- US stock opened higher

- US jobless claims rise less than expected

- Apple (AAPL.US) warned suppliers on weakening iPhone demand

Major Wall Street indices launched today's session higher, after a sharp intraday reversal in the previous session as CDC confirmed the first Omicron case in the US. The Dow Jones Industrial Average gained 1.40%, The S&P 500 rose nearly 1.0%. The technology-heavy Nasdaq Composite gained 0.7%. The small-cap benchmark Russell 2000 added 1.8%. Still Omicron variant weighs on market sentiment due to uncertainty around its rate of transmissibility and fears that it could evade vaccines. On the data front, the number of initial jobless claims last week had risen to 222k, which is the second-lowest number since the pandemic began and below analysts' estimates of 240k.

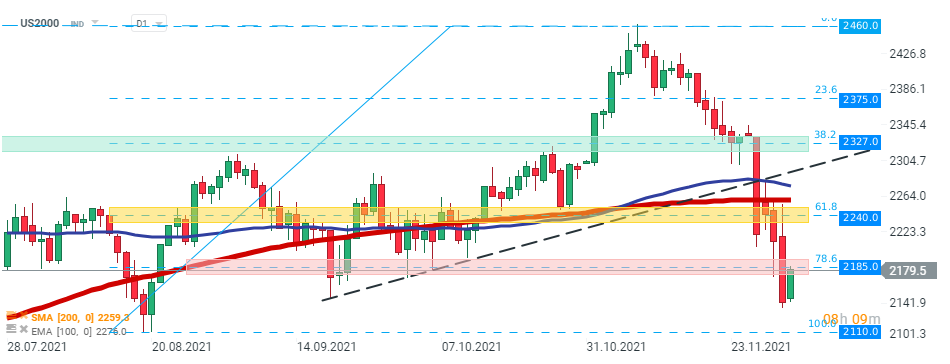

US2000 together with other Wall Street indices plunged on Wednesday. Index finished cash trading around 2143 pts mark for the first time since August 20, 2021. However today one can observe slightly better moods. Index is currently testing strong resistance at 2185 pts which coincides with 78.6% Fibonacci retracement of the last upward wave. Should break higher occur, upward move may accelerate towards next resistance at 2240 pts. On the other hand, if sellers manage to regain control, then support at 2110 pts may be at risk. Source: xStation5

US2000 together with other Wall Street indices plunged on Wednesday. Index finished cash trading around 2143 pts mark for the first time since August 20, 2021. However today one can observe slightly better moods. Index is currently testing strong resistance at 2185 pts which coincides with 78.6% Fibonacci retracement of the last upward wave. Should break higher occur, upward move may accelerate towards next resistance at 2240 pts. On the other hand, if sellers manage to regain control, then support at 2110 pts may be at risk. Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appCompany news:

Apple (AAPL.US) stock dropped 3% before the opening bell after Bloomberg reported that the tech giant informed component makers that demand for the iPhone 13 lineup has weakened.

Apple (AAPL.US) stock launched today's session lower and is testing local support at $160.00 which coincides with 23.6% Fibonacci retracement of the last upward wave launched in June 2021. Should break lower occur, downward move may accelerate towards $152.50 which is marked with lower limit of the 1:1 structure and 38.2% Fibonacci retracement. Source: xStation5

Apple (AAPL.US) stock launched today's session lower and is testing local support at $160.00 which coincides with 23.6% Fibonacci retracement of the last upward wave launched in June 2021. Should break lower occur, downward move may accelerate towards $152.50 which is marked with lower limit of the 1:1 structure and 38.2% Fibonacci retracement. Source: xStation5

Boeing (BA.US) stock jumped over 4.0% after Bloomberg reported it’s in talks with the new owners of previously bankrupt Jet Airways about bringing its fleet of 11 planes to more than 100 in five years. Jet Airways made an order for 225 of Boeing’s 737 Max aircraft that it could revisit, a deal which would be worth more than $12 billion, according to the report.

Five Below (FIVE.US) shares surged over 9.0% after the discount store posted solid quarterly results. Company also reported an increase in comparable-store sales of 14.8%, well above analysts expectations of 5.3%, according to Refinitiv.

Dollar General (DG.US) stock fell more than 3.0% after the company revealed plans to open 1,000 Popshelf stores by the end of the 2025 fiscal year, which are aimed at wealthier suburban shoppers. There are currently 30 Popshelf stores in six states.