- Wall Street indices launched trading lower

- US2000 breaks above the upper limit of long-term trading range

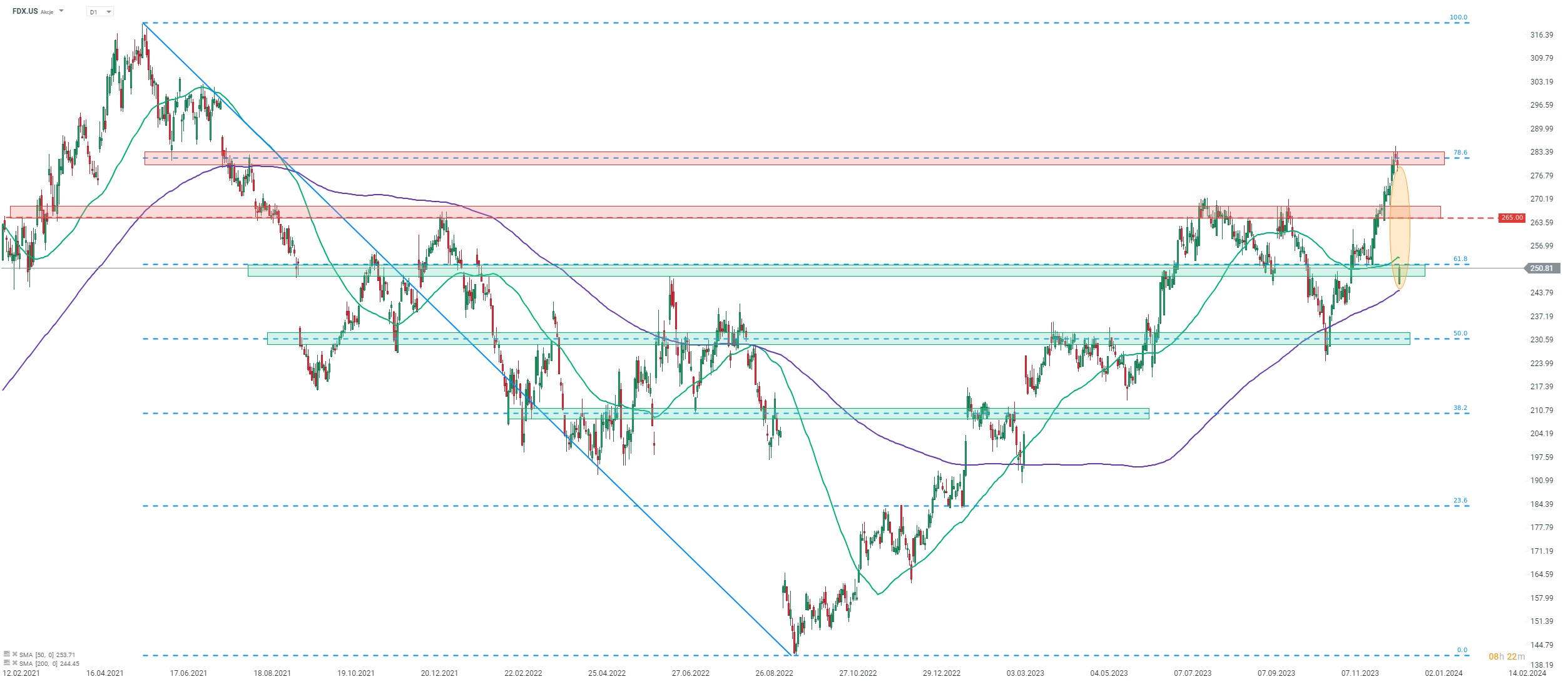

- FedEx sinks after cutting fiscal-2024 sales outlook

Wall Street indices launched today's trading a touch lower. S&P 500, Nasdaq and Dow Jones opened around 0.2% lower while small-cap Russell 2000 dropped around 0.4% at the session launch. FedEx is in the spotlight as US package delivery company sinks over 10% following release of lackluster fiscal-Q2 2024 earnings. Conference Board consumer confidence index for December and US existing home sales data for November, both scheduled for 3:00 pm GMT, are the only noteworthy readings in the US economic calendar today.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appRussell 2000 futures (US2000) broke above the 2,025 pts resistance zone yesterday and reached the highest level since the second half of April 2022. The aforementioned resistance zone acted as the upper limit of the 20-month trading range. A break above hints that a bigger upward move may be looming. Textbook range of the upside breakout suggests a possibility to a move as high as 2,410 pts area. However, bulls would have to overcome two important resistance levels in order to reach this area - 2,135 pts and 2,300 pts. The former acted as a lower limit of the 2021 trading range while the latter acted as the upper limit. While textbook range suggests a possibility of index jumping around 19% above current market prices, it would still be short of record highs for the index (2,450 pts area).

Company News

FedEx (FDX.US) is slumping over 10% today, following release of fiscal-Q2 2024 earnings. Company reported a fiscal-Q2 revenue at $22.2 billion (exp. $22.4 billion) and adjusted EPS at $3.99 (exp. $4.19). Adjusted Operating income came in at $1.42 billion, below $1.49 billion expected. FedEx expects revenue for full fiscal-2024 to drop by 'low-single-digit', compared to previous forecast that saw flat year-over-year growth. Full-year adjusted EPS is seen at $17.00-18.50 while capital expenditures are seen at $5.7 billion.

AON (AON.US) announced that it has entered into an agreement to acquired NFP, a global professional services company, for around $13.4 billion in cash and stock transaction. Deal will be funded with $7 billion in cash and the remaining $6.4 billion in AON's stock. AON said that the transaction will be dilutive to EPS in 2025, neutral in 2026 and accretive in 2027 and beyond. Deal is expected to close in mid-2024.

Analysts' actions

- Cinemark (CNK.US) downgraded to 'underweight' at Wells Fargo. Price target set at $13.00

- Coupang (CPNG.US) downgraded to 'neutral' at UBS. Price target set at $18.50

- Discover Financial (DFS.US) upgraded to 'buy' at Citi. Price target set at $133.00

- Zoom Video (ZM.US) downgraded to 'underweight' at Wells Fargo. Price target set at $70.00

- Paramount Global (PARA.US) upgraded to 'equal-weight' at Wells Fargo. Price target set at $18.00

FedEx (FDX.US) slumped around 12% at cash session launch today, following release of disappointing fiscal-Q2 2024 earnings. Stock pulled back from the resistance zone, marked with 78.6% retracement of the downward move launched in 2021, and broke below the support zone marked with 61.8% retracement. An attempt to climb back above this hurdle can be spotted at press time. Source: xStation5