- Wall Street retreats slightly

- Bond yields gain again

- Chevron announces a takeover for 53 billion dollars

The first day of the new week does not bring the sentiment change on Wall Street that investors were hoping for. The start of the day looked promising, given the lack of escalation in the Middle East conflict and the arrival of humanitarian aid in the conflict zones. However, the sentiment quickly reverted to its previous direction.

At the start of the Wall Street session, we again observe rising yields of US Treasury bonds and a rather strong dollar. The yields of 10-year US Treasury bonds remain just below the 5.0% level. Today, the dollar is one of the stronger currencies of developed countries, alongside the euro. The EURUSD currency pair is trading flat.

The US500 is down 0.50% today, and the price is approaching resistance at the 4200 point level. This is the lowest level since May 2023. The 4200 point level is significant resistance, as historically it has been a strong barrier and has marked many peaks and troughs in recent months. However, if the selling pressure is strong enough to break this level, the next range for the movement will be 4100 points.

Company news:

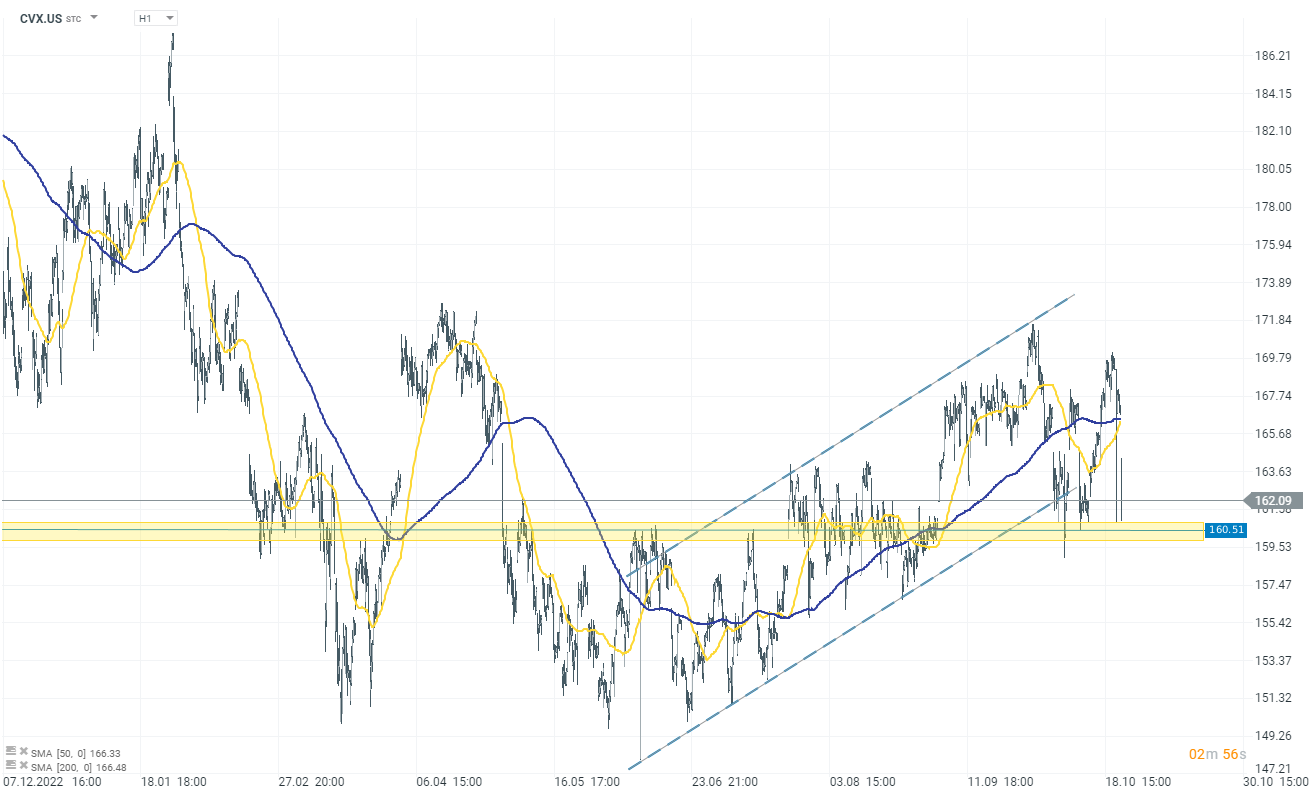

Chevron Corp. (CVX.US) has agreed to acquire Hess Corp. for $53 billion in an all-stock transaction, aiming to bolster its production growth amidst the U.S. oil industry's confidence in the long-term viability of fossil fuels. This acquisition, which values Hess at a 10% premium based on a 20-day average price, will provide Chevron with a significant presence in Guyana, a newly emerging oil producer. Analysts highlight the immense potential of Guyana's oil reserves. This move follows another major U.S. oil deal where Exxon Mobil Corp. agreed to purchase Pioneer Natural Resources Co. for $58 billion. The Chevron-Hess deal, expected to close in the first half of 2024, underscores the belief in the continued centrality of oil and gas in the global energy landscape.

