- Tech stocks under pressure

- US trade gap reached record high

- Pfizer (PFE.US) posted upbeat quarterly figures

US indices launched today’s session lower with technology stocks experiencing the biggest selling pressure. The so-called FAANG companies (Facebook, Amazon, Apple, Netflix and Google-parent Alphabet) were all trading lower shortly after the open. It seems that investors turn to companies that are likely to benefit more from the reopening of the economy rather than big tech names which posted recently upbeat quarterly figures. On the bond market, U.S. 10 Year Treasury yields fell to 1.58%. Yesterday Fed chair Powell said the US economy was doing better but was "not out of the woods yet" and US Treasury Secretary Janet Yellen said on Sunday that Biden's plans for infrastructure would not boost prices. Meanwhile, Warren Buffett said Saturday that he is seeing “very substantial inflation” among Berkshire Hathaway’s collection of businesses amid the economic recovery. On the data front, The U.S. trade deficit widened to a new record in March as the value of imports surged to a fresh high. The gap increased to USD 74.4 billion in March, from a revised USD 70.5 billion in the previous month and compared with analysts' estimates of a USD 74.5 billion gap. Imports surged 6.3 % to an all-time high as the domestic demand consolidated its recovery amid re-opening efforts. Exports jumped 6.6 % to a 13-month high, boosted by sales of industrial supplies and materials, and capital and consumer goods. Investors now focus on services data due on Wednesday and non-farm payroll numbers on Friday.

US2000 bounced off the upper limit of the descending channel during yesterday’s session and tested major support at 2248 pts today which is additionally strengthened by the 200 SMA (red line). As long as price remain within the aforementioned channel further downward move is the base case scenario. On the other hand, if buyers will manage to regain control and break above the upper limit of the formation then another upward impulse towards resistance at 2305 pts could be launched. Source: xStation5

US2000 bounced off the upper limit of the descending channel during yesterday’s session and tested major support at 2248 pts today which is additionally strengthened by the 200 SMA (red line). As long as price remain within the aforementioned channel further downward move is the base case scenario. On the other hand, if buyers will manage to regain control and break above the upper limit of the formation then another upward impulse towards resistance at 2305 pts could be launched. Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appPfizer (PFE.US) stock rose more than 1% in premarket after the drugmaker posted better than expected quarterly figures. Pharma giant earned 93 cents per share, well above analysts’ estimates of 77 cents a share. Revenue also beat market estimates and the company lifted its full-year guidance due to strong as sales of its Covid-19 vaccine. According to The New York Times, the Food and Drug Administration is set to authorize the vaccine for use in adolescents aged 12-15.

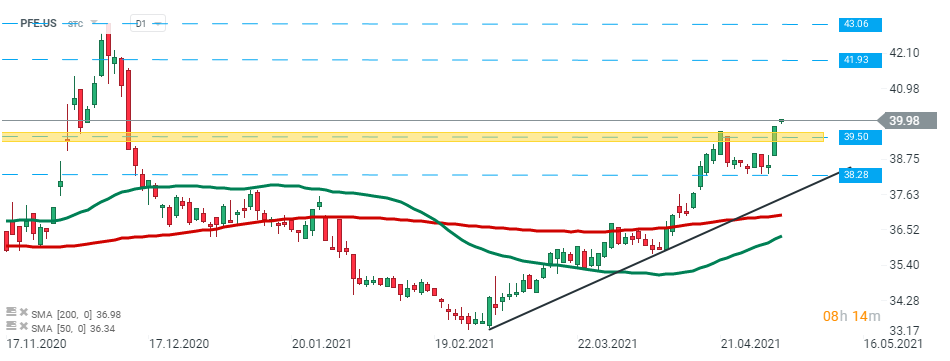

Pfizer (PFE.US) stock launched today’s session slightly higher and is trading above support at $39.50. Should current sentiment prevails upward move may be extended to the resistance at $41.93. Source: xStation5

Pfizer (PFE.US) stock launched today’s session slightly higher and is trading above support at $39.50. Should current sentiment prevails upward move may be extended to the resistance at $41.93. Source: xStation5

CVS Health (CVS.US) stock rose 3% in premarket after the company earned $2.04 per share in the first quarter, above analysts’ projections of $1.72 a share. Revenue also topped expectations due to strong sales at its stores, with customer traffic spurred by Covid-19 vaccination visits. CVS also raised its full-year forecast.

iRobot (IRBT.US) fell more than 9% in premarket despite the fact that the company posted upbeat quarterly figures. The maker of the Roomba robotic vacuum’s earned 41 cents per share, well above analysts' expectations of 9 cents a share. Revenue also beat market projections, however concerns regarding shipping and component costs weighed on company’s stock price.

Under Armour (UAA.US) reported first-quarter profit of 16 cents per share, crushing analysts’ expectations of 3 cents a share. Revenue also beat Wall Street estimates. The athletic apparel maker’s also lifted its full-year guidance as reopening markets increased demand for shoes and apparel. Separately, the company agreed to pay $9 million to settle a Securities and Exchange Commission probe into its accounting.