- GameStop (GME.US) fever continues

- Tesla (TSLA.US) stock fell 5% after Q4 results

- US GDP rises 4% in Q4

- Jobless claims fell more than expected

US indices launched today's session higher following a sharp sell-off in the stock market the day before as the Reddit-driven retail momentum continued to heat up. On the data front, US GDP expanded an annualized 4% in the last quarter of 2020, slowing from a record 33.4% expansion in the third quarter as the continued rise in COVID-19 cases and restrictions on activity moderated consumer spending. Figures came in line with analysts' expectations. At the same time, the Department of Labor reported a bigger-than-expected drop in the number of weekly jobless claims, although the number remained stubbornly high at 847,000 while markets expected a number of 875,000.

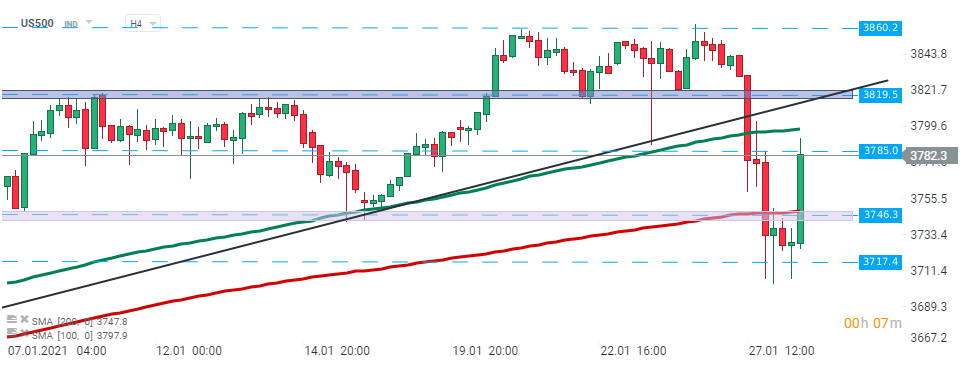

US500 is trying to erase yesterday losses. Index bounced off the support at 3717 pts and easily broke above 200 SMA (red line) and resistance at 3746 pts. Currently index is testing resistance at 3785 pts. Should the price break above it, the way towards the next major resistance at 3819.5 pts will be left open. Source: xStation5

US500 is trying to erase yesterday losses. Index bounced off the support at 3717 pts and easily broke above 200 SMA (red line) and resistance at 3746 pts. Currently index is testing resistance at 3785 pts. Should the price break above it, the way towards the next major resistance at 3819.5 pts will be left open. Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appTesla (TSLA.US) reported EPS of $0.80 (exp. $1.03) and sales of $10.74 billion (exp. $10.4 billion). Elon Musk said that company is aiming for a 50% growth rate in deliveries in 2021.

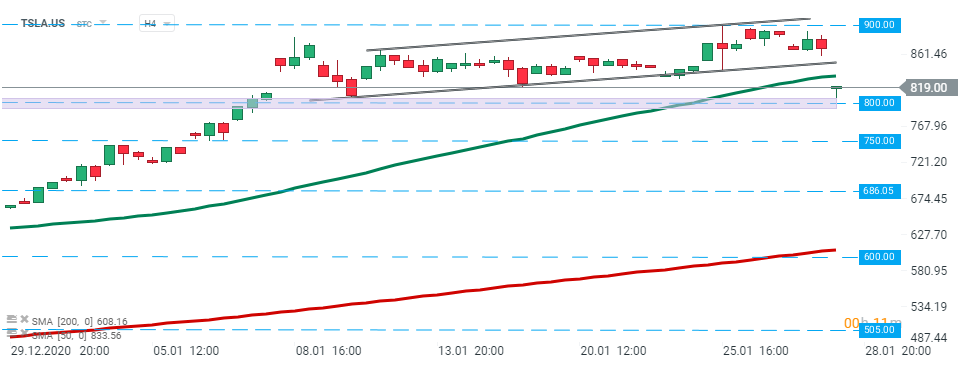

Tesla (TSLA.US) stock launched today’s session 5% lower. Currently price is trading below the lower limit of the ascending channel and 50 SMA (green line). Should a break below the support at $800 occur, downward move may accelerate. Next support to watch lies at $750. On the other hand, the bearish scenario will be invalidated once the price jumps above the aforementioned 50 SMA. Source: xStation5

Tesla (TSLA.US) stock launched today’s session 5% lower. Currently price is trading below the lower limit of the ascending channel and 50 SMA (green line). Should a break below the support at $800 occur, downward move may accelerate. Next support to watch lies at $750. On the other hand, the bearish scenario will be invalidated once the price jumps above the aforementioned 50 SMA. Source: xStation5

Apple (AAPL.US) reported better-than-expected earnings for Q4 2020. Sales came in at $111.44 billion (exp. $103.12 billion) while EPS reached $1.68 (exp. $1.42). iPhone sales reached $65.6 billion (exp. $60.3 billion)

Facebook (FB.US) reported revenue of $28.1 billion (exp. $26.4 billion) and EPS of $3.88 (exp. $3.22). Number of monthly active users increased to 2.8 billion. Mark Zuckerberg said that his company will work to limit political discussions on Facebook

GameStop (GME.US) stock continues to witness wild swing moves. Game retailer managed to reverse losses in overnight trading and shares surged 41% to $490.06 only to fall back down to $350 level in premarket trading. The stock was worth about $40 just a week ago. Other stocks involved in the short squeeze, including AMC Entertainment (AMC.US) and Bed Bath & Beyond (BBBY.US), were trading mixed in the pre-market.

McDonald’s (MCD.US) reported quarterly earnings of $1.70 per share while analysts expected earnings of $1.62 per share. Revenue also came below market projections. However comparable-restaurant sales in the US surprised on the upside with 5.5% increase.