- ADP report below expectations

- US indices rebound on Wednesday

- General Motors (GM.US) earnings crushed expectations

US indices started today's session in positive moods and are trying to erase steep losses from the previous session. Investors welcomed today's ADP reading which showed that the private sector added 742k new jobs in Jobs, the most since September 2020. Even though today's reading fell below analysts' expectations many investors believe that the economic recovery continues to strengthen. Also, risk appetite was supported by US Treasury Secretary Yellen's who downplayed her yesterday's comments regarding rate hikes. Today Yellen said that she sees no inflation problem brewing so far. She also mentioned that she is not trying to forecast Fed's rate path and that she strongly believes in Fed's independence.

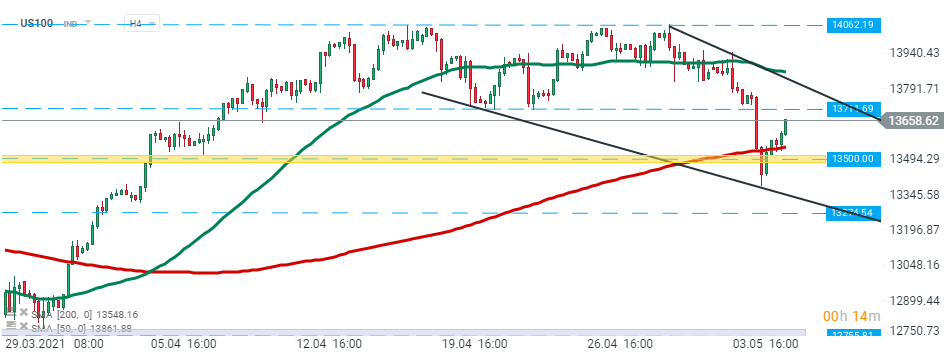

US100 managed to erase most of yesterday's losses. Index broke above 200 SMA (red line) and earlier broken support at 13500 pts and is approaching local resistance at 13711 pts. If buyers will manage to break higher, then the next obstacle will be the upper limit of the wedge formation and 50 SMA ( green line). On the other hand, if buyers will be unable to uphold momentum, then another downward impulse towards aforementioned support could be launched. Source: xStation5

US100 managed to erase most of yesterday's losses. Index broke above 200 SMA (red line) and earlier broken support at 13500 pts and is approaching local resistance at 13711 pts. If buyers will manage to break higher, then the next obstacle will be the upper limit of the wedge formation and 50 SMA ( green line). On the other hand, if buyers will be unable to uphold momentum, then another downward impulse towards aforementioned support could be launched. Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appGeneral Motors (GM.US) stock rose 3.5% in premarket despite the fact that the automaker posted mixed quarterly figures. Company earned $2.25 per share, which came in well above analysts’ expectations of $1.04 a share, though revenue missed slightly market projections. GM said its results were helped by strong auto pricing as well as solid credit performance at GM Financial.

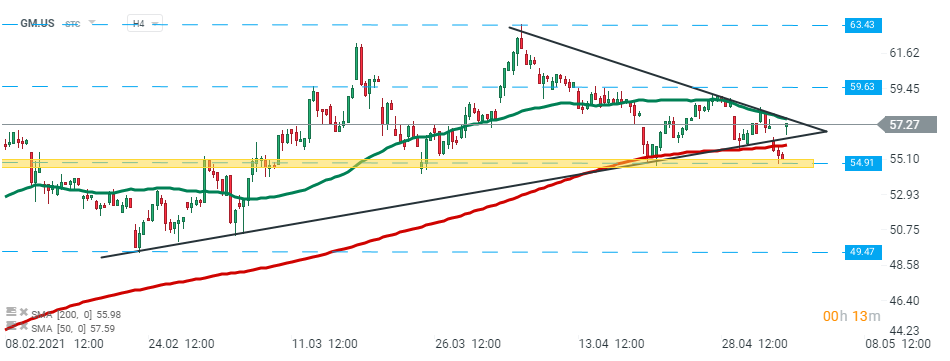

General Motors (GM.US) stock is trading higher following the release of quarterly earnings report. Price managed to return above the 200 SMA (red line ) which coincides with earlier broken lower limit of the triangle formation. Source: xStation5

General Motors (GM.US) stock is trading higher following the release of quarterly earnings report. Price managed to return above the 200 SMA (red line ) which coincides with earlier broken lower limit of the triangle formation. Source: xStation5

Lyft (LYFT.US) jumped nearly 7% in premarket after the company posted a quarterly loss of 35 cents per share, smaller than the 53 cents a share that analysts were anticipating. The ride-hailing company’s revenue beat market estimates. Also the number of active riders increased during the quarter.

Match Group (MTCH.US) shares jumped 6.2% in the premarket after company beat estimates by 17 cents a share, with first-quarter earnings of 57 cents per share. Revenue also beat analysts’ forecasts. Match Group posted upbeat current-quarter guidance as company expects a surge in dating demand as the pandemic recedes.

Hilton Worldwide (HLT.US) stock dropped nearly 3% in premarket after the hotel operator posted disappointing quarterly figures. Company earned 2 cents per share which came in well below analysts’ estimates of 8 cents a share. Revenue also missed forecasts due to pandemic-related travel restrictions. Still the company managed to open 97% of its hotels by the end of April.