- Pfizer(PFE.US) and BioNTech (BNTX.US) requested regulatory clearance for their vaccine in Europe

- S&P500 and Nasdaq hit record highs

- OECD sees brighter economic outlook

- Fed Chair Powell testifies

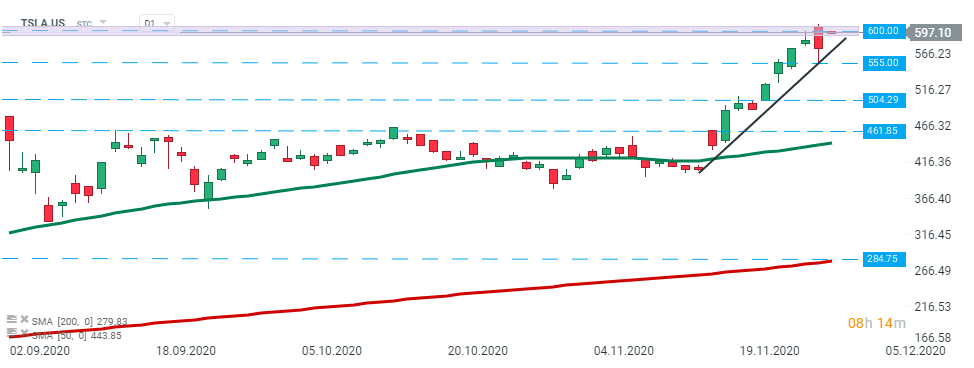

- S&P 500 index will add Tesla (TSLA.US) stock in one fell swoop before Dec. 21

US indices launched today's session higher thanks to another positive information about the Covid-19 vaccine. Dow Jones rose 1.12% while S&P 500 and Nasdaq hit all-time highs at the open, gaining 1% and 0.8%, respectively. Pfizer (PFE.US), and its German partner BioNtech (BNTX.US) applied to European authorities for authorization to rollout their Covid-19 vaccine. This announcement comes in line with yesterday news from Moderna (MRNA.US), with the biotech firm stating it was applying for US and European emergency authorization for its vaccine candidate. Also investors welcomed signs of a global economic recovery. OECD expects the global economy to expand 4.2% in 2021, rebounding from a 4.2% contraction in 2020. Still, the organization warned that delays to vaccination deployment, difficulties controlling new virus outbreaks and failure to learn lessons from the first wave would weaken the outlook and advised governments to maintain exceptional fiscal support and ensure that the money reaches those who need it the most. According to the OECD forecasts, US economy should grow 3.2% next year (-3.7% in 2020). Fed Chair Jerome Powell's and Treasury Secretary Steven Mnuchin will testify before the Senate shortly. In his testimony which was published yesterday, Powell stressed the importance of the lending programs aimed at battling the economic fallout from the coronavirus pandemic.

On the data front, US Markit final manufacturing PMI jumped to 56.7 in November from 53.4 in the previous month and came in line with market expectations of 56.7.

![]() US500 managed to erase yesterday losses and looks set to hit new record highs. Currently price is testing resistance at 3668 pts however fading momentum indicates that bulls may encounter some difficulties with overcoming this level. In case sellers will manage to regain control then nearest support lies at 3588 pts and is additionally strengthened by 50 SMA ( green line). Source: xStation5

US500 managed to erase yesterday losses and looks set to hit new record highs. Currently price is testing resistance at 3668 pts however fading momentum indicates that bulls may encounter some difficulties with overcoming this level. In case sellers will manage to regain control then nearest support lies at 3588 pts and is additionally strengthened by 50 SMA ( green line). Source: xStation5

Tesla (TSLA.US) will be added to the index in a single step despite its more than $500 billion market capitalization. Previous phased approach that was considered to ease the impact of adding such a large company to the U.S. stock benchmark has been abandoned. “In its decision, S&P DJI considered the wide range of responses it received, as well as, among other factors, the expected liquidity of Tesla and the market’s ability to accommodate significant trading volumes on this date,” the index provider said.

Tesla (TSLA.US) shares rose nearly 40% since the announcement that it would join the S&P500. Today stock launched the session higher and is approaching the psychological level at $600.00. If sellers fail to break above it, then nearest support lies at $555.00. Source: xStation5

Exxon Mobil (XOM.US) shares gained 2% in premarket after the energy giant revealed more streamlined capital spending plan. Exxon will also write off up to $20 billion of assets.

Nio (NIO.US) — stock rose 2% in premarket trading after company announced that it delivered 5,291 vehicles last month, which is a new record for the company and up 109% year-over-year. Goldman Sachs also upgraded the Chinese electric vehicle stock to “neutral” from “sell.”

US500 managed to erase yesterday losses and looks set to hit new record highs. Currently price is testing resistance at 3668 pts however fading momentum indicates that bulls may encounter some difficulties with overcoming this level. In case sellers will manage to regain control then nearest support lies at 3588 pts and is additionally strengthened by 50 SMA ( green line). Source: xStation5

US500 managed to erase yesterday losses and looks set to hit new record highs. Currently price is testing resistance at 3668 pts however fading momentum indicates that bulls may encounter some difficulties with overcoming this level. In case sellers will manage to regain control then nearest support lies at 3588 pts and is additionally strengthened by 50 SMA ( green line). Source: xStation5