3.3% year-over-year (y/y) after the last reading maintained at 3.7%.

-

On a monthly basis, a decrease to 0.1% is forecasted compared to the last reading of 0.4%.

-

Core inflation is expected to remain at the unchanged level of 4.1% (month-over-month data also expected to show a maintained dynamic of 0.3%).

-

Residual seasonality suggests an increase in the core CPI of about 7 basis points in the data for October.

What About the Fed?

CPI inflation is one of the key readings for the Fed. Of course, the Fed pays more attention to core CPI inflation and to PCE inflation. In this aspect, it's particularly important to pay attention to the core reading, as it is expected to maintain last month's dynamics, which combined with the recent hawkish comments from Fed bankers, may strengthen the bias assuming the possibility of further rate hikes (this is a narrative that, in the longer term, can significantly affect financial instruments linked to the Fed's monetary policy).

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app

Assuming a scenario of inflation returning to the 2% target, the monthly core CPI index must grow at an average pace of 0.2% throughout the year. Inflation grew at this pace in the summer, but since then, the dynamics have accelerated, which may permanently change the Fed bankers' narrative about the current tightening path. Source: XTB

Inflation Contributions

Forecasts indicate a further decline in inflation dynamics in the housing sector - shelter component, due to the narrowing difference in rents for new and ongoing leases. Analysts at Goldman Sachs also point out that we may see slightly higher dynamics in vehicle prices due to a decrease in production amid UAW (United Auto Workers) strikes and the withdrawal of promotional incentives by dealers. Source: XTB

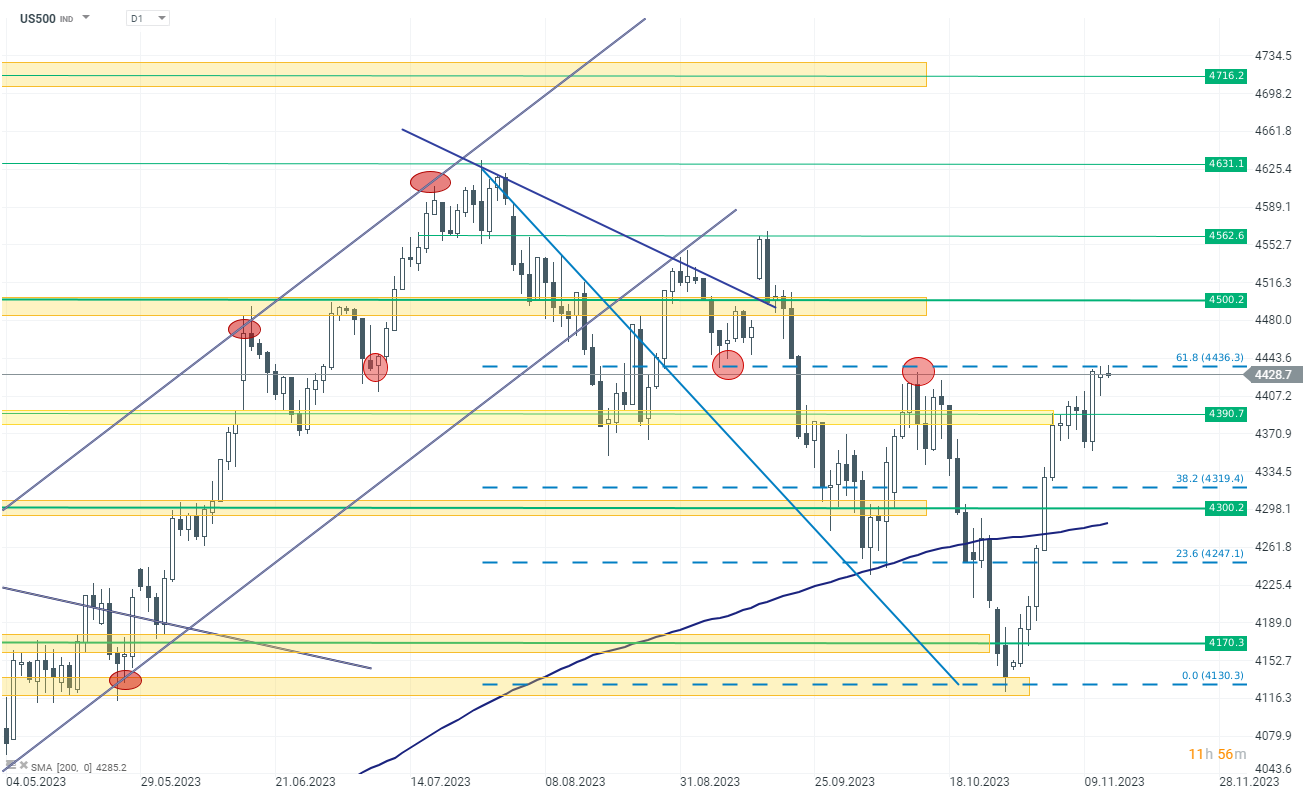

US500 Chart

Futures on Wall Street are slightly rising before the opening of the cash session, gaining between 0.05%-0.20%. For US500, today's session and the October inflation report may be crucial for the continuation of the further trend. Currently, bulls are fighting resistance at the 4430 point level, which coincides with the 61.8% Fibonacci retracement of the last downward wave. If a decrease in prices is confirmed, investors may try to break the price above this resistance zone, then the path to the 4500 level remains open. Otherwise, the 4370-4400 point levels should be watched, as they may be significant for maintaining the upward trend after the last rebound at the end of October. Source: xStation