- Wall Street opens lower

- Safety assets leading the gains

- Morgan Stanley declines after earning results

Today's session started with declines for both US100 and US500 which are losing 0.70-0.80%. US equities ticked lower as investors weigh rising tensions in the Middle East alongside rising oil prices.

On the market, we observe a flight of capital to safe assets. Today, gold is gaining strongly, and the dollar is also up, albeit to a lesser extent. Yields on 10-year bonds are rising, currently around historical highs at 4.86%. Markets fear the escalation of the conflict and its impact on the global market, including the oil market. Iran's Foreign Minister is calling today for an oil embargo on Israel. Accusations have also been made against the USA, which, in the eyes of Arab countries, is equally responsible for the escalation of the conflict as Israel. Today, emotions are really tense after a hospital in Gaza was bombed, leading to the death of many Palestinians. Initial accusations were immediately directed at Israel, but so far, we do not know exactly who is responsible for the bombing. At the moment, US President Joe Biden is also visiting Israel. As far as we know, Biden has publicly expressed support for Israel and claimed that some Palestinian militant group is allegedly behind the bombing.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app

Looking at the main indices on Wall Street, one can notice nervousness among investors. The significant gains in gold are proof of this. Meanwhile, the US500 index has again retreated below the key zone of 4400 points and is currently trading at 4378. If the declines are sustained and the bulls fail to break above this resistance line, the next range in the event of a downward move is the 4300 point level. Otherwise, the 4500 level is the first target in case of negating the declines and moving upwards. Source: xStation 5

Company news:

Morgan Stanley (MS.US) declines over 5.0% after the company reported third-quarter earnings. Despite being partially better than expected mainly in trading revenue the overall bank outlook remains weak. The bank posted earnings per share of $1.38, compared to the estimated $1.30, and a revenue of $13.27 billion, almost in line with the expected $13.23 billion. However, profit declined by 9% to $2.41 billion from the previous year. Despite the bank's bond traders generating $1.95 billion in revenue and equity traders producing $2.51 billion, both exceeding estimates, the wealth management division fell short by over $200 million, reporting $6.4 billion in revenue. Investment banking also missed the mark, with revenues of $938 million, citing a decline in mergers and IPO listings. CEO James Gorman mentioned a challenging environment and highlighted the attraction of money market funds and Treasuries due to rising interest rates.

Source: xStation 5

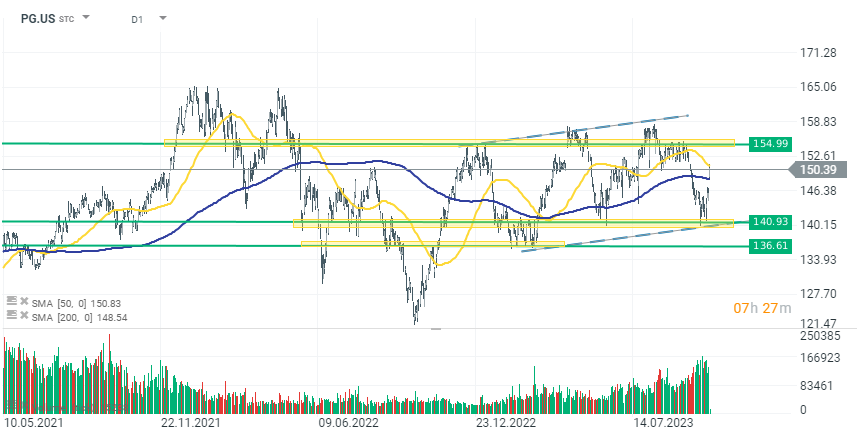

Procter & Gamble (PG.US) reported quarterly earnings and revenue that surpassed analysts' expectations, with shares rising over 3%. The company posted earnings per share of $1.83, compared to the expected $1.72, and a revenue of $21.87 billion, against the anticipated $21.58 billion. Despite this, P&G's volume decreased for the sixth consecutive quarter, with a 1% shrinkage. This decline is attributed to the company's consistent price hikes on products over the past two years, leading some consumers to opt for cheaper alternatives. CEO Jon Moeller expressed satisfaction with the current pricing, while CFO Andre Schulten noted minimal pushback from retailers. P&G's health-care division was the only one to report volume growth, driven by demand for respiratory products.

Source: xStation 5