- Wall Street indexes post gains in 0.1 - 0.4% range after U.S. market opening

- S&P PMI preliminary data for November above forecasts; slightly weaker final consumer sentiment reading

- Nvidia (NVDA.US) shares lose more than 2% after yesterday's upbeat session following financial results

Sentiment in the U.S. stock market is fairly mixed in the last session of the week. Most indexes are up slightly, but the largest-cap companies are doing less well against the market. Yields on the 10-year bond retreated to 4.41%, but the dollar is gaining strongly; USDIDX is hitting new local peaks above 1.07. The rise in 5-year inflation expectations, coupled with much stronger services data, likely provides another 'hawkish' signal for the Fed, which may be considering whether an interest rate cut in December would be appropriate, given the recent strong US data and the inflation risks associated with the tariffs the new administration intends to implement in the US.

Macro data from the US

UoM consumer sentiment index: 71.8 (expected: 73.5; previous: 70.5)

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app- 1-year inflation expectations: 2.6% (expected: 2.6%; previous: 2.7%)

- 5-yr inflation expectations: 3.2% (expected: 3.1%; previously: 3.0%

Preliminary PMI for services: 57 (expected: 55.2; previous: 55.0)

- Preliminary PMI for industry: 48.8 (expected: 48.8; previous: 48.5)

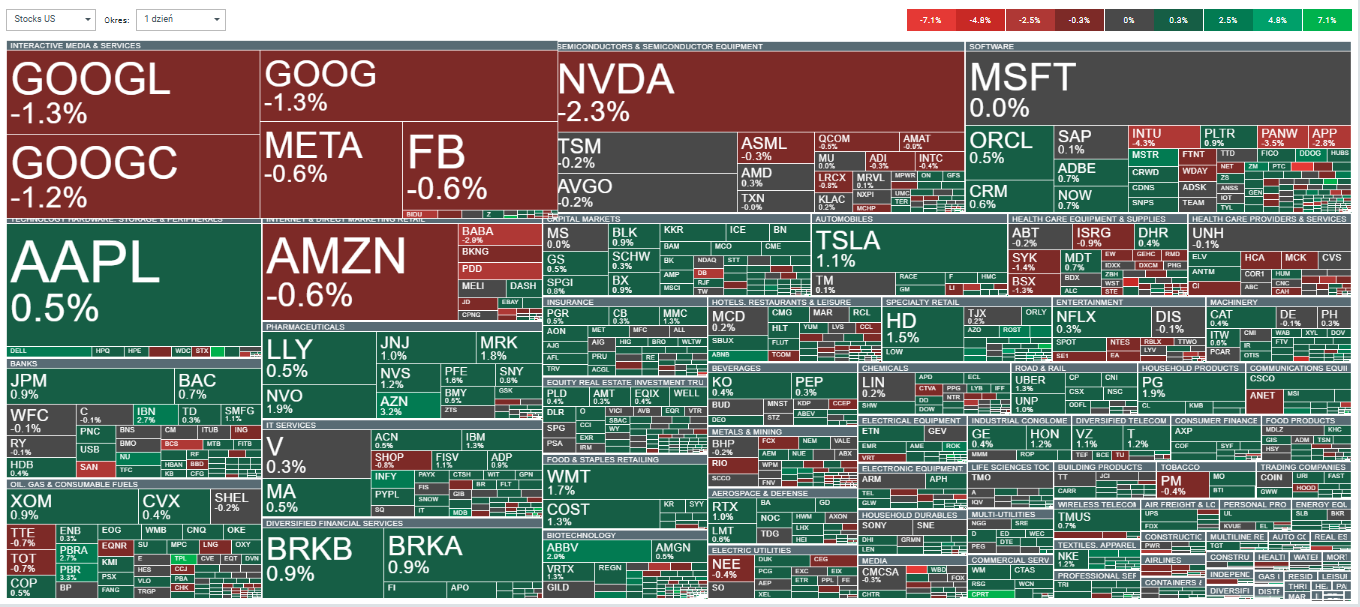

Sentiment around mega-cap stocks is clearly mixed today; Alphabet, Amazon, Microsoft and Meta are losing but Nvidia is the strongest seller. The stocks of Intuit and Palo- Alto Networks are also losing. The oil and gas sector and pharmaceutical and biotech companies are doing better, with Abbvie shares gaining nearly 3%.... Source: xStation5

Looking at the short 15-minute interval, we see that selling volume has slightly prevailed in the last few sessions, which, combined with a potential bearish flag, may indicate pressure to break out of the formation at the bottom in the scenario of testing the lower limit of the price channel at 5930 points, where we also see the 38.2 Fibo retracement of the last upward impulse after the US election. A breakout above, 5980 could open the contract to new highs.

Source: xStation5

In the broader daily interval, the US500 is still trading at the upper range of the uptrend channel and more than 54% of the stocks of the index companies are trading above the 50-session simple moving average.

Source: xStation5

Company news

- Leerink Partners upgraded the drugmaker Abbvie (ABB.US) to outperform from market perform, saying recent setbacks create an upside opportunity

- Baidu (BIDU.US) dips 3% after the Chinese internet search engine was cut to equal weight from overweight by Barclays following disappointing results

- Gap (GAP.US) gains 15% after raising its full-year outlook as the apparel retailer attracts wealthier shoppers seeking value

- Intuit (INTU.US) falls 3.5% after the maker of the TurboTax tax preparation software provided a sales and profit outlook for the current quarter that fell short of analysts’ estimates

- NetApp (NTAP.US) climbs 5% as the tech-hardware firm boosted guidance following an earnings beat

- Roblox (RBLX) gains 1% after the video-game provider was added to the Raymond James current favorites list