- Rising number of COVID-19 cases in India, Canada and Japan

- Netflix's (NFLX.US) stock fell more than 8% due to weak subscriber growth

- Verizon (VZ.US) loses more-than-expected wireless subscribers

US indices launched today's session lower as investors digest mixed bag of corporate earnings and rising coronavirus infections across the world. Netflix posted better-than-expected earnings but subscriber growth disappointed. Chipotle Mexican Grill is due today after the closing bell. On the coronavirus front, a number of new infections continue to rise in India, Canada and Japan, which raise concerns over global economic rebound. The Department of State strongly recommended US citizens to reconsider all travel abroad and said it would issue specific warnings not to visit roughly 80% of the world’s countries due to risks from the pandemic. On the data front, mortgage applications rose 8.6 % last week, which is the strongest gain since early January, as mortgage rates dropped to their lowest levels in around two months.

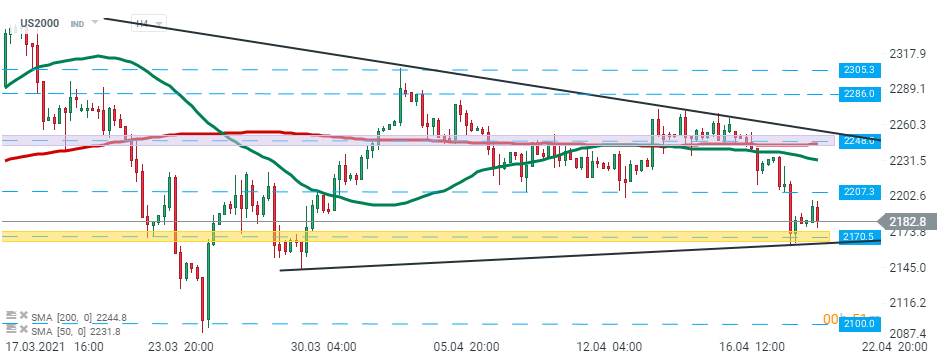

US2000 fell sharply during yesterday's session and that the downward move is being continued after the US open. Index is approaching major support at 2170.5 pts which coincides with lower limit of the triangle formation. Should break lower occur, then next support at 2100 pts could be at risk. On the other hand, if buyers will manage to halt declines then another upward impulse towards resistance at 2207.3 pts could be launched. Source: xStation5

US2000 fell sharply during yesterday's session and that the downward move is being continued after the US open. Index is approaching major support at 2170.5 pts which coincides with lower limit of the triangle formation. Should break lower occur, then next support at 2100 pts could be at risk. On the other hand, if buyers will manage to halt declines then another upward impulse towards resistance at 2207.3 pts could be launched. Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appNetflix (NFLX.US) stock plunged nearly 9.0% in premarket trading even despite upbeat quarterly figures. The US streaming company reported revenue of $ 7.163 billion, which came in above analysts’ expectations of $ 7.137 billion. EPS of $ 3.75 also beat market estimates of $ 2.975. However weaker-than-expected subscriber growth numbers namely 3.98 million compared to expectations of 6.29 million weighed on sentiment. The company expects that the second quarter to be slower as well.

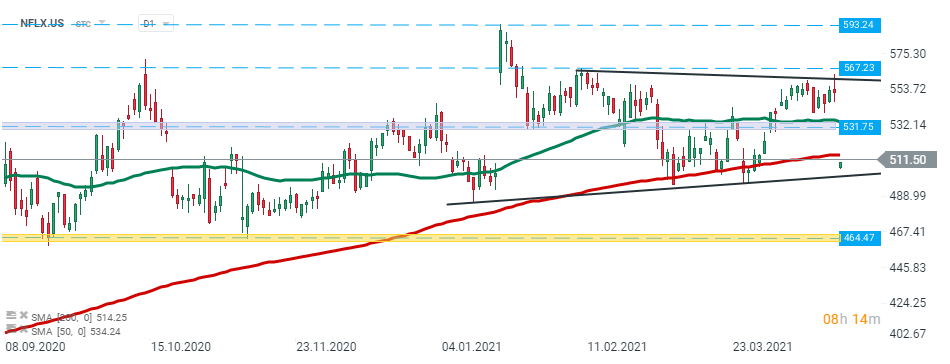

Netflix's (NFLX.US) stock launched today’s session with a massive bearish price gap and is approaching the lower limit of the wedge formation. If the current sentiment prevails, downward move may be extended towards support at $464.47. Source: xStation5

Netflix's (NFLX.US) stock launched today’s session with a massive bearish price gap and is approaching the lower limit of the wedge formation. If the current sentiment prevails, downward move may be extended towards support at $464.47. Source: xStation5

Anthem (ANTM.US) stock rose more than 1.5 % in premarket despite the fact that the health insurer posted mixed quarterly figures. Company earned $7.01 per share, well above Wall Street projections of $6.51 per share. Meanwhile revenue figures disappointed. However, Anthem lifted its full-year guidance, amid growth in its various medical plans and higher pharmacy benefit management revenue.

Nasdaq (NDAQ.US) earned $1.96 per share for the first quarter, 23 cents a share above estimates. Revenue also came in above market forecasts. Results were boosted by double-digit increases in equity and fixed income trading revenue. The stock exchange operator will also rised its dividend by 10%.

Verizon (VZ.US) posted quarterly earnings of $1.31 per share, slightly above market estimates of $1.29 per share. Revenue also came in above analysts’ estimates. The company lost more wireless subscribers during the quarter than analysts had been anticipating.