source: xStation 5

source: xStation 5

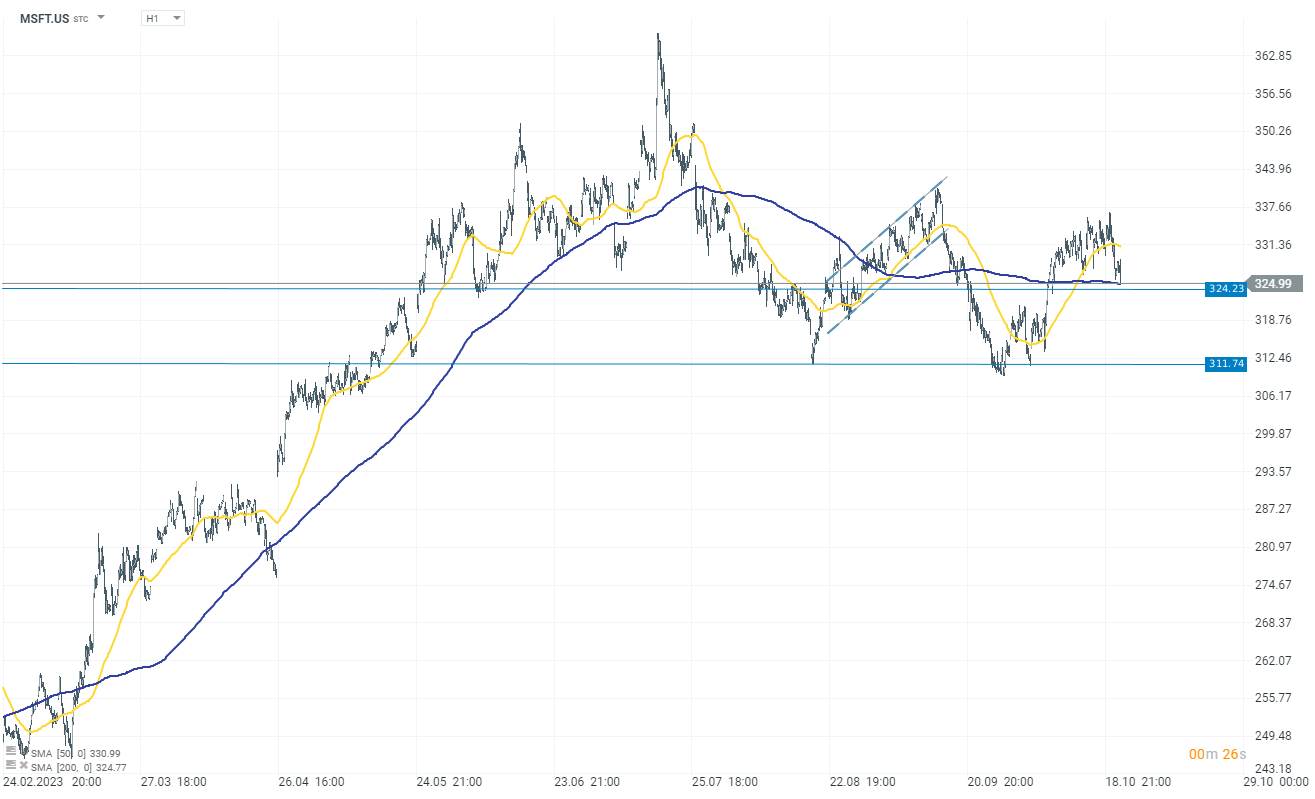

Microsoft Corp. (MSFT.US) has announced an investment of $5 billion AUD ($3.2 billion) in Australia over the next two years to enhance its cloud computing and AI infrastructure. This marks the company's most significant investment in Australia in 40 years. As part of this initiative, Microsoft plans to expand its data centers in Canberra, Sydney, and Melbourne by 45%, increasing the number from 20 to 29 sites. Furthermore, in collaboration with the state of New South Wales, Microsoft will establish a Datacenter Academy and will also partner with the Australian Signals Directorate on a cybersecurity project. Microsoft President Brad Smith emphasized the company's commitment to Australia's growth in the AI era. This announcement coincides with Prime Minister Anthony Albanese's visit to the US, where discussions on critical minerals and tech innovation are anticipated. The investment aligns with the Aukus agreement signed in 2021, fostering closer collaboration between the US, UK, and Australia in areas like quantum computing and AI.

Source: xStation 5

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?