- Wall Street opened slightly higher ahead of labor market data later this week

- 3M has agreed to pay more to resolve lawsuits

- The Jackson Hole event brought no expected changes

Wall Street opened slightly higher today, marking the start of an intense week. While no significant macro data is scheduled for today, investors will be served with several key labor data indicators in the coming days. Currently, the SP500 is up by 0.60%, and the Nasdaq 100 is increasing by 0.82%.

Over the weekend, the Jackson Hole symposium ended. Contrary to the expectations of many investors for a change in the global tightening policy, the conference was even perceived by some experts to set the stage for future interest rate hikes. At Jackson Hole, Federal Reserve Chair Jerome Powell conveyed a cautious approach to further interest-rate hikes, signaling a high bar for more tightening. Some interpreted Powell's comments as hawkish, hinting at potential hikes, while others saw them as fundamentally optimistic yet cautious. A number of regional Fed officials noted the favorable direction of inflation, suggesting that increasing yields might stabilize the economy. Despite this cautious optimism, derivative market traders are leaning toward a rate hike in November. After the Jackson Hole event, the focus will shift to the forthcoming August employment report. Powell emphasized that any signs of a robust labor market might prompt a monetary policy adjustment.

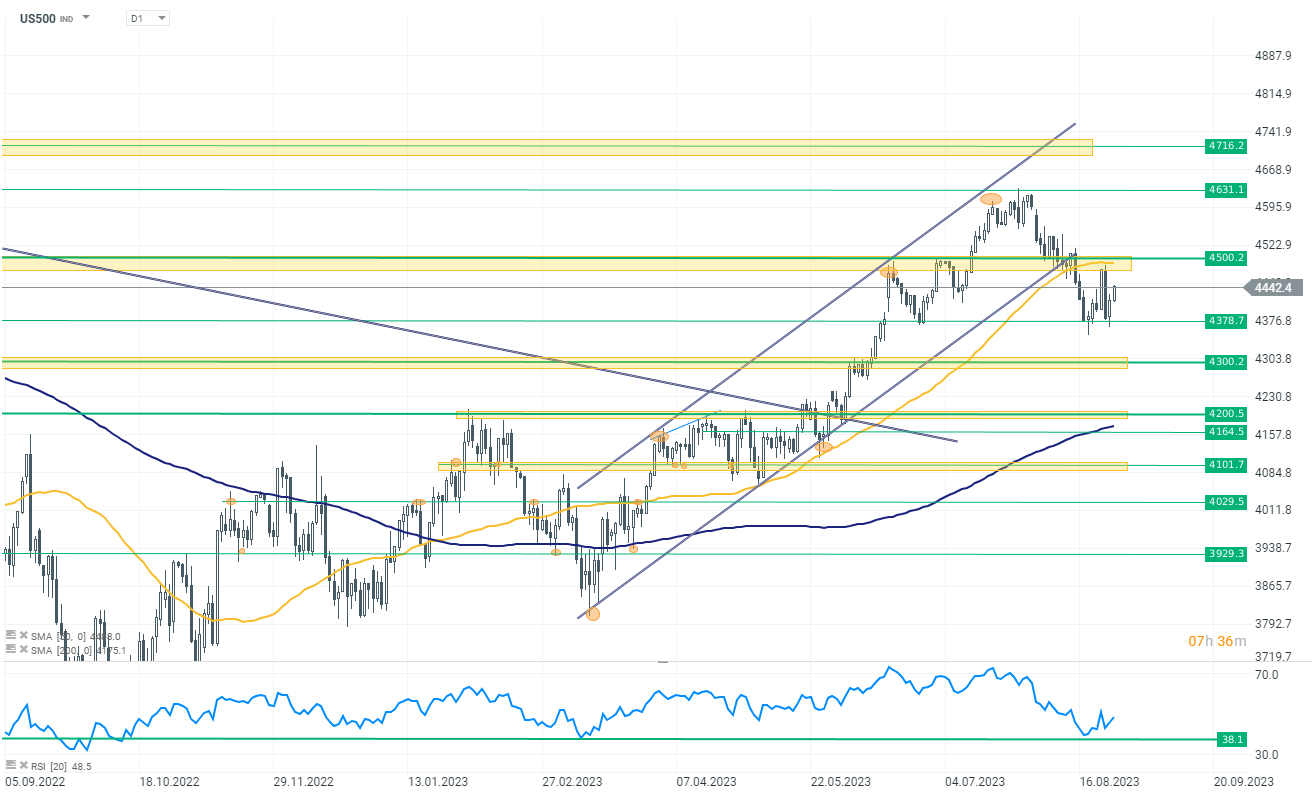

The US500 index is currently trading at 4440, marking an increase of 0.50% for the day. Notably, the price has twice tested the 4378 mark, reinforcing it as a strong support zone. Following this test, the index has rebounded today and is now on track to approach the 4500 level, which is identified as the next resistance zone. The forthcoming macroeconomic data to be released by the end of the week will likely influence the US500 next moves. Specifically, if the labor market appears to be strong again, there's a potential for the index to retract back to the 4378 point level.

Company news:

-

3M (MMM.US) stock rose 4.7% after agreeing to pay over $5.5 billion to settle more than 300,000 lawsuits alleging it provided the US military with faulty combat earplugs, according to Bloomberg News. Analysts believe this move could lift the stock's lingering uncertainties. Citi's Andrew Kaplowitz notes the settlement is smaller than anticipated and might help 3M shift away from the persistent legal challenges affecting its valuation. RBC's Deane Dray perceives the settlement as progress in 3M's ongoing legal battles, attributing the stock's positive response to the lower-than-expected settlement and potential reduction in legal pressures. However, Bloomberg Intelligence warns that this agreement doesn't rule out further potential downgrades for 3M's ratings.

Source: xStation 5

-

Boston Scientific Corp. (BSX.US) shares are rising 5.7% after announcing that a study for its atrial fibrillation treatment met its primary efficacy and safety endpoints. The Farapulse Pulsed Field Ablation (PFA) System achieved a single-procedure, off-drug treatment success of 73.3% over 12 months, compared to 71.3% in the thermal arm of the study. Analyst feedback was largely positive, emphasizing the robust data, predicting U.S. approval for Farapulse, and highlighting its potential for market share gains. Many anticipate the product's approval in 2024, with some noting its potential to drive significant revenue growth and share gains for Boston Scientific's Electrophysiology segment.

-

Xpeng Inc. (XPEV.US) announced the agreement to acquire Didi Global Inc.’s smart-car development division for an all-stock deal valued at HK$5.84 billion ($744 million). This acquisition not only helps Xpeng eliminate a potential rival in the electric-vehicle sector but also equips them with a technologically advanced ally. Post-acquisition, Didi will hold a 3.25% stake in Xpeng. Furthermore, Xpeng has plans to introduce a new EV brand by 2024 in collaboration with Didi, aiming for the broader market with an approximate price of $20,000.

Source: xStation 5

Source: xStation 5

-

CrowdStrike (CRWD.US) falls 2.2% as Morgan Stanley downgrades the software company to equal-weight from overweight ahead of 2Q earnings, citing likelihood of cut to consensus estimates and saying riskreward appears more balanced after strong YTD rally

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026