- Some Democrat senators do not support raising corporate tax rate to 28%

- IMF revises up global GDP forecast

- Illumina (ILMN.US) stock rose 10% on upbeat guidance

US indices launched today's session slightly lower after both the Dow Jones and the S&P 500 reached new all-time highs yesterday. The yield on the benchmark 10-year Treasury retreated slightly to 1.69% as investors await 42-day bill auction later in the day. Meanwhile, Credit Suisse announced a $4.7 billion loss from its exposure to Archegos Capital and Treasury Secretary Yellen called for a global minimum corporate tax rate, citing competitiveness issues. The IMF raised its outlook for global economic growth to 6% from 5.2% this year, citing additional fiscal support. Investors’ attention will focus on negotiations between Republicans and Democrats over President Biden's new infrastructure plan worth $2.25 trillion. Democrats may be able to pass a new stimulus bill via a reconciliation process that does not require a 60-vote majority in the Senate. Instead, a 50-50 result with Vice President tie-breaker vote would be enough to pass a new bill. However this would require support from all of their senators. Meanwhile some of them, including senator Manchin, are not willing to support a corporate tax hike to 28%. Manchin said the highest rate he can accept is 25%. On the data front, the number of job openings in the US increased by 268 k from the previous month to 7.367 million in February, the highest level since January 2019 and above analysts estimates of 6.995 million.

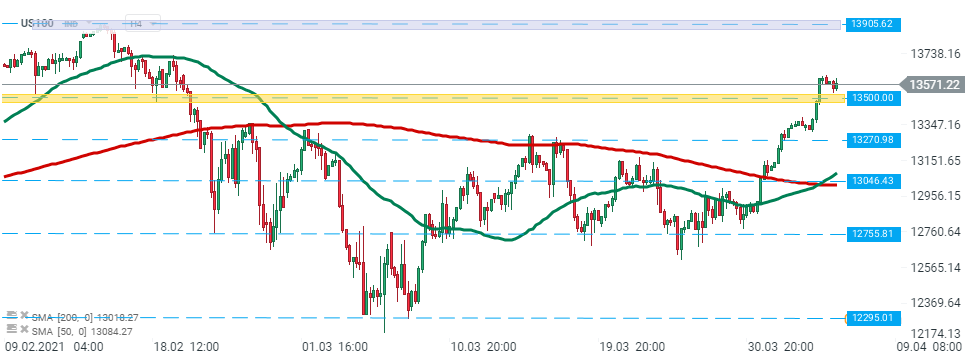

US100 broke above local resistance at 13,500 pts during today’s session. If buyers will manage to uphold momentum, then next resistance at 13,905 pts, where all-time highs are located, could be at risk. However if sellers will manage to halt declines here, then another downward impulse towards support at 13270 pts could be launched. Source: xStation5

US100 broke above local resistance at 13,500 pts during today’s session. If buyers will manage to uphold momentum, then next resistance at 13,905 pts, where all-time highs are located, could be at risk. However if sellers will manage to halt declines here, then another downward impulse towards support at 13270 pts could be launched. Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appIllumina (ILMN.US) stock surged more than 9.0% in premarket after the life sciences company provided upbeat preliminary current-quarter and full-year guidance. The company said its projected results are being driven by record orders in its gene-sequencing and related businesses.

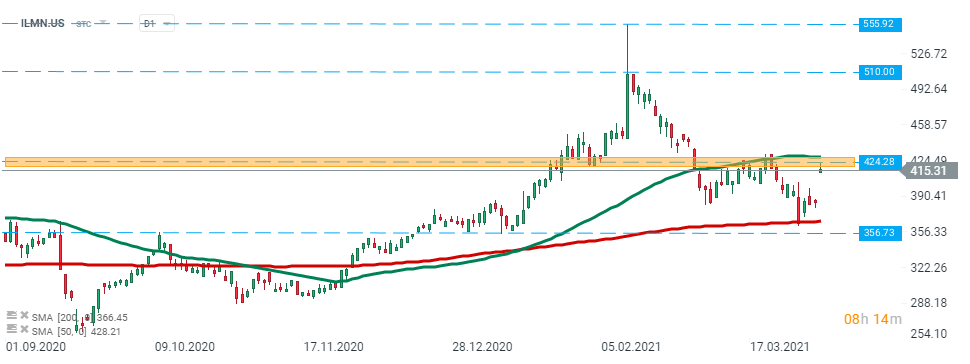

Illumina (ILMN.US) stock launched today’s session with a bullish price gap and is currently testing major resistance at $424.28 which is additionally strengthened by 50 SMA (green line). If the current sentiment prevails, then upward move may be extended towards next resistance at$ 510.00. On the other hand, if sellers will manage to regain control then downward impulse towards support at $356.73 could be launched. Source: xStation5

Illumina (ILMN.US) stock launched today’s session with a bullish price gap and is currently testing major resistance at $424.28 which is additionally strengthened by 50 SMA (green line). If the current sentiment prevails, then upward move may be extended towards next resistance at$ 510.00. On the other hand, if sellers will manage to regain control then downward impulse towards support at $356.73 could be launched. Source: xStation5

Cara Therapeutics (CARA.US) soared 11.4% in premarket following news that from tomorrow the biopharmaceutical company’s stock will join the S&P SmallCap 600 index.

Snap (SNAP.US) stock rose 1.5% in premarket after Atlantic Equities upgraded company's stock, to “overweight” from previous “neutral.” Atlantic Equities cites valuation as a key factor, as well as Snap’s transformation from a messaging-centric platform to a broad content platform.

Moderna (MRNA.US) reached a deal with contract manufacturer Catalent (CTLT.US) thanks to which output of Moderna’s Covid-19 vaccine at Catalent’s Bloomington, Indiana, plant will nearly double, according to The Wall Street Journal.