- US stocks open lower

- ADP report above expectations

- Constellation Brands (STZ.US) Q2 adjusted earnings miss expectations

US indices launched today’s session lower as rising energy prices and elevated Treasury yields continue to weigh on sentiment. Yields have been rising this week as worries persist over high inflation and an early Fed tapering. Also today’s jump in ADP payrolls prompt expectations of a sooner move by the Fed. September’s ADP report showed that private companies hired at a faster pace than expected last month, despite the spread of the Delta variant. Private jobs rose by 568k for the month, compared to market expectations of 428k.

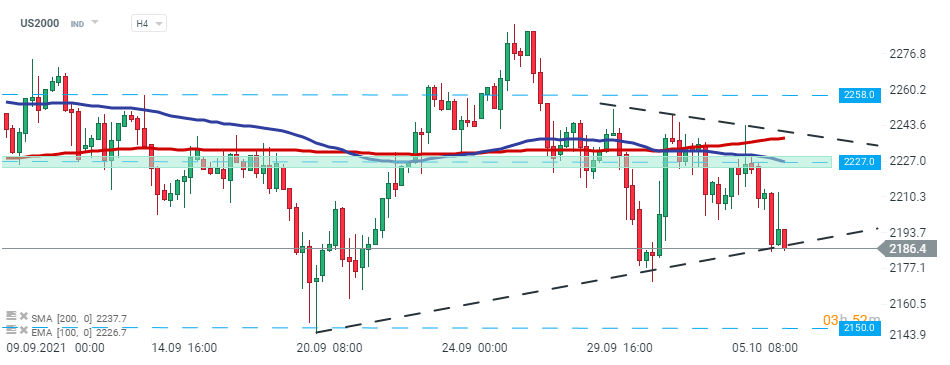

US2000 fell sharply at the beginning of today’s session, however buyers managed to halt declines at the lower limit of the triangle formation. If current sentiment prevails then upward move may accelerate towards major resistance at 2227.0 pts. However, if sellers manage to regain control and break below the aforementioned lower limit of the triangle formation, then downward move may be extended to the support at 2150 pts. Source: xStation5

US2000 fell sharply at the beginning of today’s session, however buyers managed to halt declines at the lower limit of the triangle formation. If current sentiment prevails then upward move may accelerate towards major resistance at 2227.0 pts. However, if sellers manage to regain control and break below the aforementioned lower limit of the triangle formation, then downward move may be extended to the support at 2150 pts. Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appCompany news:

Constellation Brands (STZ.US) stock fell nearly 2.0% in premarket after the drinks company missed expectations with its quarterly earnings. Company earned $2.38 per share, well below analysts' estimates of $2.77. Revenue topped market estimates and the company increased its full-year earnings forecast.

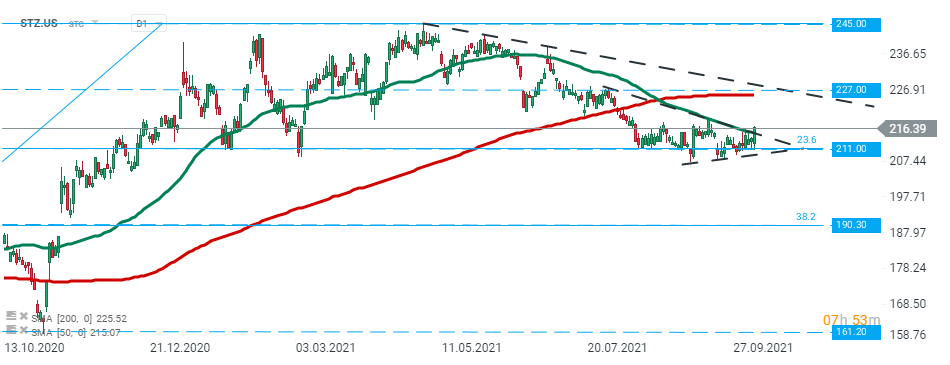

Constellation Brands (STZ.US) stock launched today’s session slightly higher and is approaching the upper limit of the triangle formation. Should a break higher occur, then upward move may accelerate towards resistance at $227.00 which coincides with 200 SMA (red line) and downward trendline. On the other hand, if sellers manage to break below the lower limit of the triangle formation which is additionally strengthened by 23.6% Fibonacci retracement of the upward wave launched in March 2020, then support at $190.30 may be at risk. Source: xStation5

Constellation Brands (STZ.US) stock launched today’s session slightly higher and is approaching the upper limit of the triangle formation. Should a break higher occur, then upward move may accelerate towards resistance at $227.00 which coincides with 200 SMA (red line) and downward trendline. On the other hand, if sellers manage to break below the lower limit of the triangle formation which is additionally strengthened by 23.6% Fibonacci retracement of the upward wave launched in March 2020, then support at $190.30 may be at risk. Source: xStation5

Palantir Technologies (PLTR.US) stock jumped nearly 7.0% after the software company won the bulk of a $823 million contract with the US Army to provide data and analytics software.

Acuity Brands (AYI.US) stock rose 1.50% in premarket after the company posted better than expected quarterly figures. The maker of lighting and building management systems earned $3.27 per share, well above analysts' expectations of $2.85. Revenue also beat market estimates. The earnings beat came amid what the company terms a “challenging” environment that included higher labor, materials and freight costs.

Moderna (MRNA.US) stock fell 3.5% in premarket after news that Sweden will stop administering the drugmaker's Covid-19 vaccine, citing reports of possible rare side effects such as myocarditis.